[Update to the article below: On Dec. 10, Georgia Power reached an agreement with the state’s PSC staff to greenlight Georgia Power’s request to spend $20 billion in new power generation. Read our statement about the agreement here.]

In Georgia, a lame-duck Public Service Commission (PSC) is set to approve huge spending by Georgia Power that could add significant cost and risk to customer bills.

Voters frustrated by unaffordable electric bills ousted two incumbent Public Service Commissioners in the November 4th statewide election by a margin of 60% to 40%. Will the remaining Commissioners learn a lesson or turn a blind eye to voters?

What’s on the table

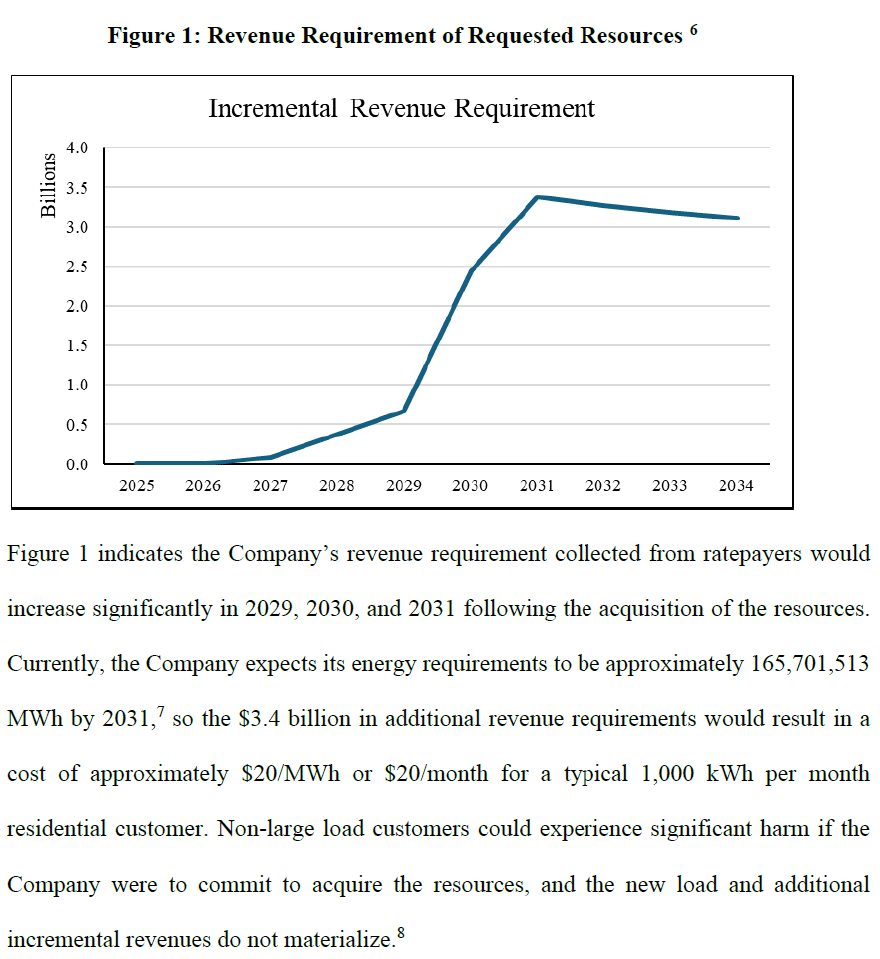

The PSC is made up of just five Commissioners, and the two newly elected Commissioners will take their seats at the start of the new year. In December, the Commission, including the two lame-duck members, is set to approve or disapprove Georgia Power’s request to spend $20 billion in new power generation to meet the utility’s projections that there will be huge data center power demands several years from now. The Public Service Commission (PSC)’s own staff estimate the total investment would total to $50-60 billion over the operating life of the assets if the Commission approves Georgia Power’s request in full. That is why the PSC’s own staff recommend a more measured approach: approve only part of the plan and only move forward with additional projects if the data centers sign binding contracts to pay for the new energy infrastructure. We agree.

