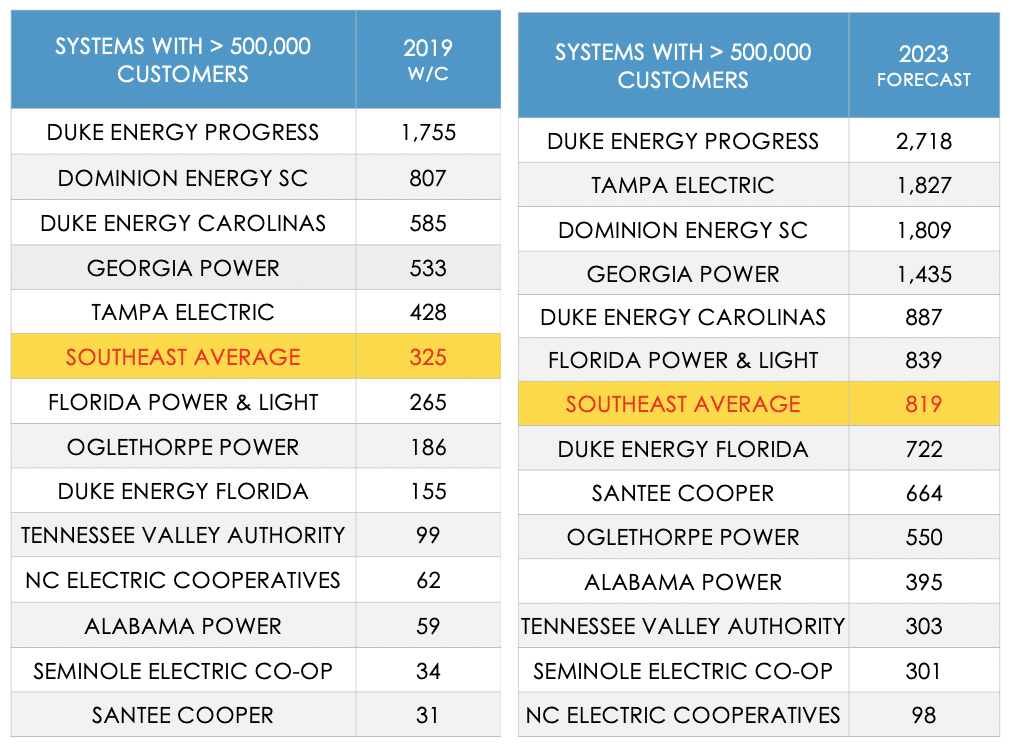

In our annual Solar in the Southeast report, SACE applies the term “SunBlocker” to any of the large utilities in the Southeast forecast to offer less solar to customers four years from now than the average utility offers today. The 2019 average watts per customer solar ratio across the Southeast was 325 W/C. Three of the large utility systems are forecast to remain below that level for 2023.

Seminole Electric, the North Carolina Electric Cooperatives, and the Tennessee Valley Authority (TVA) deserve this dishonorable mention again for this reporting cycle.

The solar ambition for each of these three utilities over the next four years (2023) remains below the regional average from last year (2019).

Last year’s report included a fourth SunBlocker. Each of the potential options for the future of Santee Cooper includes substantial solar expansion so the SunBlocker designation no longer applies for that South Carolina utility.

