Tragedies highlight the cost of reliance on fossil fuels

The anniversary of the Deepwater Horizon tragedy is always a reminder of the costs of society’s reliance on fossil fuels. On April 20, 2010, the cost of the explosion and subsequent oil catastrophe came in the form of lives taken from people, environmental disaster, and economic loss. Lives and livelihoods were impacted as oil flowed for 87 horrific days and ultimately spread oil over a thousand miles of coastline from Texas to Florida. That tragedy was a wake-up call and a demonstration of the need to phase out offshore drilling.

Now, twelve years later, a new tragedy is opening our eyes to the extraordinarily high costs of our society’s reliance on fossil fuels. Russia’s attack on Ukraine is showing again that running the global economy on fossil fuels has immense costs in lives lost, livelihoods destroyed, and worldwide economic effects–even for families a world apart from the conflict.

A large part of Russia’s brutal invasion is financed by global reliance on fossil fuels. Russia makes hundreds of millions of dollars every day from exporting oil and gas to other countries–money that finances their war. A former adviser to Russian President Vladimir Putin said recently to the BBC that a real embargo by the West on Russian oil and gas exports–in essence shutting off the flow of cash into Russia for oil and gas–would stop the war in Ukraine. Yet because of past investments in fossil fuel-reliant technology and infrastructure, actually cutting off the flow of gas and oil from Russia to countries that do not have readily available alternatives for energy at the scale needed to replace Russian oil and gas is difficult and complicated.

Here at home in the U.S., we are feeling the impact when we fill up our cars at the pump. The price of gasoline has surged in the weeks since Russia’s invasion and many families simply can’t afford the higher costs. The oil industry has responded by calling for more drilling. Politico reported that last week the head of the American Petroleum Institute visited Tallahassee and called on Florida lawmakers to take action to allow offshore oil drilling, even if by moving to undo the protection that Florida voters’ afforded the state’s coastlines by passing the 2018 Amendment 9 to the state’s constitution.

But more offshore oil drilling is exactly the wrong approach and is a false solution that stands to harm Americans economically and environmentally.

People benefit from leaving fossil fuels behind, not doubling down on continued reliance

In the rhetorical calls for increased offshore oil drilling, several facts are conveniently left out:

- Increased offshore oil production wouldn’t lower the price of gas for Americans at the pump since oil prices are set on the international market. Previous analysis has shown that opening the Atlantic, Eastern Gulf of Mexico, and Pacific to offshore drilling–and taking on all the risk of drilling those areas–might affect prices at the pump by 0-3 cents after a decade or two.

- It would take about 10-15 years of project development work to get any oil from a new well to sale, according to the oil industry, meaning a new lease granted today wouldn’t get oil on the market until the 2030s.

- The oil cost impact of the Russian attack on Ukraine is not expected–at least by some experts–to last nearly enough time for new drilling projects to come online.

Overreliance on fossil fuels subject to extreme market volatility is exactly what is causing the problems we are experiencing now–more reliance is not going to solve them. Rather, we can and should scale up homegrown clean energy and electric transportation. When we switch from polluting fossil energy to homegrown, local clean energy, we not only liberate ourselves from toxic economic ties, like reliance on Putin’s fossil fuels, and insulate ourselves from the wild cost swings that oil and gas can subject us to, but we also develop local resilience, reduce pollution and improve health, protect the environment, and create jobs.

Leaving behind offshore drilling and fossil fuels is feasible and beneficial

While twelve years ago, as oil flowed into the Gulf of Mexico, clean energy solutions to reduce our reliance on fossil fuels certainly existed, but it was difficult to imagine how we could totally eliminate fossil fuels from our lives. But today, most of the technology that is needed to move beyond fossil fuels is here, widely available, and affordable.

In these last twelve years, the cost of solar has dropped 85% and wind energy 70%. Wind and solar are now often the cheapest new forms of electricity you can produce. Battery technology is a critical component of a clean energy future, allowing us to store energy for when the sun doesn’t shine or the wind doesn’t blow, and propel our vehicles with electricity rather than by burning gasoline or diesel. Battery storage has had price declines similar to those of solar and wind energy, unlocking the widespread viability of electric vehicles and power system batteries.

With these remarkable cost declines, our nation can achieve much of the transition to a carbon-free electricity system and electric vehicles well before any new offshore oil wells could even begin production.

Looking at the power sector, there is now a growing expert consensus that our country can reach 80% clean electricity within the decade, while maintaining the same reliable service we need, and at practically no additional cost, even while saving hundreds of thousands of lives and improving people’s health by cutting power plant pollution, and creating hundreds of thousands of jobs.

