A number of utilities filed a proposal to the Federal Energy Regulatory Commission (FERC) in February to create the Southeast Energy Exchange Market (SEEM). We haven’t posted on SEEM for a while, below we’ve outlined our responses to some of the latest questions on what SEEM is, whether or when it will happen, and who is involved. We will continue to follow these developments, so stay tuned for more on SEEM and electricity market reforms in the Southeast. Read all of our blog posts on SEEM.

What is SEEM?

SEEM is a proposed change to the bilateral market among Southeast utilities. For more see our previous blog post.

Did SACE file comments on the SEEM proposal?

Yes. SACE joined with a number of other public interest groups to file a protest and comments on SEEM on March 15. Our filing recommends that FERC reject the SEEM proposal and, among other things, hold a technical conference to spur discussion among Southeast states and utilities about electric market reforms.

If markets and competition help clean energy, why are SACE and its allies asking FERC to reject the SEEM proposal?

We looked at the SEEM proposal as filed, and have talked to some of the SEEM utilities, and we have serious concerns that it would not lead to more clean energy or address high energy burdens in the Southeast.

States in the Southeast continue to have some of the highest electricity bills in the country. An unacceptable combination of low incomes, a general lack of investment in energy efficiency, the prevalence of the need for electricity to provide both heating and cooling, and monopolistic utilities that are insulated from customer pressure have led states in the region to consistently appear among the worst in terms of energy burden (energy costs as a portion of household income).

The SEEM proposal would not even scratch the surface of these issues. If the utilities’ claims of the benefits of SEEM are to be believed, and $40 million in annual savings is spread across the entire SEEM footprint, we estimate that could lead to, at most, a savings of $1/year for residential customers served by SEEM utilities. Most likely the impact would be lower.

There are two main reasons we think the SEEM proposal would not help clean energy:

- The SEEM proposal lacks the ability for independent or small developers or projects to participate, and would not change how utilities plan future resources (i.e. would not change how Southeast utilities develop their Integrated Resource Plans), so will not lead to additional renewable energy on the grid, offset the need for planned new gas plants, or drive utilities to retire coal plants earlier than currently planned. Even the claims that SEEM would help to integrate existing renewables, particularly by leading to less curtailment of solar energy, are suspect. So in this regard, we don’t see SEEM as a driver of clean energy.

- It is possible SEEM could derail true market reform efforts if allowed to move forward in its current form. In our protest filed with allies, we detail all the examples of Southeast states and localities that are considering electric market reforms. If SEEM is approved it could derail these discussions and either prevent or delay the kind of market reforms that could drive a significant increase in future renewable energy, accelerate the retirement of coal and gas units, and cause the cancellation of new gas plants before they are built.

What are the next steps for SEEM?

The SEEM utilities requested that FERC approve the SEEM proposal within 90 days of filing, by May 13, 2021. It is SACE’s understanding from the filing and conversations with staff at various SEEM utilities that they are seeking FERC approval of SEEM before making a significant investment in setting up the infrastructure and contracting for someone to build the algorithm. With approval in May 2021 the SEEM utilities estimated a “go live” date for SEEM to be in the first quarter of 2022.

However, the utilities’ desired schedule is not necessarily the schedule that FERC will take. Several intervenors submitted requests FERC hold a technical conference on market reforms in the Southeast. If FERC wants to hold such a technical conference before deciding on SEEM, it could push the decision back by months. If FERC finds the SEEM is unjust, unreasonable, and unduly discriminatory, it could use its ruling to reject SEEM to provide guidance to SEEM utilities on how to fix deficiencies. SEEM utilities could then choose to re-submit SEEM in a form that begins an iterative process toward developing a robust wholesale market in the Southeast.

Who are the SEEM utilities?

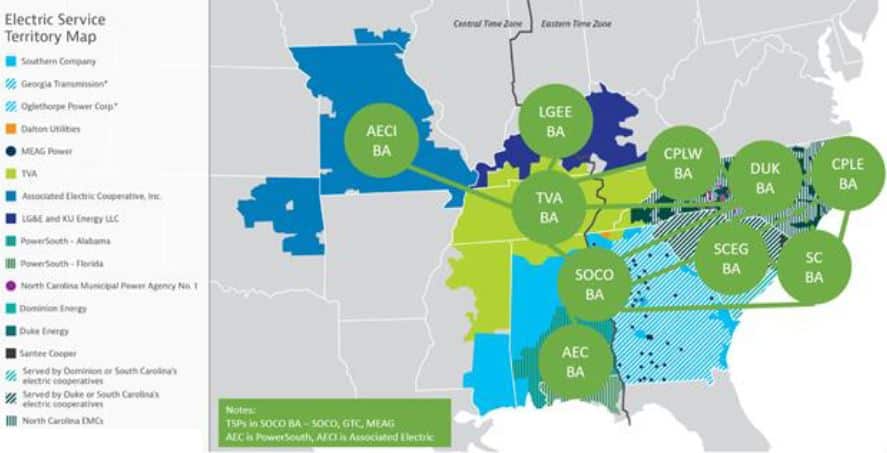

As of February 12, 2021 “SEEM Members” includes Alabama Power, Georgia Power Company, and Mississippi Power Company (collectively, “Southern Companies”); Associated Electric Cooperative, Inc. (“AECI”); Dalton Utilities (“Dalton”); Dominion Energy South Carolina, Inc. (“Dominion SC”); Duke Energy Carolinas, LLC (“DEC”) and Duke Energy Progress, LLC (“DEP”) with DEC and DEP collectively referred to as “Duke”; Louisville Gas & Electric Company (“LG&E”) and Kentucky Utilities Company (“KU”) collectively (“LG&E/KU”); North Carolina Municipal Power Agency Number 1 (“NCMPA Number 1”); Power South Energy Cooperative (“PowerSouth”); North Carolina Electric Membership Corporation (“NCEMC”); and Tennessee Valley Authority (“TVA”).

There are also potential SEEM members that are not officially part of the SEEM filing at FERC but are considering joining SEEM. Potential SEEM Members as cited in the filing are Georgia System Operations Corporation (“GSOC”); Georgia Transmission Corporation (“GTC”); Municipal Electric Authority of Georgia (“MEAG Power”); Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe”); and South Carolina Public Service Authority (“Santee Cooper”).

What are the docket numbers and who has intervened?

The SEEM dockets are a busy place! There are twelve dockets and by our latest count over 70 organizations have intervened and/or submitted comments. These intervenors range from utilities involved in SEEM, utilities not involved in SEEM, neighboring RTOs like MISO and PJM, state regulatory commissions, clean energy associations, environmental and public interest organizations, and more. See our filing page for a list of the dockets, and use FERC’s elibrary tool to search each docket for the filed comments.

What are the next steps for SACE?

We will continue to push for policies and market reforms that advance equity and work toward clean, safe, and healthy communities throughout the Southeast.

Read all of our blog posts on SEEM.

#SoutheastEnergyExchangeMarket