Seminole Electric

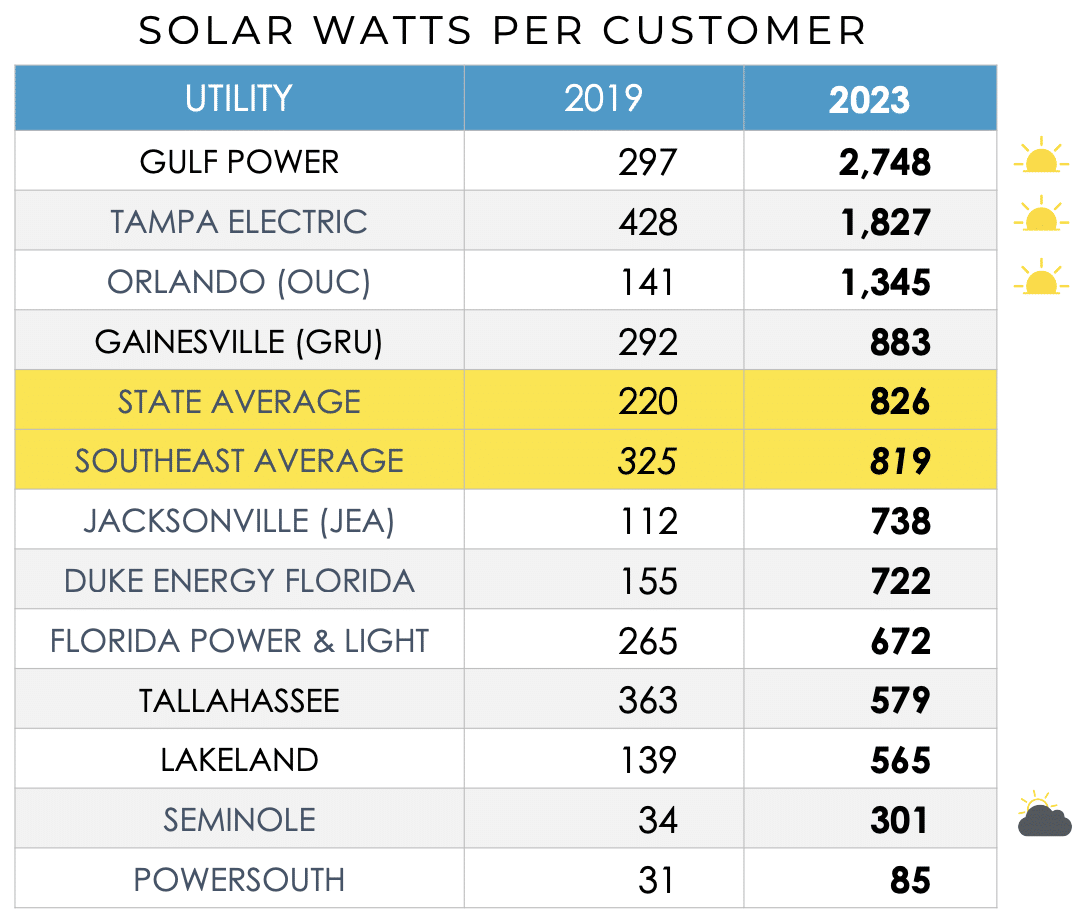

Seminole Electric is a large generation and transmission cooperative serving nine members coops across Florida. It replaced a small 2022 solar contract (40 MW) with a larger one for 2023 (298 MW), yet remains one of the least ambitious large utilities.

North Carolina Electric Cooperatives

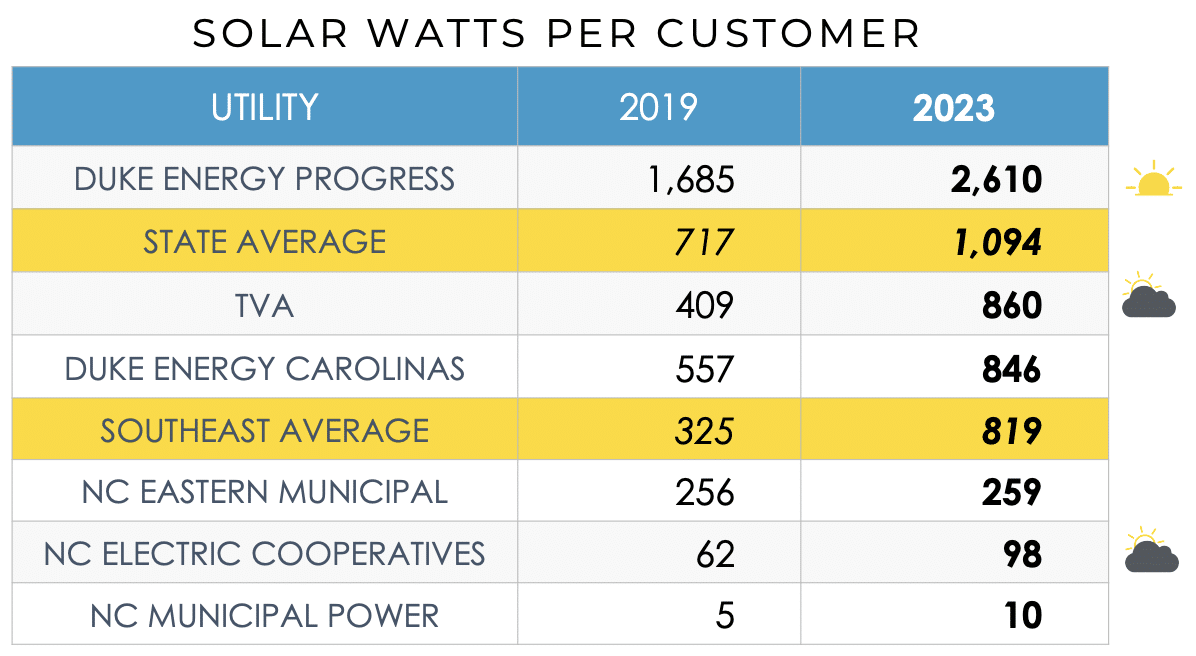

Similarly, the North Carolina Electric Cooperatives have been slow to adopt utility-scale solar resources for its members. They tend to discourage distributed solar, as well. Whereas the investor-owned utilities in North Carolina offer true retail net metering, the North Carolina coops typically only offer wholesale rate (avoided cost) for energy contributed to the grid from on-site self-generation.

