Today, the Southern Alliance for Clean Energy (SACE) filed comments to the Federal Energy Regulatory Commission (FERC) in the review process for the pipeline that would serve the Tennessee Valley Authority’s (TVA) proposed new fossil gas plant to replace its Cumberland coal plant.

TVA’s environmental review, which has yet to be finalized, is flawed and skews the results toward TVA leadership’s desired outcome: to build a new gas combined cycle (CC) power plant instead of renewable energy. Part of FERC’s review of proposals for new gas pipelines is to verify there is a need for that pipeline. Tennessee Gas Pipeline Company, LLC, which is a subsidiary of Kinder Morgan, filed its application to build and operate a new gas pipeline to feed TVA’s proposed CC plant at Cumberland in the FERC Docket #CP22-493.

Since the pipeline in question only feeds one customer, TVA, for one need – the proposed new gas plant, it is FERC’s responsibility to then verify the need for that new gas plant. In the comments SACE submitted to FERC, we lay out several key reasons that FERC should not use the analysis TVA presented in its Draft Environmental Impact Statement (DEIS) on Cumberland.

In its DEIS, TVA states that it found the gas CC power plant option to be the best alternative after performing “financial and system analysis,” but nowhere does TVA present the detailed and comprehensive assumptions and results that went into and came out of these analyses. A reminder that TVA’s analysis only included three alternatives to replace the coal unit: one gas CC, multiple smaller gas plants spread throughout the system, and multiple large-scale solar and storage resources spread throughout middle Tennessee. Instead of this limited one-off analysis, SACE has urged TVA to evaluate the retirement and replacement of all of its coal units comprehensively in its next Integrated Resource Plan (IRP), which it should start immediately.

1. TVA’s DEIS lacks transparent analysis to justify the need for a gas plant

We laid out criticisms of TVA’s DEIS in comments we submitted to TVA in the comment period that followed the release of the DEIS. But here we attached our comments and also described the drawn-out process of trying to get even the smallest nuggets from TVA about the underlying assumptions it used in its analysis to compare these alternatives.

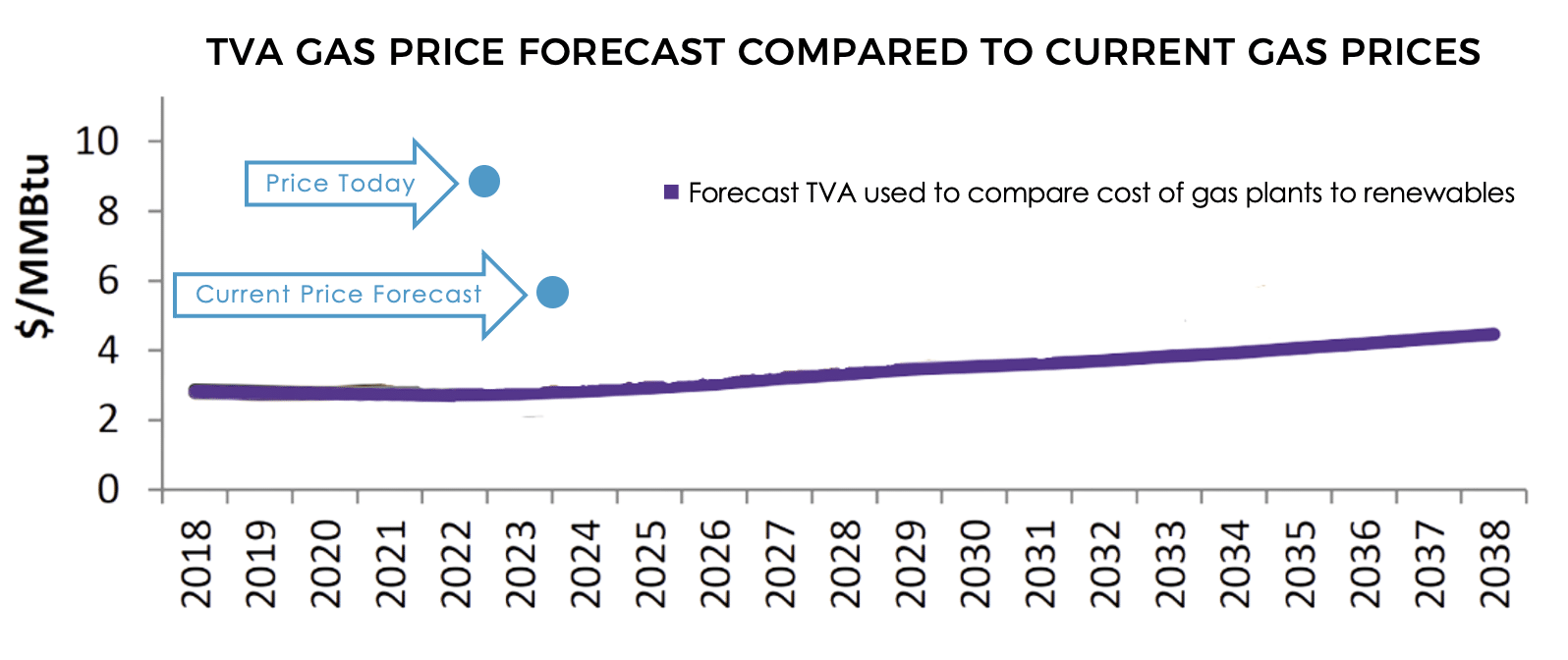

From what little information about TVA’s assumptions we were able to get after multiple back-and-forths with TVA staff, those assumptions appear to be cherrypicked to favor the gas combined cycle (CC) power plant option. Particularly notable is that TVA chose to use the lowest gas price forecast from its 2019 IRP despite the clear evidence that high and volatile gas prices are hurting customers today and are likely to continue to do so.

