I often get asked about the state of the EV market. The answer is a moving target; every successful disruptive technology follows a non-linear growth trajectory with gains followed by plateaus and then more gains. However, over the past decade, the EV adoption trendline in the US and globally has been steadily marching upward as more consumers abandon internal combustion vehicles for the lower operational costs, reduced maintenance, and cleaner ride EVs provide, even as America’s hyper-partisan politics drag EVs into the political fight.

The market is undoubtedly experiencing whiplash as an EV-friendly Biden Administration is replaced by the Trump Administration, which is weaponizing EVs to undermine the nation’s clean energy economy. Still, the data shows that the US and global EV markets continue to grow steadily, indicating there is likely sufficient market momentum at home and abroad to withstand America’s political EV flip-flop.

There are caveats: we are only six months into an anti-EV administration hastily unraveling the work of a pro-EV one; the rollback of EV manufacturer and consumer incentives has yet to hit the market fully; lawsuits against many Trump Administration actions are working their way through the courts; and economic headwinds caused by inflation, tariffs, and tariff uncertainty are impacting the auto industry as a whole.

Still, if you ask me what the state of the EV market is today, I will respond that it is solid despite the shaky political ground: sales and market share are up, EV drivers continue to report high satisfaction, and consumers continue to express interest. Though the politics of the moment may slow it down, the EV transition can’t be stopped.

EV Market Share

Vehicle sales and market share are two different measures of market performance. While both are important indicators, market share is the measure that provides more meaningful context. Because market share shows the percentage of new cars sold that were electric, it takes into account the downturns and surges in the automarket that affect all vehicle sales. For example, in June, EV sales dipped 1.4% compared to May, but market share increased 1.1%. Though fewer EVs were purchased that month, EVs made up a higher percentage of all new car sales, showing the technology’s increasing competitiveness with gas cars.