TVA

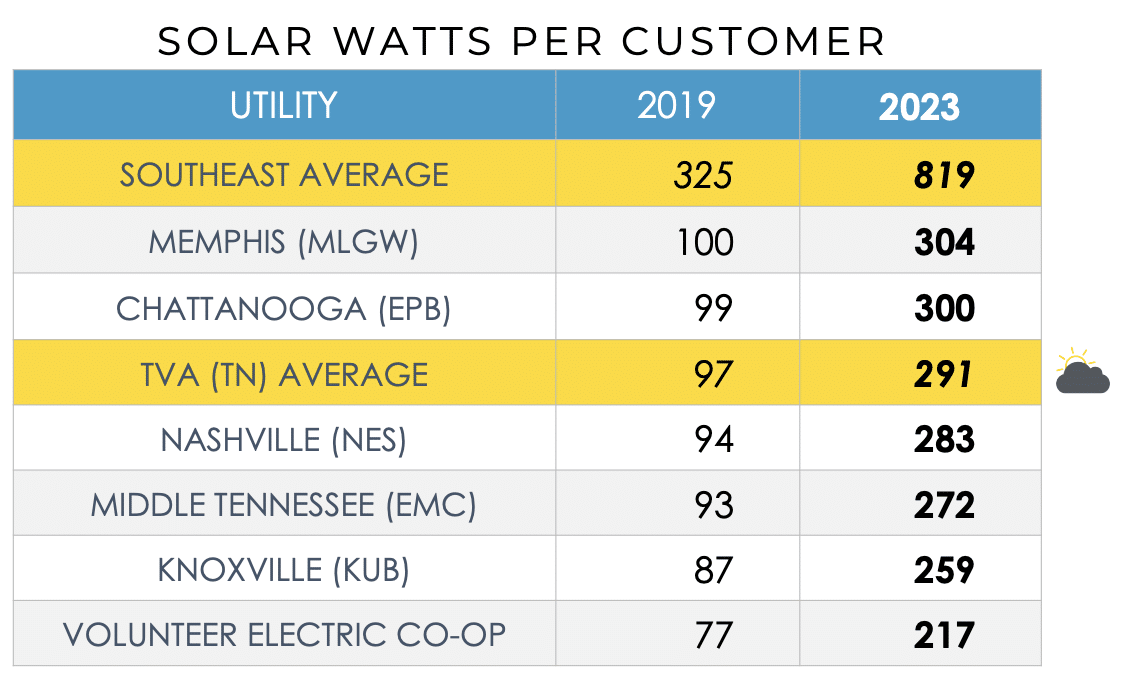

TVA is the largest, federally-owned utility monopoly, serving Local Power Companies (LPCs) — municipal utilities as well as cooperatives — in most of Tennessee and parts of six other states. Like many other utilities in the region, the TVA updated its integrated resource plan (IRP) in 2019. However, the self-regulated monopoly, not subject to federal or state regulatory oversight, promoted a false narrative around that plan to imply significantly more utility-scale solar than it intends to adopt.

Adverse policies continue to emerge from the TVA on distributed solar, as well, like sunsetting the once exemplary Green Power Provider program.

TVA is presently coercing local power companies (LPCs) within its service territory to sign a long-term (20-year) partnership agreement. As part of the agreement, TVA offers the LPCs “flexibility” to generate 3-5% of their own power. However, the convoluted way TVA computes that allowance really results in much less than 5% of an LPC’s load. For comparison, TVA will “allow” their largest customer, Memphis Light, Gas & Water (MLGW), to commission 202.5 MW of solar themselves (3%). If MLGW decides to leave the restrictive TVA system, as they are currently considering doing, portfolios modeled by Siemens include 1,000 MW of solar locally and up to 4,450 MW of renewables in total (75%), mostly solar.

It’s rather interesting that each of the utility SunBlockers are a level removed from their retail customers. The leaders on our list tend to be those that are not just involved with generation and transmission, but also with distribution and customer service at the local level. That necessarily makes them more conscious of, and responsive to, customer demand.

MLGW is in that latter role. It is clearly listening to what the Memphis customers want and need. SACE supports the recommendation to issue a Request for Proposal (RFP) to validate significant cost savings and environmental benefits from departing the TVA system. Memphis has the power to decide whether it remains tethered to a SunBlocker or emerge as a SunRiser in its own right.

[button color=”blue” url=”https://bit.ly/SolarReport2020Download”]Download the Report[/button]

[button color=”blue” url=”https://cleanenergy.org/news-and-resources/webinar-solar-in-the-southeast-report/”]Watch The Webinar[/button]

[button color=”blue” url=”https://cleanenergy.org/?s=ssr2019″]Read the Report Blog Series[/button]

#SSR2019