2. TVA did not consider all the alternatives in its DEIS

TVA left out key resources that could be part of a portfolio of resources to replace Cumberland: energy efficiency, wind, and distributed solar and storage. Sierra Club had an independent consultant compare TVA’s proposed gas plant to a clean energy option that includes solar, wind, storage, and energy efficiency. That study found that the clean energy portfolio option maintains the same level of reliability as the gas plant while saving customers $5.8 billion over 20 years. Appalachian Voices recently produced a report that shows that investments in clean energy, particularly energy efficiency, can bolster the local economy and create thousands of more jobs than TVA’s planned gas plant.

3. TVA leadership has a conflict of interest

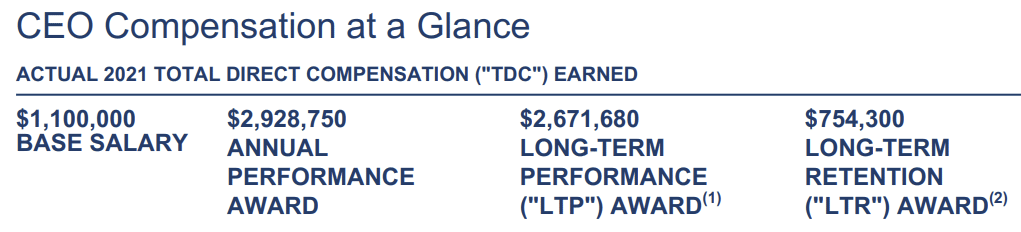

The performance metrics used to determine the bonus levels of TVA’s CEO and executive team are such that if TVA replaced Cumberland with a gas CC instead of renewable energy, TVA’s CEO and executives will see a pay boost. TVA’s executive compensation is based on a number of metrics, with three tied to the reliability and availability of three resources that dominate TVA’s resource mix: nuclear, coal, and gas combined cycles. Removing an unreliable plant like Cumberland will rightly improve the coal availability metric that represents 5% of executives’ annual bonuses. In addition, adding a new gas CC to TVA’s fleet will also serve to increase the gas combined cycle metric that represents 10% of executives’ annual bonuses.

It’s also important to note that while most annual bonuses are small compared to annual salaries, for these executives annual bonuses make up one of if not the largest part of their take-home pay. In 2021 alone, TVA’s CEO Jeff Lyash received nearly $3 million in this annual bonus. Dive into the details starting on page 185 of the 10-K annual report TVA filed in November of 2021.

While we are all for rewarding executives that run a reliable utility, if there are incentives for executives to make a decision that is counter to the interests of the customers, that decision should be taken out of the hands of those executives.

4. Governmental entities agree that TVA’s DEIS is flawed

What do the U.S. Environmental Protection Agency, U.S. Department of the Interior, Nashville Electric Service (NES) Board, Nashville Metro Government, and Nashville Mayor John Cooper all have in common? They all filed comments on TVA’s DEIS that were critical of TVA’s decision to replace Cumberland with a gas CC plant and pipeline. It’s not just SACE that recognizes how bad this decision is for TVA’s customers. There are common themes across all of these comments and more that were submitted by individuals and organizations: TVA customers would be better served if TVA replaced Cumberland with renewable options instead of gas.

5. FERC has new information to improve the analysis of alternatives to replace Cumberland

Many of the assumptions TVA used in its analysis that led it to choose the Cumberland gas CC over renewable options are outdated or inappropriate. Even since TVA published its DEIS based on the results of this analysis in the spring of 2022, things in the electricity sector have shifted enough to warrant a revisit to that analysis. Gas prices remain high and volatile, and are expected to remain so. The Inflation Reduction Act (IRA) was recently enacted, extending and expanding incentives for energy efficiency and clean energy — in particular allowing public entities like TVA to better take advantage of those incentives, thus requiring a refresh of costs for all of those eligible resources. The IRA also introduces a fee on methane, the main component of natural gas, presenting another reason to revisit the gas price forecast used in this analysis.

With all of these assumptions updated, it is unlikely that the Cumberland CC will in fact be needed, and thus TGP’s proposed Cumberland gas pipeline would not be needed either.

SACE Recommendations

Our recommendation to FERC is simple: do your own review of the need for the Cumberland gas CC. Our comments to FERC cover the many reasons that FERC should perform its own evaluation, and not just rely on TVA’s. If there is no need for the Cumberland gas CC, there’s no need for the Cumberland pipeline.