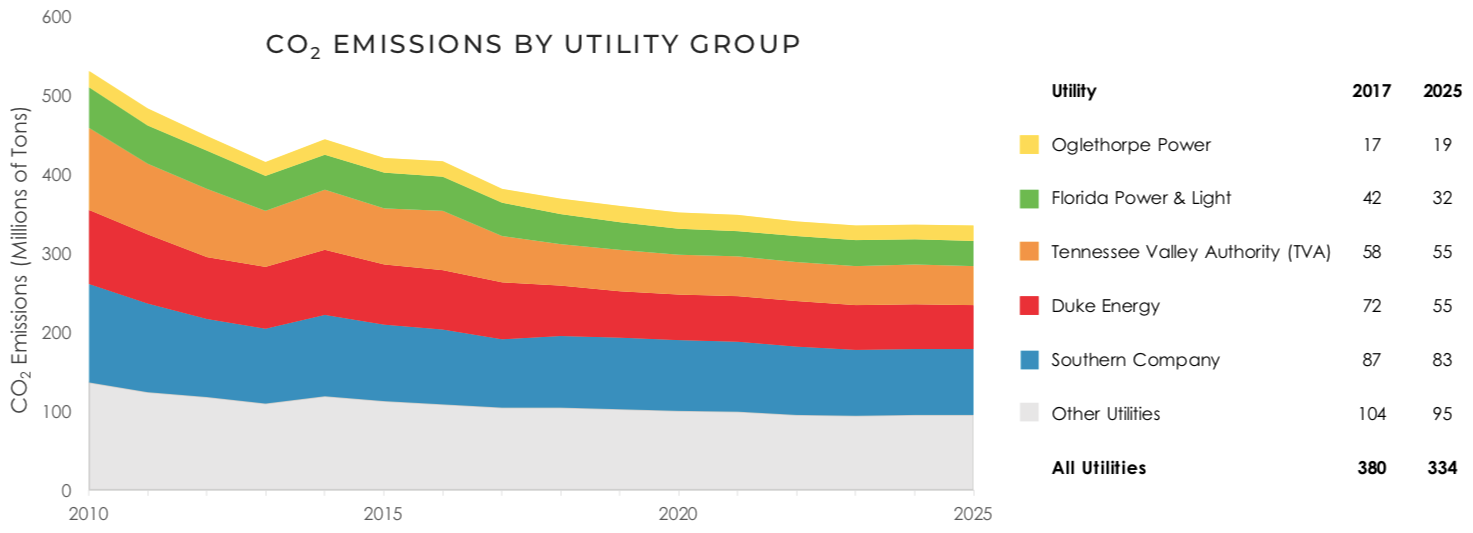

None of the Southeast’s electric utilities are taking sufficient action to decarbonize our power supply. Even though these utilities have demonstrated a sharp decline in carbon emissions over the past decade, the next decade will see a gradual slowing and then perhaps even an uptick in the emissions that drive global warming. The lack of long-term plans to decarbonize stands in contrast to utility commitments to reduce or even eliminate carbon emissions over the next few decades.

That is the unfortunate conclusion in our first annual report tracking power generation and the related carbon dioxide (CO2) emissions in the Southeast. In the report, we illustrate the changes in generation and CO2 emissions since 2010 in utilities and states, and include a forecast of the generation fuel mix and CO2 emissions based on where utility plans stand today.

Others have recently come to similar conclusions. The Energy and Policy Institute found that utility carbon targets reflect a slowdown in decarbonization in the next decade. Carbon Tracker’s profiles for major Southeast utilities Duke Energy, Southern Company, and NextEra Energy (owner of Florida Power & Light) categorize all three as “Paris-Unaligned,” referring to the 2015 Paris Agreement.

Download: Tracking Decarbonization in the Southeast: 2019 Generation and CO2 Emissions report.

Webinar: SACE technical staff take a deeper dive into the report findings.

Why do we care about decarbonization?

