Memphis and Shelby County are positioned to be among the biggest beneficiaries of Congress’ newly-enacted Inflation Reduction Act, which could bring hundreds of millions of dollars of benefits to Memphians through its process of buying power from new suppliers. The Inflation Reduction Act (IRA) provides hundreds of billions of dollars of investment in clean energy and climate action nationwide, with big benefits on the line for communities that decide to take advantage of the tools provided for transitioning to clean energy.

Multiple studies conducted in the past few years have shown that MLGW could save dozens or hundreds of millions of dollars every year by switching to new suppliers of power. Yet these analyses were conducted before the IRA tax credit provisions were enacted, which means the potential savings for Memphians are now much higher than previously estimated.

Why Memphis and Shelby County?

The passage of the IRA could not have come at a better time for Memphians and it is difficult to think of another city nationwide that is in as good a position as Memphis to make the most of the provisions of the IRA. I’ll explain in more detail below, but in summary, a few factors that make Memphis incredibly well positioned to benefit from the new policies–if deliberate action is taken to secure the benefits–include:

Memphis Is In The Right Place At The Right Time

The coincidence of MLGW’s historic decision on the entirety of its future energy supply exactly as new clean energy financial incentives are becoming available is remarkable. Taking advantage of the financial incentives in the IRA could reduce MLGW’s annual billion-dollar electricity budget by tens or hundreds of millions of dollars per year.

Tax Benefits Are Now Available To Local Governments And MLGW

Historically, tax credits for clean energy have left local governments like Memphis and Shelby County and municipal utilities like MLGW ineligible to directly benefit since they are tax-exempt. But new provisions in the IRA would allow local governments and MLGW to receive direct payments from the federal government equal to the value of tax credits. This is a remarkable development in opening new doors and possibilities in allowing the community to access the benefits of clean energy that have been historically closed.

Bonus Tax Credits For Energy Transition Communities

The core of the IRA clean energy investments is a set of tax credits for clean energy generation and manufacturing that are widely available. But only certain communities can qualify for particular bonus credits. One such bonus credit is the “energy community” bonus that tacks on an additional 10% credit for projects located in communities with a history of economic reliance on fossil fuels and often environmental racism. Memphis’ legacy with the Allen coal plant and potentially other facilities like the Valero oil refinery set Memphis up to be eligible for the additional 10% energy community credit in certain circumstances.

Bonus Tax Credits For Low-Income Communities

Another major bonus credit available is an additional 10%-20% investment tax credit for clean energy projects for low-income communities. Clean energy facilities (i.e. solar and/or battery storage) located in low-income communities can get a 10% bonus ITC, while facilities that are part of a qualified low-income residential building project or a project that benefits low-income households can get a 20% bonus ITC.

Bonus Credits Stack On Top Of Each Other

Memphis is in an incredibly good position to make the most out of the new tax credits given that it can qualify for multiple bonus credits, which all stack on top of each other. For example, if a community solar project were built to serve low-income families in an area that qualified for the energy community credit, its cost could be lowered by up to 70% (base credit + prevailing wage/apprenticeship bonus + domestic content bonus + energy community bonus + low-income project bonus).

Which Specific IRA Provisions Would Be Particularly Good For Memphis?

Below are a few specific tax credit provisions on the newly-enacted Inflation Reduction Act (IRA) that could bring hundreds of millions of dollars of benefits to Memphians – should Memphis choose the path of clean energy and energy justice. This by no means is a comprehensive list, but rather an illustration of the immense opportunity for the Memphis community that the IRA offers. In addition to tax credits, discussed below, the IRA provides billions of dollars in rebates, grants, loans, and other programs that we will dive into at another time.

Tax Credits For MLGW To Lower Costs With Renewable Energy

MLGW is considering transitioning to a portfolio of approximately 75% renewable energy – mostly solar. The IRA provides tax credits for renewable energy that can either be taken as a production tax credit (PTC) for each kilowatt-hour of renewable energy produced or as an investment tax credit (ITC) of the cost to install and bring the clean energy facility online.

Any eligible project can receive a base credit, but if the project pays workers prevailing wage and employs apprentices, the base credit is multiplied by five (i.e. PTC of ~0.6 cents/kWh becomes ~2.6 cents or 6% ITC becomes 30%). Then, bonus credits are able to be stacked on top:

- 10% bonus for projects meeting domestic content standards,

- 10% bonus for projects in “energy communities” like Memphis (as described above), and

- 10-20% bonus for projects sited in or benefiting low-income communities (ITC only).

