A contingency of large electric utilities across the Southeast has proposed to form the Southeast Energy Exchange Market or SEEM. While the title suggests the creation of a competitive energy market, the proposal is anything but. FERC responded by noting deficiencies in the proposal and required the utilities to submit updates. If utilities want to really put the “M” in SEEM, they should go back to the drawing board and propose a Southeast Energy Imbalance Market (EIM). Absent this option, FERC could use the update process to at least make sure that SEEM will meet its limited goals in the near term and be a tool to speed the adoption of a regional competitive market over the long term.

Background and Timeline

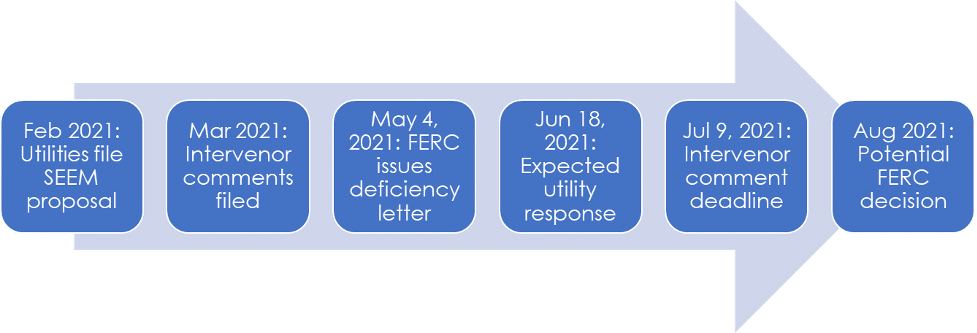

Before the SEEM “market” can be set up it first needs to be approved by the Federal Energy Regulatory Commission (FERC). On May 4, 2021, FERC issued 10 pages of “deficiency letter” questions for utilities to answer in order to flesh out missing or unclear information. Robust utility responses would provide much-needed transparency into SEEM. Intervenors in the FERC case (of which SACE is one with a group of public interest organizations from across the region) will then have the opportunity to further comment.

What did FERC ask for in its deficiency letter?

- How will SEEM interact with Southern Company’s Market-Based Rate (MBR) Tariff?

- How transactions between buyers and sellers of power in SEEM will interact with or replace transactions that would occur under other bilateral agreements, and how SEEM will interact with neighboring markets

- How will SEEM prevent market manipulation, including how will existing auditing and monitoring tools remain sufficient and how will the treatment of unconsummated SEEM transactions help identify market manipulation?

- Clarify of membership requirements and the standard of review for changes to SEEM

- Explain SEEM’s use of transmission, such as clarifying contradicting claims about the use of excess transmission, how SEEM transmission use could impact other transmission rates, and how a proposed Network Map of transmission from all SEEM participants will be developed and used.

- Clarify the roles and authorities of the SEEM Administrator and SEEM Auditor

- Clarify what information will be provided and who has access, including what will be in business practice manuals, who will have access to the manuals, and data available on the SEEM website

How could the SEEM utilities respond?

SEEM as proposed is unlikely to deliver on its own promise: small incremental cost savings and marginally reduced renewable energy curtailments. Instead, ratepayers in the Southeast need actual competition, under a neutral administration, with broad participation, market transparency, and accountable governance. SEEM does not even attempt to promise these market essentials. The deficiency response is an opportunity for the SEEM utilities to introduce them so that SEEM is the first step toward a true competitive electric market in the Southeast.

To do that, the following elements should be included in the utilities’ response to promote basic access and transparency:

- SEEM needs an independent Market Monitor for the SEEM, similar to the setup in integrated markets and Energy Imbalance Markets (EIM) across the country, to guard against market manipulation.

- SEEM needs to remove unnecessary roadblocks to participation. This could be done by having a single pro forma enabling agreement and not allowing existing SEEM members and participants to arbitrarily refuse to enter into enabling agreements.

- SEEM’s provisions allowing participants to block energy exchanges with other participants should be removed, or at least very limited criteria should be set for blocks, requiring pre-approval from the market monitor if a participant is not allowed to exchange with another participant.

- SEEM data on trades and unconsummated transactions should be publicly reported after an appropriate, short time lag.

- SEEM participants should have voting participation in its governance.