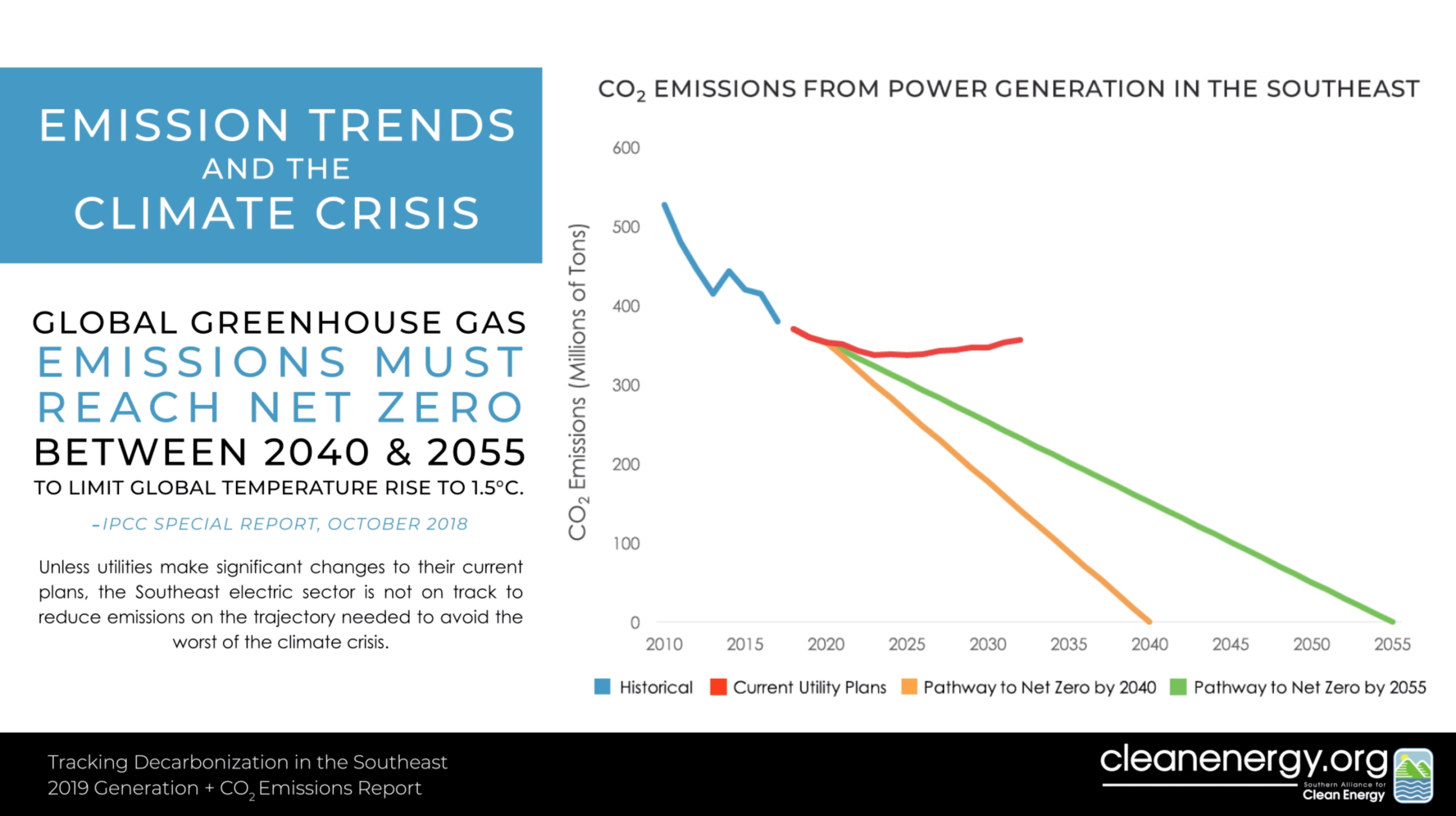

Decarbonization is the transition of our energy use to a sector that emits lower CO2 emissions. Climate scientists tell us we need to get to net zero global greenhouse gas emissions between 2040 and 2055 to limit global average temperature increase to 1.5 degrees C and avoid the worst of the climate crisis. A growing number of states, cities, and electric utilities have set long-term goals intended to address the crisis that include transitioning to renewable energy and lowering greenhouse gas emissions. But are utilities doing enough to meet those goals? In this companion blog to the Tracking Decarbonization in the Southeast report, we examine key themes that help explain how utilities are failing to sufficiently lower emissions in the electric power sector.

Decarbonization faces many challenges

Under current utility plans, the next decade of power sector decarbonization slows from rates seen in this decade. High costs and the need to further develop technologies are often falsely cited as the primary barriers to decarbonization. Even where goals have been set, there are structural challenges to realizing these goals and decarbonizing at rates needed to address the climate crisis.

- Inconsistency between goals and plans: Public facing goals may not have an impact if they are not also adopted by utilities internally.

- Power contracts: Many utilities have goals to reduce CO2 emissions from utility-owned power plants. Goals that exclude emissions from purchased power or goals based on emission intensity may overstate emissions reductions.

- City goals: The structure of utility service and franchise agreements make it difficult for cities that depend on large, monopoly utilities to achieve decarbonization or 100% renewable goals.

- Customer choice: Many customers want power from low-to-no carbon sources, but it can be difficult for customers to participate in utility long-term planning processes where these decisions are made.

What is the role of electric utilities?

Many utilities are playing a passive role in lowering CO2 emissions, when they should be taking an active one. Globally, carbon emissions are rising, but in the U.S. and in the Southeast they have been gradually declining, driven by decreases observed in the electric power sector driven primarily by economics. That’s good, right?

Well, it depends on the reason that they’re declining. Although the economics of clean energy generation continue to improve and solar is being deployed at an increasing scale, renewable energy penetration among most Southeastern utilities is still relatively low. However, by examining trends over time we can see that there are other factors influencing this historical drop in emissions that will factor into whether emission declines continue.