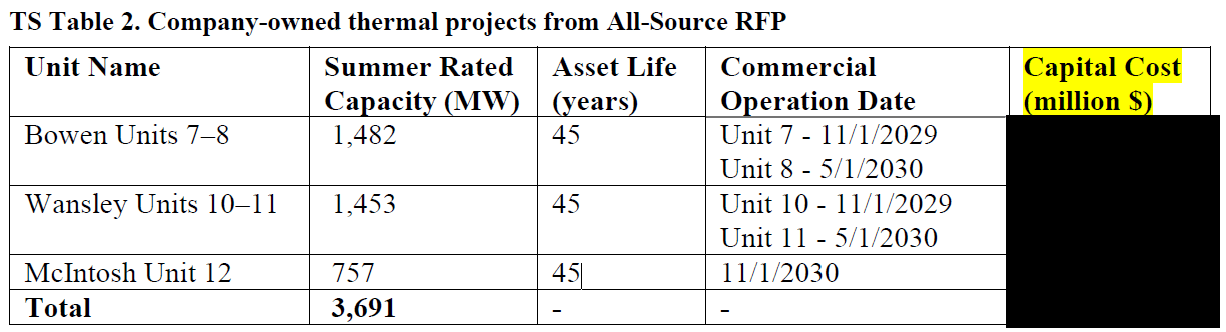

Georgia Power’s proposal includes a lot of different resources: contracts to buy power from existing power plants, contracts with battery and solar with battery projects, adding storage to existing solar facilities, and a plan to build three massive new gas power plants. Those new gas plants are a significant cost and similar to extending a mortgage to lower a monthly rate, Georgia Power is proposing to spread the costs of those plants over 45 years, much longer than typical, meaning customers will still be paying for the construction of these plants through 2075. The Commission’s staff estimates that Georgia Power bills will go up $20/month just for the construction and contract costs of these resources; the costs of fuel and fuel contracts would also be paid for by all Georgia Power customers.

Locking in Customers until 2075

I have a background in modeling electricity systems. So one thing that struck me, in addition to the high cost of these new gas power plants, is the asset life: 45 years. Typical “asset life” of a new gas power plant is modeled as 25-30 years, in my experience.

Pushing the asset life of these new gas plants to 45 years appears to be a clear tactic to make hugely expensive power plants appear less so. It brings to mind the recent proposal by the federal administration to push people toward 50-year mortgages to be able to afford home ownership. Yes, it would technically bring the monthly payment down, but the overall cost balloons as payments are stretched over longer and longer timeframes.

Since these new gas power plants don’t begin operation until late 2029 and 2030, this means the Commission is currently deciding whether to add a cost that customers will be paying off on their electricity bills until 2075!

New Gas Plants are a Bad Deal for Georgia

As our technical expert Lucy Metz testified, these gas plants are a bad deal for Georgia Power customers for many reasons, including:

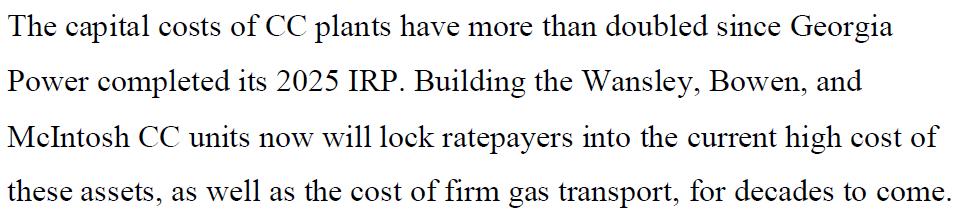

The cost to build these plants has more than doubled since Georgia Power ran its IRP analysis