With MLGW eyeing transitioning such a large portion of its energy generation to come from renewable energy sources, if it were to switch energy suppliers, it would be able to lower its costs dramatically by taking advantage of these incentives.

Tax Credits For MLGW To Boost Reliability With Battery Energy Storage Systems And Microgrid Controllers

Standalone energy storage systems and microgrid controllers are now eligible for the ITC, which could be hugely beneficial for MLGW managing demand peaks such as on hot summer afternoons and cold winter mornings, and improving the reliability of its distribution system so that customers have power when they need it. The bonus tax credits apply to these technologies, meaning the cost of these tools could be reduced up to 70% for projects benefitting low-income households, in an area qualified as an “energy community,” meeting domestic content standards, paying workers prevailing wages, and employing apprentices.

Tax Credits For Local Economic Development From Clean Energy

The IRA provides a lot of financial incentive for investment in workforce development. As discussed in previously mentioned tax credits, the core clean energy tax credits are geared around a system that heavily incentivizes clean energy employers to pay their workers well and provide apprenticeship opportunities, which guarantee entry points for people looking to get into a new career.

Additionally, there are investment tax credits and production tax credits directly for businesses that manufacture clean energy products and components. The ITC is for the establishment, expansion, or re-equipping of a manufacturing facility to produce, manufacture, or recycle clean energy and clean vehicle technologies, at a 5% base credit or 30% bonus credit for facilities that meet prevailing wage and apprenticeship requirements. Forty percent of the financial allocation for this program is reserved for “energy communities,” such as Memphis. The PTC is for the manufacture and sale of each eligible clean energy component that is produced and sold.

Then there are the tax credits and deductions for businesses to lower their operating costs through investments in clean energy and energy efficiency. Local businesses would be eligible for the commercial clean energy tax credits for installing clean energy outlined above (with the cost lowered by up to 60% for projects like solar and/or storage that meet the bonus eligibility criteria). Additionally, the IRA provides for tax deductions for businesses that undertake energy efficiency measures to improve interior lighting, HVAC, hot water system, or the building envelope, up to $5.00 per square foot of building if the project meets workers’ prevailing wage and apprenticeship requirements.

Tax Credits For Homeowners To Harness Clean Energy And Energy Efficiency

The IRA provides tax credits to homeowners to invest in clean energy systems and energy efficiency retrofits. The residential clean energy tax credit provides a tax credit of 30% of the system cost, most often used for rooftop solar systems. The IRA expands the tax credit to include battery storage systems too. The residential energy efficiency tax credit covers up to hundreds or thousands of dollars per year, depending on the specific measure undertaken.

Grants, Rebates, Loans, And Other Assistance

In addition to tax credits, the IRA provides billions of dollars in rebates, grants, loans, and other programs which I hope to be able to write about in more depth at a later time, but for the time being, I’ll list a handful of significant ones relevant to Memphis’ decision about who will provide the city’s electricity:

- Loans and grants for siting and building electric transmission lines, as MLGW is considering doing

- Loans and grants for greening affordable housing

- Grants for carrying out local governmental climate action plans

- Rebates for home energy efficiency/weatherization and electrification (switching to electric appliances, upgrading electric load service centers, electrical wiring, etc.) for single- and multi-family homes, with a focus on low- and moderate-income households

- Tens of billions of dollars in grants and financing for low-income and disadvantaged communities to install clean energy solutions and projects that reduce or avoid greenhouse gas emissions and other forms of air pollution

Realizing The IRA’s Potential Would Likely Require Leaving TVA

Altogether, the IRA’s benefits to Memphis could be worth hundreds of millions of dollars, but Memphis’ potential for benefitting from the transformative policy may be hindered by its all requirements contracts with its current electricity supplier, TVA. Here’s how TVA’s contracts could hold Memphis back from realizing the full potential of the IRA’s benefits:

Restricting Where MLGW Can Purchase Power

TVA prohibits MLGW from getting power anywhere else but TVA, which blocks MLGW from buying low-cost renewable energy from other capable sellers. Studies undertaken in the last few years have shown that Memphians could save $100+ million per year if MLGW switched to new power suppliers–yet the possible savings are now much larger than previously calculated due to the large tax incentives available for clean energy development. However, MLGW would be blocked from accessing a large portion of the savings offered by the IRA on power under a future with TVA.

