There has been a flurry of news about Southeast utilities exploring some sort of market competition in recent days. While I, unfortunately, wasn’t in the room to hear what exactly these utilities are talking about (in fact, no stakeholders, regulators, or policymakers have been involved in any discussions to date), I’ll break it down into what we know and what it could mean for customers and clean energy in the Southeast.

What do we know?

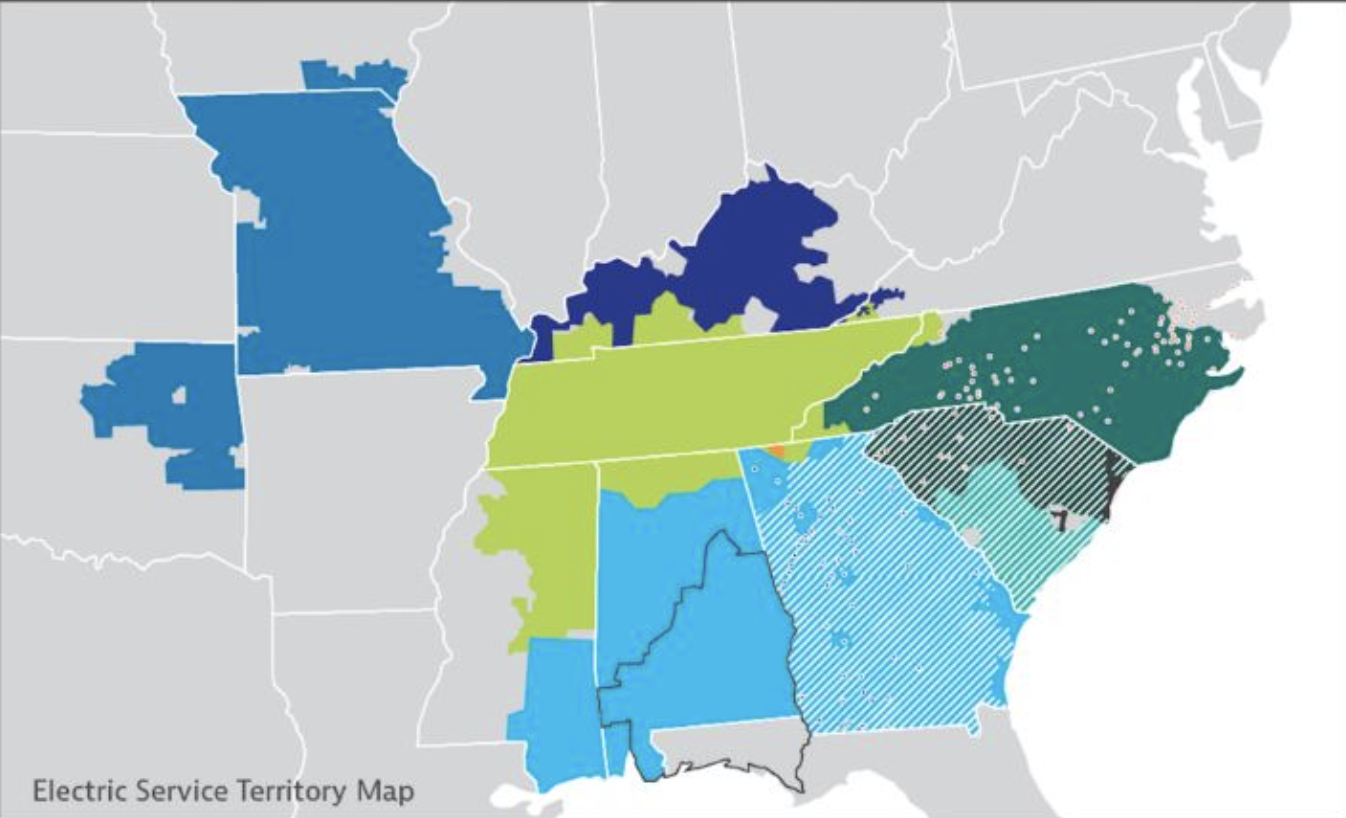

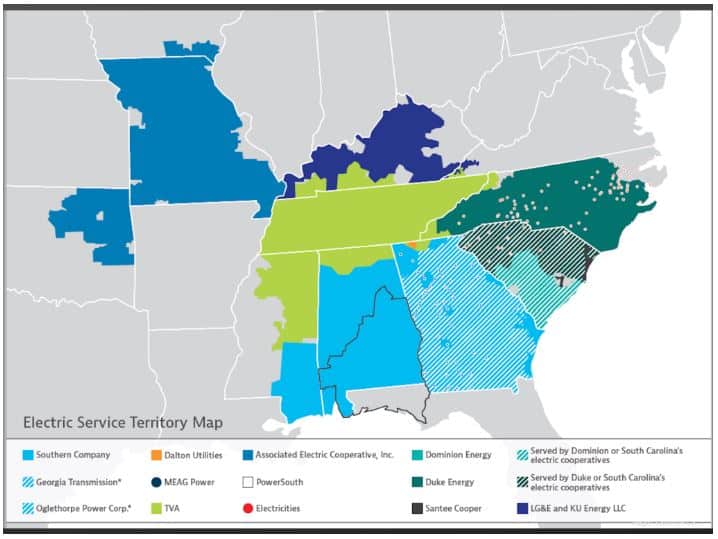

Utilities involved include:

- Southern Company

- Duke Energy

- Tennessee Valley Authority (TVA)

- Dominion Energy South Carolina (DESC)

- Oglethorpe Power Corp and MEAG in Georgia

- LG&E and KU in Kentucky

- Santee Cooper in South Carolina

- Associated Electric Cooperative headquartered in Missouri

- Other municipal and cooperative utilities

The benefits of an energy market increase as the market gets bigger. Thus I suspect the large utilities in these discussions (Southern, Duke, TVA) are able to exert more power over how this market would be structured than the smaller utilities involved.

The most detailed look at this potential market comes from a discussion John Downey at the Charlotte Business Journal had with spokespeople from Southern, Duke, and the Missouri-based Associated Cooperative Inc. Here’s a summary of what Downey reported on in that discussion and what it means.

It’s an exchange, not an EIM (Energy Imbalance Market)

Southeastern utilities can already buy and sell power from each other, they just have to use an antiquated system to do so—pick up the phone and call to schedule the purchase. The proposal currently under discussion would be an upgrade to that system not a move to a full-on market. Utilities would be able to submit a bid to provide or purchase power and have an algorithm automatically match them together.

No governing board

All three utilities Downey talked to were adamant that the new setup would not involve any new governing board or authority that could enforce sales or require transmission be set aside for sales. All sales would remain voluntary and would be ultimately up to each utility. This is different from every other energy market construct in the country.

Why now?

Southeast utilities have long resisted competition, so why are these discussions happening now? One likely driver is that at least two state legislatures have been exploring bringing electricity competition to the region. In North Carolina, there was a bill that would allow the regulator to force investor-owned utilities to join or create a market if it is in the public interest (HB 958, in committee since April 2019). In South Carolina, the legislature could establish a committee to study the benefits of an electricity market in the state (H. 4940 passed over to the Senate and S. 998 in committee).

Discussions are still early, in the “learning phase” according to Duke and the “exploratory stage” according to Southern, however, they have already come up with a name: the Southeast Energy Exchange Market (SEEM), and have decided on a settlement interval: 15-minutes. Could the utilities be closer to filing a proposal for this market with the Federal Energy Regulatory Commission (FERC) than we realize? This is definitely something we will be watching closely.

Our take

I’ll end with this: I and other advocates were surprised to see that TVA is involved in these discussions. As a self-regulated federal agency, TVA is not feeling pressure from Congress or the President the same way other utilities like Duke and Santee Cooper are feeling from state policymakers. So why is TVA interested in participating in a market? Could it be because TVA may soon need a place to sell excess generation if Memphis leaves and takes 10% of TVA’s load with it?

Thinking through this scenario brings up one last potential impact of this market. While a market set up like this will likely reduce overall solar curtailment, it could also prop up older fossil plants that a utility would otherwise retire. So let’s not jump to the conclusion that this market would be an emission-reducing machine.

For true emission reductions, a market in the Southeast would need at least the following:

- Wholesale generation competition with complete transparency and complete divestment of existing generation resource to remove bias toward incumbent utilities.

- Combined regional resource and transmission planning to eliminate redundant proposals for new generation and open up existing power plants to competition with new resources.

- Involvement from state policymakers to ensure state clean energy policies are met (and to avoid what PJM is going through).

Analysis from by the Nicholas Institute’s Jennifer Chen shows that market competition in the Southeast would bring about benefits to customers, with the most benefits arising from the region joining or forming a Regional Transmission Organization or RTO.

What’s next?

Despite being an “exchange” and not a true market, the rules for the SEEM will need to be approved by FERC before the exchange can begin. SACE agrees with the many regulators and advocates across the region that have rightly critiqued these utilities for holding these discussions without transparency and without stakeholder involvement.

Before anything is filed with FERC, a robust stakeholder process is needed to determine how to bring competition to the Southeast in a manner that most benefits ultimate customers.

We will continue to monitor these developments. Sign up for our newsletter to receive regular updates on this and our other work throughout the region.

#SoutheastEnergyExchangeMarket