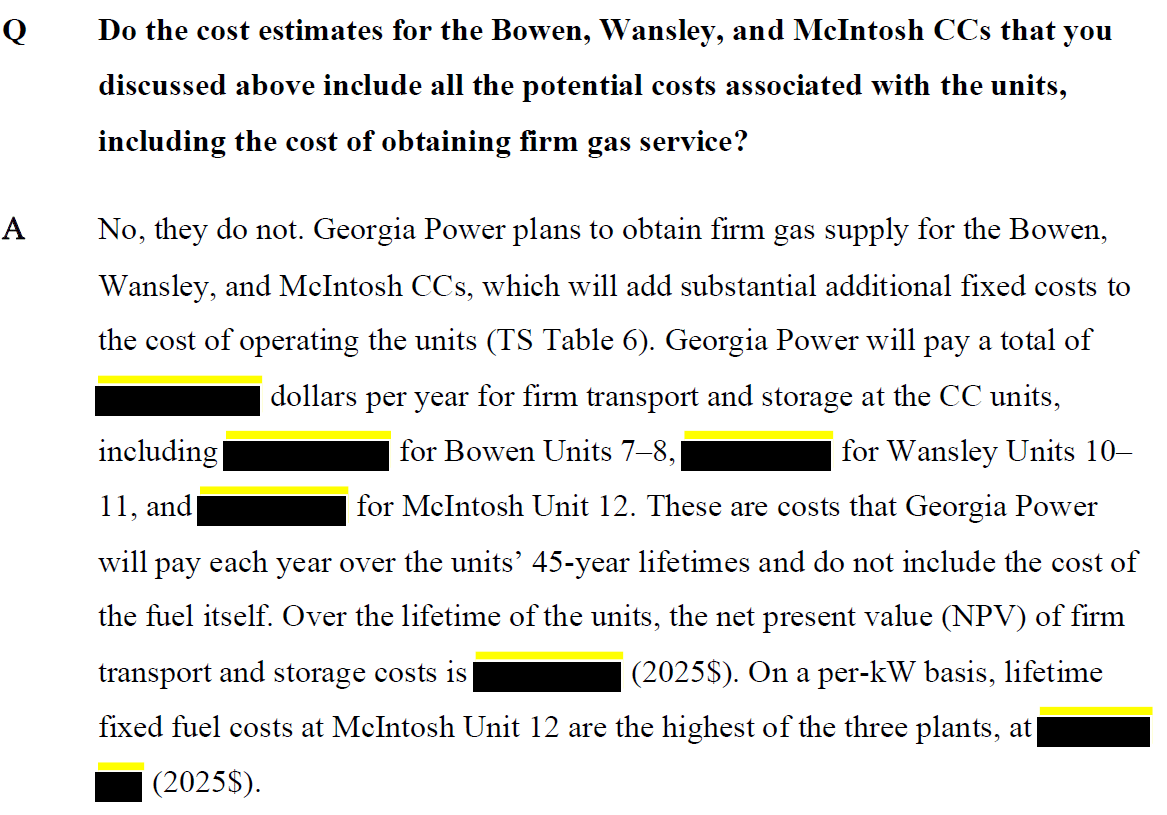

Georgia Power customers will be locked in to paying historically high “firm transportation” costs (which is essentially paying to reserve the right to purchase gas on a given pipeline).

