It’s been two months since my first blog post about SEEM, the soon-to-be-proposed Southeast Energy Exchange Market, so here’s an update on what we know as of mid-September.

One of our main criticisms of the SEEM idea was the lack of transparency and collaboration with regulators and stakeholders. With no apparent overarching stakeholder plan by the utilities involved, information about SEEM has leaked out slowly over the last two months. The following has come from direct communications with utilities, stakeholder briefings held by one utility (Southern Company), and even from documents obtained through public records requests of the publicly-owned utilities involved.

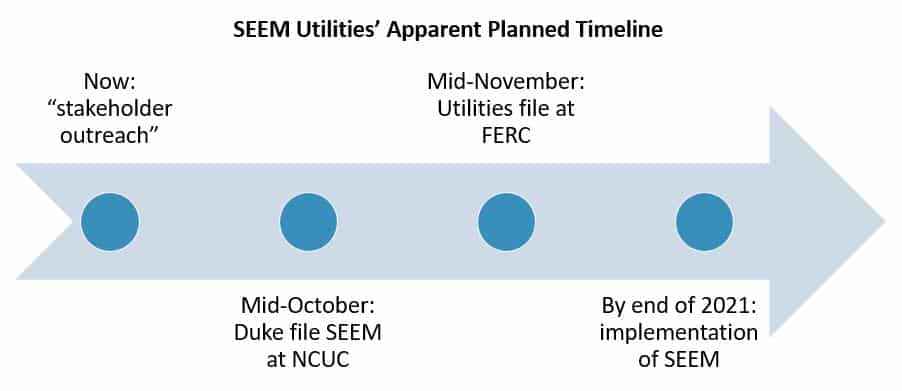

Timeline

We have a pretty good idea of what to expect from SEEM over the next few months and into implementation, according to current plans from SEEM-involved utilities.

The most interesting takeaway from this timeline is the fact that Duke will have to file the SEEM proposal at the North Carolina Utilities Commission (NCUC) a month before filing at FERC, and that the filing at the NCUC will be the same proposal that all SEEM utilities will file at FERC. We will be watching closely to see what is filed at the NCUC, and how it impacts our impressions of SEEM.

What we expect in the SEEM filing

We already knew that the SEEM proposal would include settlement at 15-minute intervals, as opposed to other real-time markets where bids and offers are settled in smaller increments such as every 5 minutes. More recently, we have learned that this settlement process will use a “split the difference” method. This means that if a utility has excess generation it offers at $20/MWh, and another utility has a need for generation and bids to purchase generation at $10/MWh, if the two utilities match under the SEEM construct, the price of power exchanged would be $15/MWh. This is different from other price settlement methods in energy markets across the country that settle at the generator’s offer price and thus encourage generators to offer at the lowest possible price. It is unclear how this settlement method will impact bidding behavior, and it makes it difficult to model a potential SEEM because existing energy market models tend to assume generators are bidding into the market at their actual cost.

We have also learned that exchanges will be made using excess transmission; that there will be some way for independent power producers (IPPs) to participate; and that there may be a governance body that consists of representation from across the region.

However, the list of what we don’t know is still longer than what we do know and includes:

- Whether there will be a market monitor and who that will be.

- How trade and price information will be made available to the public.

- How state regulators and other stakeholders will be involved in developing or changing rules.

- Who will operate the market.

- How the SEEM footprint can be expanded in the future.

- How the SEEM interacts with neighbor markets.

- How the SEEM may impact transmission operations and transmission congestion across the region.

Cost/benefit study

We have also learned in the past two months that SEEM utilities have not performed individual cost-benefit studies for each utility territory (that we know of), but they hired consultant Guidehouse to study the costs and benefits across the entire SEEM footprint. Full disclosure: the author of this blog previously worked for Guidehouse when it was still called Navigant.

Have we learned anything interesting from the cost/benefit report by Guidehouse?

Guidehouse findings included:

- that the average internal cost for each utility would be ~$4 million to set up and ~$3 million per year to operate. These costs do not include the costs of whatever entity would run the market itself, which would need to be recuperated through membership fees from SEEM utilities.

- an average of $45-47 million in benefits per year under a business-as-usual case. They estimated that approximately half of the benefits would derive from renewable integration, and thus saw higher levels of benefits under a carbon constrained future scenario. We estimate that the $45-47 million in benefits would work out to approximately $1 in savings per residential customer per year.

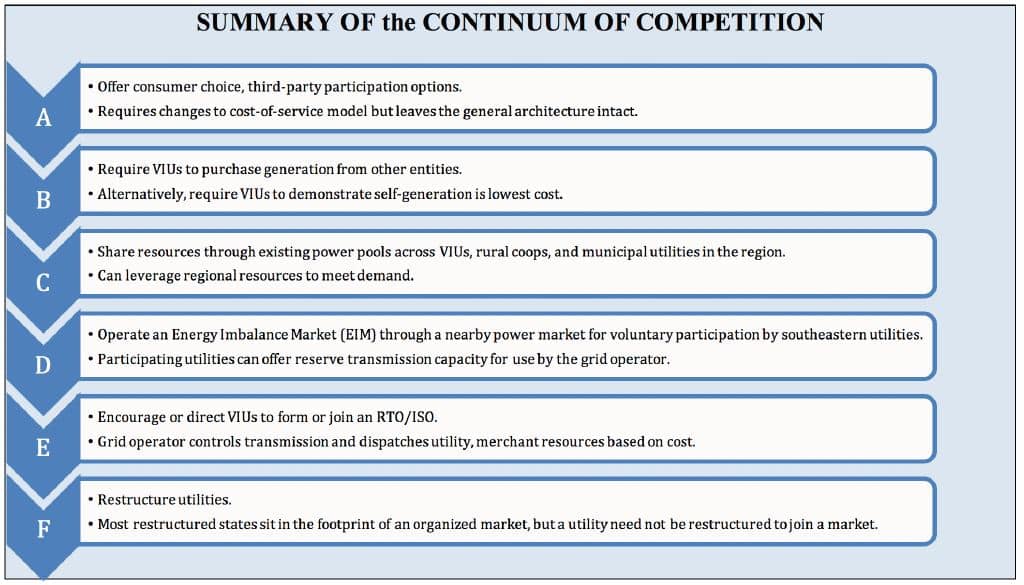

What is noticeable about these cost and benefit findings is the direction: more competition among generation means savings for customers. As described above, the SEEM is a very limited market, and really a technological improvement to the current way Southeast utilities trade energy bilaterally. The benefits of SEEM are small, but so is the level of competition inherent in the SEEM setup. If the Southeast were to continue in this direction, toward greater levels of competition, we can see that the cost benefits to utilities (and their customers) can increase as well.

Additional Resources Abound

While not entirely directly related to SEEM, I want to point out a number of recent reports and other resources related to energy market competition in the Southeast. Here’s a list with links of a few that I’ve found particularly relevant and helpful.

- Energy Innovation, GridLab, Vibrant Clean Energy report on RTO in the Southeast – modeling showing benefits of full RTO, footprint of study is not the same as SEEM footprint

- R Street + Jennifer Chen article – comparison with Energy Imbalance Markets (EIM)

- Nicholas Institute (Kate Konshnik + Jennifer Chen) policy brief – overview of options on continuum of competition (see image below)

We remain cautiously hopeful that the SEEM can be a stepping stone to the kind of competition that drives the transition to clean energy, and we will continue to work with our allies across the region to ensure SEEM is set up as that stepping stone, and not as a roadblock.

Stay tuned as we continue to learn more.

Read all of our blog posts on SEEM.

#SoutheastEnergyExchangeMarket