The past year has brought into focus EV market challenges stemming from a political landscape that has flip-flopped across four US presidential administrations. The Obama administration leveraged American Recovery and Reinvestment Act funding to spur the EV market, with the goal of 1 million EVs on America’s roads by 2015. In the first Trump administration, EVs were mocked, and the administration sought to undo incentives, supportive policies, and regulations that were accelerating the EV transition. The Biden administration enacted the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, which unleashed unprecedented private-sector investment in EV, battery, and supply chain manufacturing and job growth. The second Trump administration has been more successful at undoing EV-related policy progress, sowing market uncertainty at a time when global EV adoption is rising, and Chinese auto manufacturers are dominating the market.

2026 Will be a Bit Bumpy, but Drivable

The uncertainty caused by political whipsawing is taking its toll, adding pressure to a nascent market that is navigating the complex transition from petroleum to electric-powered transportation. That added pressure is delaying or rescinding some manufacturing investments; slowing the pace of new investments; pushing back timelines for releasing new, next-generation models; and prompting some automakers to scrap plans altogether. Despite headwinds, many start-up EV manufacturers, such as Rivian, Slate, and Scout, continue to push ahead, focusing on affordable, innovative vehicles, while legacy automakers like General Motors and Hyundai experience record EV sales.

Regarding charging infrastructure deployments, the Trump administration clawed back previously appropriated funding for the $5B National EV Infrastructure (NEVI) program and the $2.5 Community Fueling Infrastructure (CFI) program, prompting lawsuits that have led to at least some of the funding resuming. Despite the slowdown of NEVI and CFI progress, the private sector has been deploying a record number of public charging stations while significantly improving reliability.