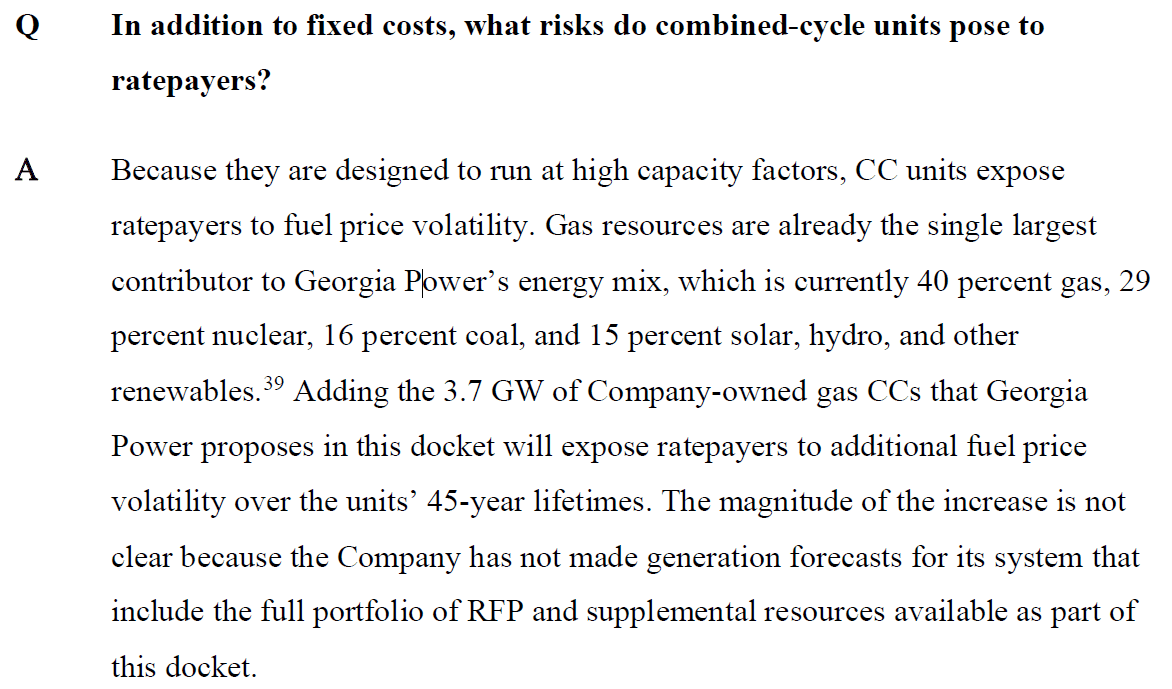

Customers will be on the hook to pay for the gas itself regardless of how high “natural” gas prices rise.

Again, looking at analysis by the PSC’s own staff, customer bills could go up an average of $20/month AND customers would pay $50-60 billion over the lifetime of the assets, not including the costs of firm transportation and fuel, which are substantial. Clearly, this is a bad deal for customers in both the near-term and the long-term.

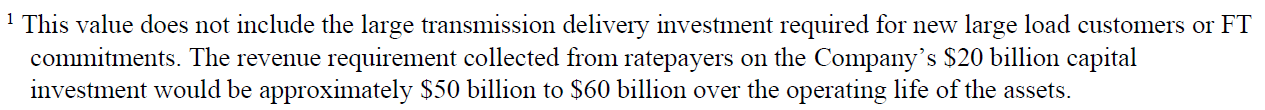

As a part of its analysis, PSC staff performed their own evaluation and ranking of the bids Georgia Power received in response to its RFP. This analysis took into account the trove of trade secret materials provided to staff and other intervenors as part of the process. While we at SACE do not agree with their method and assumptions in their entirety, the direction is clear. Some of these resources are much more cost effective and less risky than others, and the Commission should certify only what it needs to now, and ask Georgia Power to come back with additional proposals as the needs become more concrete.

Notably, PSC staff did not recommend that the Commission certify any of the three gas CC plants that Georgia Power plans to build itself. We agree with staff on this as these plants would be a potential source of skyrocketing profits for Georgia Power and risk of ever higher bills for Georgia Power customers.

What Should the Commission Do?

We’ve covered what the Commission should not do (approve Georgia Power’s request in full), so what should the Commission do? Several of the resources in Georgia Power’s request include stand-alone battery storage or battery storage associated with solar. As Metz pointed out in her testimony, battery storage resources are more modular, lack fuel cost, and have shorter asset life assumptions. They thus do not lock customers into nearly the level of long-term costs and risks that the new gas power plants do.

The Commission can approve a subset of the resources in Georgia Power’s request, and require Georgia Power to do more due diligence on the rest. Metz specifically suggests that the Commission require a further cost-effectiveness evaluation as a part of certification of resources that aren’t approved at this time. Similarly, PSC staff recommends that some resources be “conditional” so that they can be brought online if and when Georgia Power has signed contracts with large loads under the Commission’s new rules and regulations.

There has never been a larger tranche of power plant expansion considered at one time by the Georgia Public Service Commission. In this docket, lame-duck Commissioners could set the direction for energy in Georgia for decades to come. Tune in to the hearing on the Commission’s YouTube channel starting December 10 to hear Georgia Power, SACE and Sierra Club, PSC staff, and other intervenors present positions on this decision.