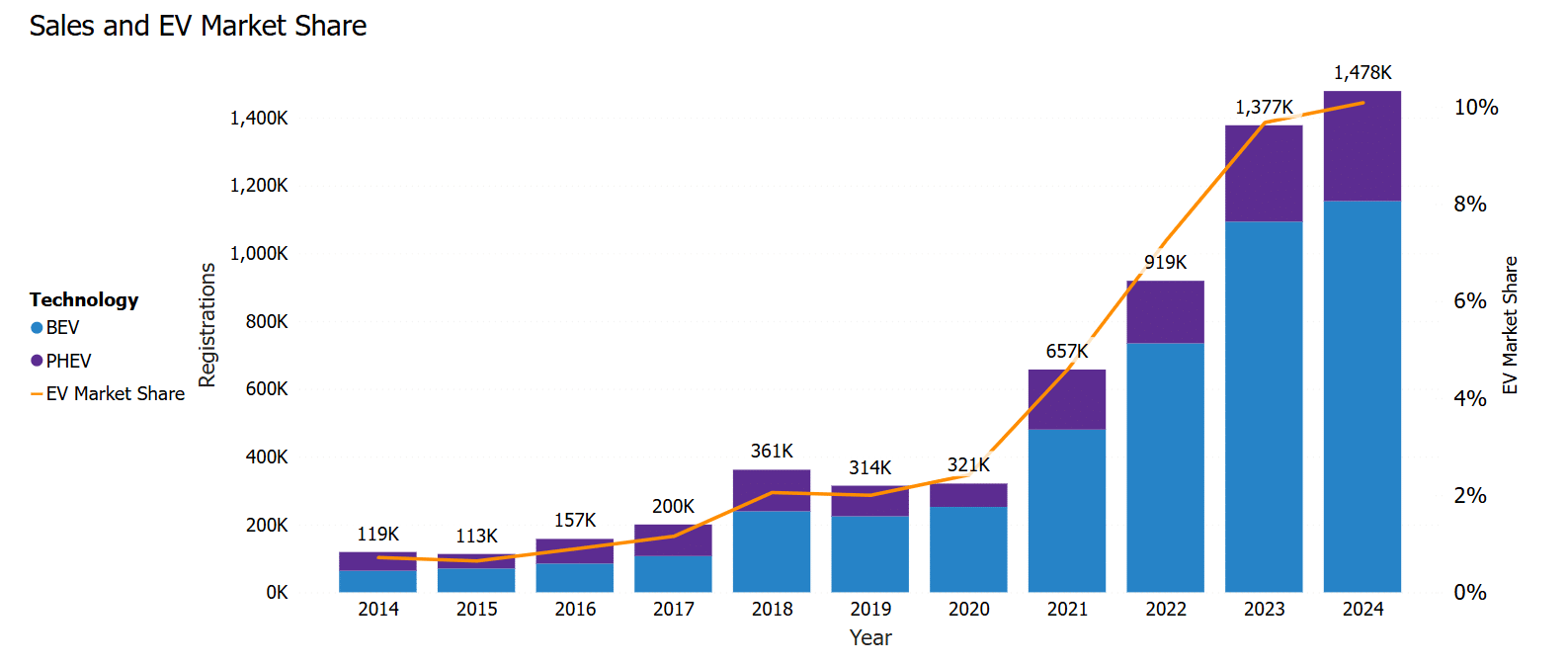

EV sales and market share have been growing impressively in the US over the past decade. Market share jumped from a mere 1% in 2014 to over 10% in 2024, meaning one out of every ten new cars purchased in the US was an EV last year. As for the claims that the EV market is slowing in 2025, the first half of the year saw a record 607,089 EVs sold.

The auto market is global, and automakers compete worldwide, so it is not enough to look at the American market. This year, the global EV market share is expected to top 25%, meaning more than one in four cars sold worldwide will be electric. The surge of EVs globally is driven by Chinese car companies offering affordable, high-performing EVs across Asia, Europe, and South and Central America. The stakes are high. The Biden Administration imposed steep tariffs to keep Chinese EVs out of the US market, but that won’t last forever. In the words of Ford CEO Jim Farley, “We are in a global competition with China… And if we lose this, we do not have a future Ford.”

Customer Satisfaction and Consumer Interest

Along with increasing domestic EV sales and market share, two other statistics provide market momentum insights. The first is EV customer satisfaction, which remains strong. A recent McKinsey & Company study confirms what we EV drivers experience: once consumers kick gas, they rarely go back. The study showed that 76% of EV-owning households intend to buy another EV. This high satisfaction rate shows that EV ownership is meeting or exceeding customer expectations. It is also important because it means EV owners have positive experiences with the technology, which is critical since EV drivers are also ambassadors, fielding questions from EV-curious family members, friends, neighbors, and colleagues.

The second important statistic is consumer interest. The latest JD Power vehicle consideration study revealed that 24% of vehicle shoppers say they are “very likely” to consider purchasing an EV, and 35% say they are “somewhat likely.” Though this study was performed before Congress voted on the tax and spending bill that will gut consumer EV incentives, it was conducted in the months after President Trump took office and replaced what had been Biden’s supportive EV position with a highly negative one. Still, the percentages of “very likely” and “somewhat likely” remained unchanged from 2024 to 2025, demonstrating the durability of consumer interest in EVs.

Cox Automotive’s 2024 Path to EV Adoption Study showed similar consumer EV interest and that the EV market is casting a wider net. Their research found that EV shoppers are younger, less affluent, more multicultural, and more likely to consider a used EV today compared to 2021. This widening of consumer interest is a big deal as the EV market gears up to shift from the early adopters who have been buying EVs so far to mass market consumers who will drive the next decade of growth.

It is up to automakers

Market optimism is warranted despite Congress and the President pulling the EV incentives rug out from under the EV industry and consumers. Without government support, the EV market’s future is up to the automakers who need to produce and market the desirable and affordable EVs they’ve been promising for years. Consumers are waiting.

Suppose American automakers are going to remain a dominant force in the global market, let alone survive the surge in Chinese EV brands’ performance. In that case, they will need to muster strong domestic demand to achieve the Biden Administration’s goal of 50% of all new light-duty car and truck sales being electric by 2030, regardless of who is in the Whitehouse. The goal of 50% market share by 2030 is not and never was an EV mandate; it is an acknowledgement of the inevitable future of the auto market and a strategic effort to boost American innovation, manufacturing, and jobs.

As Jim Farley demonstrated with Ford’s recent decision to accelerate EV production, the time for slow walking is over. EVs are the future of global transportation because they are cheaper to drive, require less maintenance, run on widely available electricity, and significantly lower the sector’s climate emissions. While the rest of the world’s major auto markets gallop into the EV future, the question now is whether America will play a leadership role to ensure American consumers, businesses, and workers benefit, or will it be dragged along reluctantly, clinging to the reins of the internal combustion past. Here’s hoping for the former.