A report released earlier this year shows very promising trends for the declining cost of offshore wind energy.

Chris Carnevale | August 14, 2020 | WindA report released earlier this year shows very promising trends for the declining cost of offshore wind energy. The report is the annual “Cost of Wind Energy Review” from the National Renewable Energy Laboratory (NREL), and while the report has been published nearly every year since 2010, this year’s report was particularly interesting to me given its ability to integrate information from the recent flurry of activity of offshore wind energy in the United States.

Land-based wind energy is a well established industry in the U.S. and with decades of national data, the trend of decreasing costs for onshore wind energy have been well understood for many years. But offshore wind is very new in the U.S., despite having a 30-year history in Europe, and estimates for how much offshore wind energy will cost in the U.S. have been somewhat speculative historically. But recent developments have made offshore wind much more of a reality in the U.S.

The first offshore wind farm to go into operation in the U.S. was the Block Island Wind Farm off in Rhode Island, which began supplying power to the grid in 2016. The second wind farm to be built in the U.S. is Dominion Energy’s wind farm off of Virginia’s coast, which will begin producing power this year. But huge movements have been made toward developing offshore wind energy in the past couple years in the Northeast and mid-Atlantic, with a pipeline of projects that will power hundreds of thousands of homes when the projects go online, presumably in the next few years. Offshore wind can attract major capital investments, create workforce development, and provide long-term supplies of clean, renewable energy. Realizing these promises of offshore wind development, state governments have made recent commitments to more than 28 gigawatts of offshore wind by 2035, which would power millions of households.

These developments and recently signed contracts lend new data to help us understand how project pricing in the U.S. might look. NREL’s “Cost of Wind Energy Review” takes this new data into consideration, making it of particular interest this year.

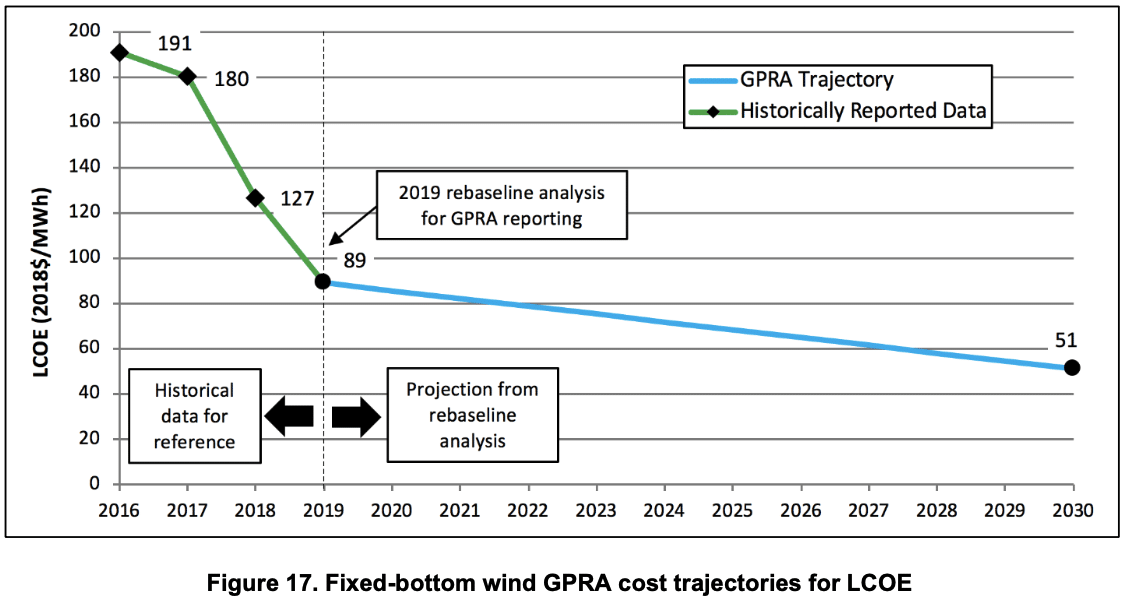

The report finds that estimates for the cost of offshore wind energy in the U.S. are declining steeply. At an estimated $89 per megawatt-hour (MWh) reference point for fixed-bottom (not floating) foundation turbines, this year’s estimated cost of offshore wind energy is about 70% of what it was last year ($124/MWh), and about half as much as it was two years ago ($173/MWh).

The report’s “reference point” of $89/MWh is based on a number of assumptions about a potential wind farm consistent with current conditions for the offshore wind market, such as turbine technology, water depth, and distance from shore. Changing the assumptions to reflect a range of different possible conditions, NREL found that the cost of offshore wind is likely as low as $63/MWh or as high as $124/MWh. NREL notes that the cost estimates “reflect a cost to a wind power plant developer and are not directly comparable with power purchase agreements that reflect the sale of electricity,” meaning that once you factor in other market conditions such as tax incentives or other revenue streams, the price of power to the purchaser may be less than NREL’s estimated cost of energy. This appears to be borne out by announcements of very low purchase prices, such as those of Vineyard Wind Farm and Mayflower Wind Farm, which have power purchase agreement (PPA) levelized prices of $74, $65, and even $58/MWh! Such low PPA prices may be workable for the wind developers given their ability to access multiple revenue streams that help bring down the cost, such as tax credits and capacity markets.

The range of $63-124/MWh and the reference point of $89/MWh line up very well with publicly reported pricing of U.S offshore wind projects in the U.S. However, given that the data set for offshore wind project pricing in the U.S. is still very limited, NREL had to continue using project information from wind farms overseas to get a more accurate assessment of what project costs would be like here. By doing so, they found that “Offshore wind cost reductions show a steep reduction through 2018 and are showing alignment more with recent European project bids or “strike prices” and might suggest continued significant reductions in the coming years.” This statement is notable because the suggestion is that even though the United States has missed out on decades’ worth of the experience and cost reducing efficiencies that Europe has built into its offshore wind supply chain, the nascent U.S. wind industry may not actually suffer much of a cost setback. And just as the European price of offshore wind is projected to continue decreasing, so too may offshore wind in the U.S.

The forward-looking information in the report is particularly good news. NREL estimates that while the energy from a typical offshore farm built today would be $89/MWh, in 2030 it may be just $51/MWh. This cost reduction may come about as offshore wind turbines get larger and more efficient. While the “reference point” wind farm in 2019 uses 5.5-megawatt turbines with a 49% net capacity factor, NREL estimates that a typical wind farm in 2030 may be using 15-megawatt turbines with a 58% net capacity factor! Bigger turbines mean more energy with fewer turbines – this translates directly to cost efficiencies.

With costs on the decline, offshore wind may be a winning energy technology for the Southeast. Southern states and utilities see the promise of offshore wind and are pursuing it, to varying degrees:

- Dominion is making a big push for offshore wind in Virginia

- North Carolina has its first offshore wind farm under initial stages of development currently

- South Carolina has had its offshore wind area identification process stalled for several years

- Georgia Power has dropped its interest in its potential offshore wind project

Offshore wind is clean and renewable, and creates lots of jobs. And while solar is the least expensive power option for the Southeast, offshore wind could contribute significantly to a pollution-free energy mix, especially helping by producing high-value power during hot summer afternoons, when electricity demand is at its highest.

I have been tracking offshore wind energy in the Southeast for nearly a decade with SACE and while there have been ups and downs in the prospects for offshore wind over the years, the future of offshore wind currently looks better than it ever has before. Please stay tuned to SACE’s work as we continue to advocate for wind energy around our region. You can learn more here: cleanenergy.org/wind

#AmericanWindWeek