What key factors drive carbon emission trends?

Changes in power generation have driven CO2 emissions from electric utilities in the Southeast down for over a decade. Despite the deployment of solar, these trends in emissions and generation flatten out under current utility plans. This flat trend falls far short of the trajectories recommended by scientists as needed to avoid the worst of the climate crisis. In our 2019 report, we focus on four factors that can drive future CO2 emissions from Southeast power generation up or down.

- Utilities are forecasting low demand for electricity

- Clean energy depends on partnership between states and utilities

- The potential for solar to replace gas as utilities’ go-to new build resource

- Purchasing power from outside the utility, state, or even region

Low Demand for Electricity

Utilities serve a growing number of customers, but that no longer translates into electric demand growth. Southeastern utilities are collectively forecasted to have relatively flat load in the 2020-2030 timeframe, a departure from historical trends. New generation needs will be driven by plant retirements instead of customer demand.

Coal retirements

Fossil fuels (gas + coal) made up over 90% of all Southeast utility CO2 emissions in 2017, though the proportion of coal emissions to gas emissions have shifted from 75% to 21% respectively in 2010 to 49% to 44% in 2017. Planned coal retirements will continue to drive regional CO2 emissions downwards, but rising gas consumption may hinder further progress towards carbon goals. Current utility plans include some new solar generation and energy efficiency investments to replace retiring coal capacity. However, gas remains the favorite new power plant of many utilities in the Southeast despite economic and emission reasons to be skeptical of building new gas plants in the future.

Purchased power

When power plants generate more electricity than customers consume, the plant owner can sell excess generation to other companies to help recover costs. Entities that buy more power than they can generate are net importers of power, whereas those that sell extra generation are exporters. The amount of power purchased each year depends on many factors and can fluctuate every year, but states such as Alabama and Georgia have large transactions, exporting and importing (respectively) 32 and 30 TWh in a single year to meet demand. Many utility CO2 emission reduction goals are based on emissions from power plants the utility owns, and thus exclude emissions from purchased power.

Resource planning

Integrated Resource Plans (IRPs) are the formal future planning process for utilities. The amount and source of energy that powers the region is guided by utility IRPs. The goal of an IRP is to compare costs of different types of energy and develop a future resource mix that best fits forecast energy demand at the “lowest system cost.” No Southeastern state requires consideration of CO2 emissions in an IRP.

So are we on track?

Historical emission trends show the Southeast power sector decarbonizing at a rate that appears acceptable to reach the recommended net-zero emissions by 2050 target, so kudos to utilities for realizing just how bad the economics of continuing to operate old coal plants really is, the renewable energy market for supplying a viable alternative to solely new gas, and cities and states that have put forth policies to spur decarbonization.

However, the outlook for the future doesn’t look so rosy. Unless current utility plans change significantly, utilities in the Southeast are not on track to get to net-zero emissions by 2050. In fact we see little to no overall emission reductions after the early 2020s.

Treating gas as a “bridge fuel” brings its own challenges

Utility future plans continue to include the construction of new gas plants. Though this report was limited to analysis of CO2 that is emitted at the power plant stack, it is important to include a note about another important greenhouse gas related to power generation: methane.

Gas emits about half the CO2 per MWh generated than coal from the stack, which makes the replacement of coal with gas the largest factor in explaining recent emission reduction trends. However, the process of drilling for and delivering gas to the region causes extremely high methane emissions, primarily from production and processing activities. This leakage is referred to as “fugitive emissions” of methane, and many utility systems are beginning to increase their efforts to replace aging gas pipelines and infrastructure.

New estimates suggest that at a national level, roughly 2.4% of gas is lost through leaks. Based on the current demand for gas from Southeast power plants, assuming an average leak rate makes Southeast gas power plants responsible for methane emissions with the greenhouse gas potential of about 44 million tons of CO2 each year. This is in addition to the 380 million tons of CO2 emissions emitted from power plant stacks. Accounting for these fugitive methane emissions is particularly important for states like Florida where gas represented 64% of the state’s entire generation in 2017 and is expected to continue to grow.

Methane emissions have been getting both constructive attention from utility and environmental groups, as well as efforts to roll back environmental protections by the current administration. Some utilities, including Duke Energy and Southern Company, have begun to estimate and report methane emissions. As more entities track and report methane emissions we will be able to report on regional methane emission trends with greater accuracy.

Final request to utilities: better data for next year’s report

This report is our first in what will become an annual report series. We expect that next year’s report will not only have different results based on an additional year of historical data but we also will include new utility plans that have since been updated. To make this type of analysis both easier and more accessible, it is important for utilities to improve transparency throughout the future planning process and to provide clear explanations of their emission reduction targets and calculations of progress.

Download: Tracking Decarbonization in the Southeast: 2019 Generation and CO2 Emissions report.

Webinar: SACE technical staff take a deeper dive into the report findings.