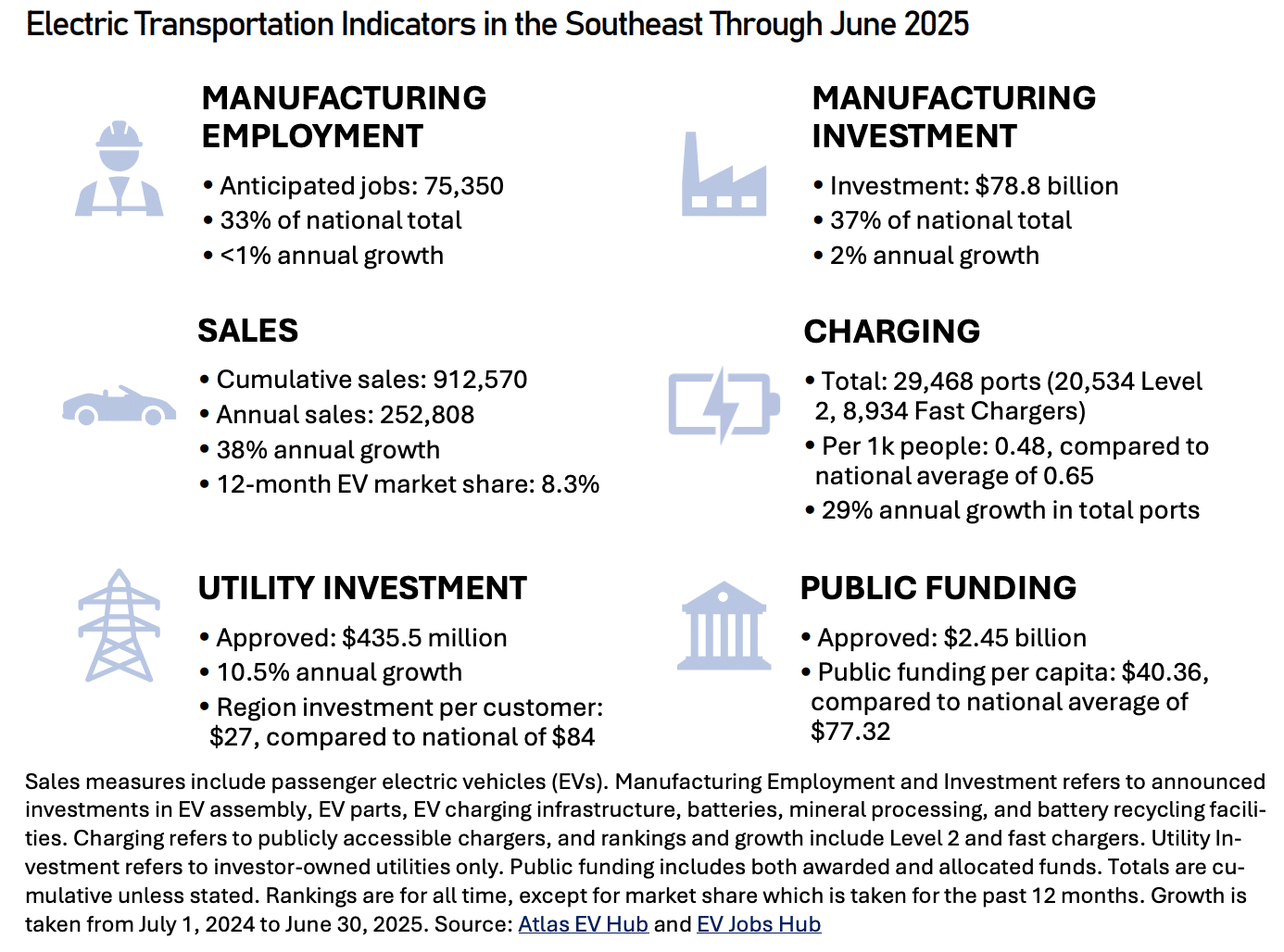

Though the EV headlines may make you think the EV sky is falling, the data shows otherwise. Case in point: SACE and Atlas Public Policy’s 6th annual Transportation Electrification in the Southeast Report indicates that the Southeastern US remains a hub for EV-related manufacturing, investment, and jobs, as EV sales continue to grow year over year and charging station deployment expands.

Three Signs and a Wildcard to Watch in 2026

Market volatility is almost certain to continue throughout 2026 as companies navigate a shifting policy landscape and broader economic factors, including tariffs and inflation, which are working against the auto industry as a whole, including EVs. Meanwhile, here are three signs to keep an eye on:

- EV owner satisfaction. EV owners’ satisfaction with EV value and performance is critical. The good news is that 92% of EV owners plan to buy another EV for their next car. Given that most new EV purchases are leases, most EV drivers will replace their EV every three years. High satisfaction indicates automakers have a strong base of committed EV consumers who understand the ABCs of EVs: affordable, better, and convenient.

- Consumer demand. There needs to be a steady stream of new consumers being drawn to EVs for the market to grow. The good news is that consumer demand has held steady, with 24.2% of new-car shoppers reporting they are very likely to consider an EV. In fact, the percentage of very likely shoppers has held relatively steady for the past year despite the anti-EV political rhetoric and negative headlines.

- The used EV market. Only one-third of car shoppers buy new cars; the rest buy used. Until now, there hasn’t been a robust used market. But in 2025, 243,000 EV leases will end, more than 3 times the number that ended in 2024. In 2026 and beyond, the used EV market will continue to expand rapidly as the surge in new EV leases over the past five years drives growth. Used EVs already compete with gas vehicles on price and outperform them on value, meaning many consumers priced out of the new-vehicle market now have access to more affordable EV ownership.

Along with watching the three signs, we are waiting for the wildcard to be dealt: the 2026 mid-term elections. Affordability remains a priority for Americans, regardless of political ideology. In the recent November elections, voters ousted incumbents they blamed for rising bills and elected candidates they trusted to make life more affordable. With voters demanding that elected officials address affordability and consumer interest in EVs remaining unshakeable, the EV market may have a wildcard up its sleeve: The best way for consumers to lower their energy and transportation costs is to ditch gas and switch to EVs, especially used ones. In November 2026, consumers will have the chance to vote for candidates who support getting America back on the path to affordable electric transportation.

2026 will be an exciting year for the EV market, with both significant challenges and opportunities. But as long as EV owner satisfaction remains high, consumer interest is strong, and the used EV market is robust, the momentum that has been building over the past decade will continue. It may turn out that the forces trying to hinder the market can’t halt the shift to EVs because the electric horse has already left the barn.