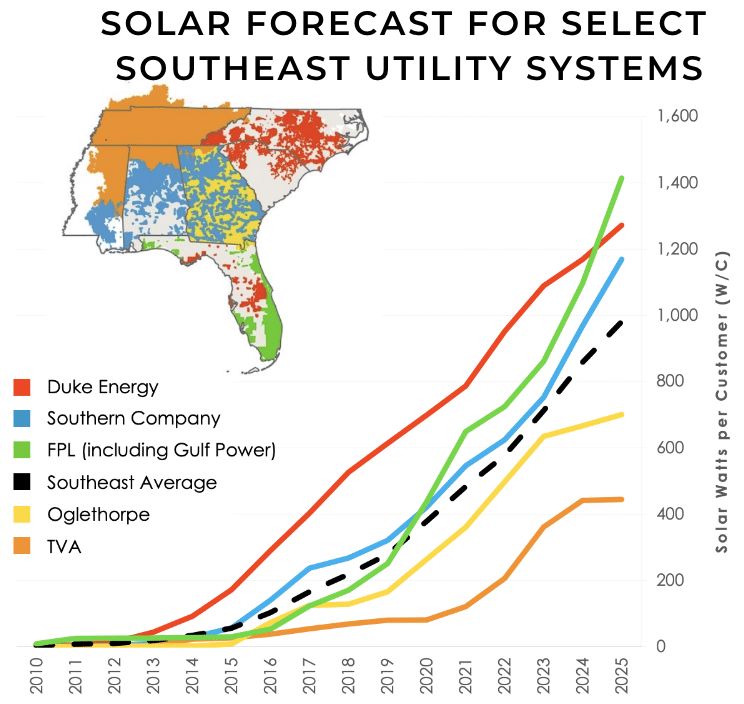

No doubt TVA will develop some renewable energy in years to come and benefit to a degree from the new tax credits, but it lags its peer utilities in renewable energy development and is not nearly as ambitious in clean energy development as MLGW’s possible alternative power portfolio could be.

Limiting the Amount of Solar MLGW Can Build

TVA mostly blocks MLGW from building its own solar, and it would block MLGW from directly utilizing the solar programs in the IRA to lower costs for Memphis customers, for example through community solar projects to benefit low-income households. The IRA provision of allowing tax-exempt entities to utilize clean energy tax credits is a major breakthrough for public power entities like MLGW, but TVA is positioned to hold MLGW back from taking advantage of this big opportunity. If MLGW were to sign up for the new long-term contract that TVA wants all their customers to sign, then MLGW would be limited to a very small amount of solar as part of the long-term contract’s “flexibility” provision.

Disincentivizing Memphians from Installing Solar

TVA limits customer-owned solar and would prevent Memphis homeowners and small businesses from benefiting from low-cost solar. TVA canceled its residential solar program in 2019, leaving homeowners and small businesses very limited opportunities for accessing the benefits of solar.

Ignoring the Cheapest Energy Option

TVA ignores valuable energy efficiency benefits for customers. TVA consistently underperforms in helping customers benefit from energy efficiency.

Meanwhile, if MLGW allocated just a fraction of the savings obtained by switching energy suppliers, it could fund a nation-leading energy efficiency program in Memphis, especially if leveraged with federal funding from the IRA.

MLGW Must Weigh The Huge Benefits Of The IRA In Its Power Supply Decision

Memphis and Shelby County really are in the right place at the right time to be one of the best-positioned communities in the country to benefit from the IRA. But of course, that means that MLGW and Memphis community leaders must take the IRA into consideration in making their upcoming decision on whether or not to switch suppliers of energy. MLGW staff is scheduled to make their recommendation on the next steps of the alternative power supply process to the MLGW Board on Thursday, September 1. In this process, it is critical that the huge opportunities for Memphis presented by the IRA are not left on the table.

Take Action

We’ll continue to monitor and intervene on MLGW’s forthcoming decision about whether or not to stay with or leave TVA. If you’d like to stay involved in our campaign and education efforts, please sign the Memphis Has the Power petition.

[button color=”blue” url=”https://www.memphishasthepower.org/”]Join the Campaign[/button]

Memphis Has the Power is a campaign to ensure Memphians have affordable, equitable, and clean energy. The campaign has worked in the Memphis community for several years, backstopped by the Southern Alliance for Clean Energy (SACE). Our work has lifted up Memphians who struggle with unaffordable energy bills and has helped result in large increases in funding to help Memphians with lower incomes reduce their energy bills. SACE is an appointed member of MLGW’s Power Supply Advisory Team, the community advisory team that helped shape MLGW’s integrated resource plan.