- SEEM should empower stakeholders to review its effectiveness every two years, with an explicit goal of enabling enhanced competition across the region. Particularly, SEEM should:

- Moving away from a “split the difference” price settlement to one based on or similar to locational marginal pricing.

- Add a day-ahead hourly market with a resource-sharing construct that removes the inefficiency of each individual utility maintaining its own reserve margin regardless of the availability of resources available within SEEM.

- SEEM utilities should pay for an independent, regularly updated study to show that SEEM, with these changes made, provides benefits that outweigh the costs. This includes looking at the impact of SEEM on energy burdens across the region, and the impact of SEEM on carbon emissions. This study should be fully available to the public.

- SEEM utilities should join SACE and other intervenors in calling for FERC to hold a technical conference on electric market reforms across the Southeast.

How utilities could put the M in SEEM

The SEEM utilities use the term “market” in the name of SEEM but claim in their original filing that SEEM is not an EIM. Fun fact: documents obtained by SACE showed that many of the utility staff involved in the development of the SEEM proposal actually started by calling it an EIM.

So while the suggestions listed above would certainly improve on the current SEEM proposal, the utilities should skip the charade and put the “M” in SEEM by making it a true EIM.

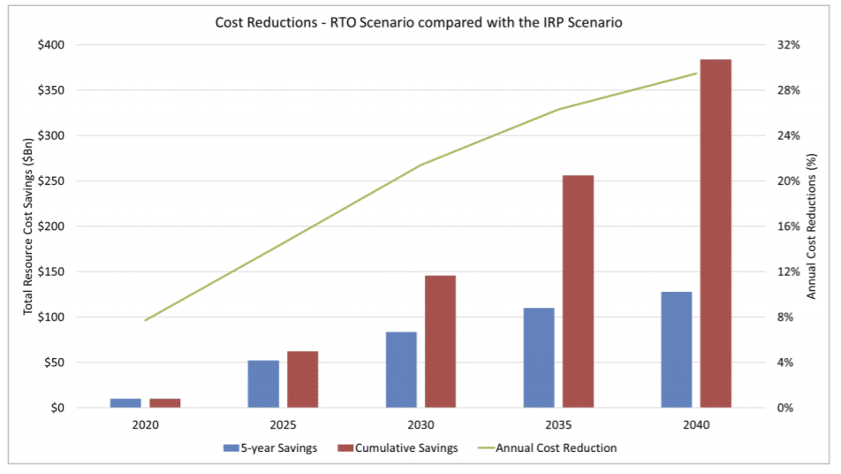

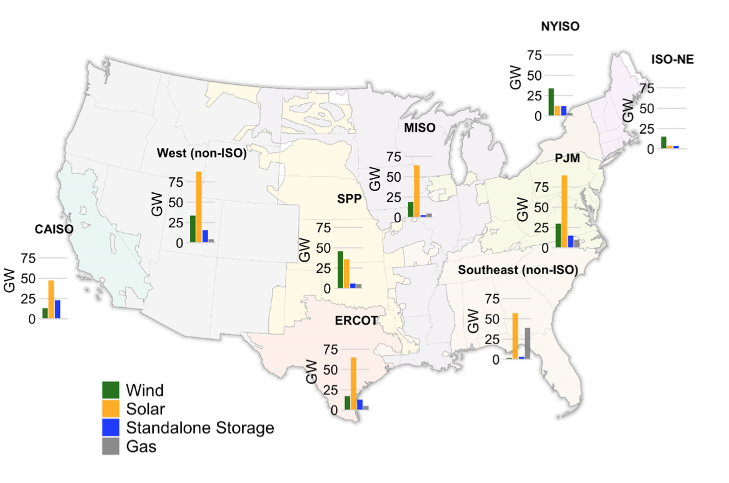

Competitive electric markets are one tool to speed the clean energy transition in a way that saves customers on their electric bills. For example, right now there are countless utilities across the region that have proposed new gas plants in their queues, far more than regions of the country where markets are in place. One key reason for this is that each utility is doing resource planning largely as an island. We’ve shown before that Southeast utilities do not tend to peak at the same time, and a platform for sharing resources across these utilities (i.e. a market) would reduce the need for all that new gas and would make it more economically efficient for complementary clean energy resources to flow across the region.

Stay tuned – SACE will continue to follow the SEEM proposal and other potential market reforms across the Southeast.

#SoutheastEnergyExchangeMarket