TVA has found the magic beans! In just four short years, TVA has somehow cut the cost of Small Modular Reactors (SMRs), an unproven nuclear generation technology, approximately in half. Why isn’t this believable? Because SMRs don’t yet exist, other new nuclear power projects have seen skyrocketing costs, and there is no concrete information to support TVA’s cost figures.

TVA has found the magic beans! In just four short years, TVA has somehow cut the cost of Small Modular Reactors (SMRs), an unproven nuclear generation technology, approximately in half. Why isn’t this believable? Because SMRs don’t yet exist, other new nuclear power projects have seen skyrocketing costs, and there is no concrete information to support TVA’s cost figures.

We can only speculate about why TVA feels confident in lowering the cost estimate by half, so I’ll speculate: TVA wants SMRs to appear economical in its proposed energy plan. TVA is either intentionally using low costs to justify including SMRs in its plan, or it is naively using the lowest cost cited by a technology developer without outside verification. Regardless, it’s in direct conflict with recent statements from TVA. The Daily Memphian reported that TVA CEO Bill Johnson told the Memphis City Council, “Nuclear construction is the riskiest activity you can engage in in the power business. Take it from me.”

NuScale, the company trying to bring this technology to market, stated in a press release in June that they have identified efficiencies in their proposed design that would increase the generating capacity and thus bring down capital costs of their SMR technology. NuScale submitted their Design Certification Application to the U.S. Nuclear Regulatory Commission (NRC) in January of 2017, and it is still pending review as of December 2018. Whether intentional or naive, TVA should not take the technology developer’s word on the cost to develop such a risky technology until after NuScale demonstrates that it can actually build safe, reliable generating capacity without cost overruns.

This kind of rosy thinking about nuclear is exactly what has many southeastern utilities in financial distress right now. The South Carolina Public Service Commission held a hearing on an abandonment proceeding for the cancelled VC Summer nuclear plant expansion this November. In Georgia, Plant Vogtle’s utility partners recently went through yet another set of round-the-clock negotiations to keep the nuclear expansion project alive (barely) despite continuing cost overruns. These projects both suffered from fantasy schedules and budgets that couldn’t be met.

Outside the southeast, few utilities or energy analysts include SMRs in their forecasts or planning studies because the technology and costs are so speculative. During a Q&A while developing its 2018 forecast, the Energy Information Administration (EIA) was asked whether it will include SMRs as a selectable generation supply resource in its modeling. “EIA staff noted that with the early stages of this new technology there is still not reliable cost information to include it as an endogenous technology choice.” Despite the questioner volunteering to provide a recent study on cost information, SMRs were not included as a selectable resource in EIA’s 2018 forecast. This kind of modeling is similar to the modeling TVA is currently doing to develop its 2019 Integrated Resource Plan.

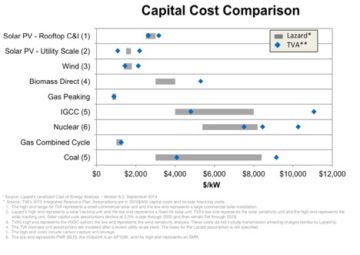

In its IRP modeling TVA is assuming SMR technology is 40-52% less expensive than its assumption in 2015, when TVA determined it was cost prohibitive to build SMR generation. TVA has said that SMRs are not being considered a resource and are not being chosen in its IRP modeling. If that is the case, why include the resource in the model? And why include it with such a narrow and unrealistic assumed cost?

TVA began the process of adding SMRs at its Clinch River site in January of 2017, despite the fact that no SMRs were included in the recommendation from TVA’s current generation plan (the 2015 IRP). The 2015 IRP found SMRs “cost-prohibitive.” If SMRs look cost-effective in TVA’s latest IRP, it will be easier for TVA to move forward with the Clinch River project.

In fact, we aren’t sure exactly how much TVA’s cost assumptions have declined because the 2015 IRP had conflicting SMR cost figures. Costs were either approximately $8,252/kW or $10,250/kW (both in 2013 dollars) depending on if you look at the chart or table in Appendix A, respectively. Check out the chart and table below to judge for yourself. We’ve also included the preliminary chart of resource cost assumptions for the 2019 IRP, for comparison.

We will continue to blog about the latest developments with TVA’s 2019 IRP, so please check back later for more. You can explore TVA’s 2019 IRP landing page here.