Meanwhile, our society’s switch to clean, electric vehicles is getting underway and can completely negate any perceived need for expanding offshore drilling. At SACE, we have updated and published annually since 2018 an analysis of how many electric vehicles (EVs) it would take to deploy on American roads to offset any gasoline that could be produced from opening new, currently-protected offshore areas to drilling for oil. Consistently, our findings have shown that feasible levels of EV deployment can more than offset any gasoline from drilling in the Atlantic, Eastern Gulf of Mexico, and Pacific.

I updated our analysis for this year, incorporating the updated Bureau of Ocean Energy Management’s (BOEM) offshore oil resource assessment that was published in 2021, and found that even with the updated resource assessment and higher oil prices (at least in the short term), EVs indeed can drive down offshore oil.

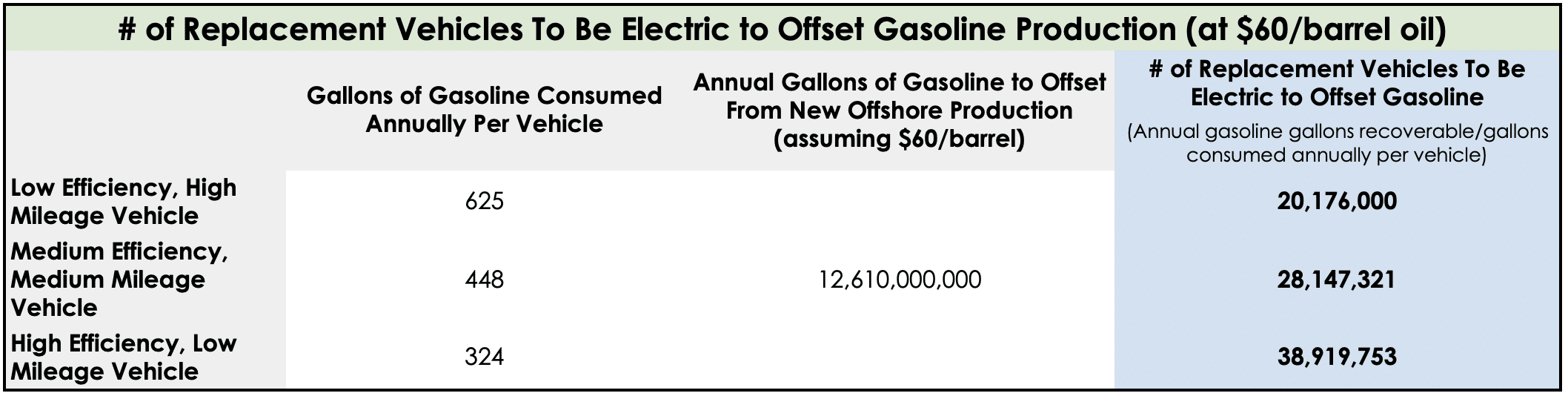

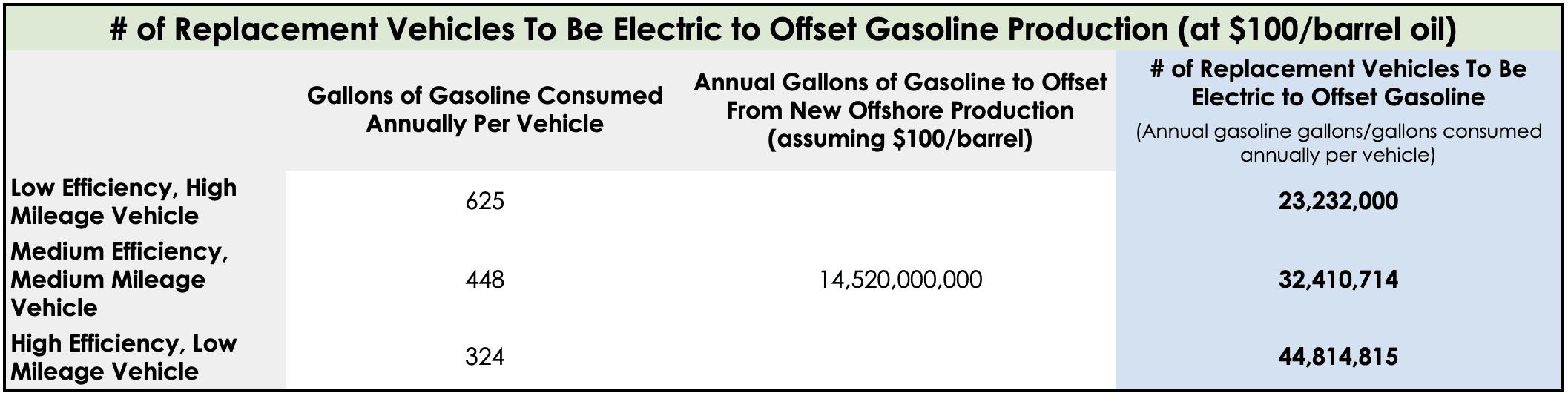

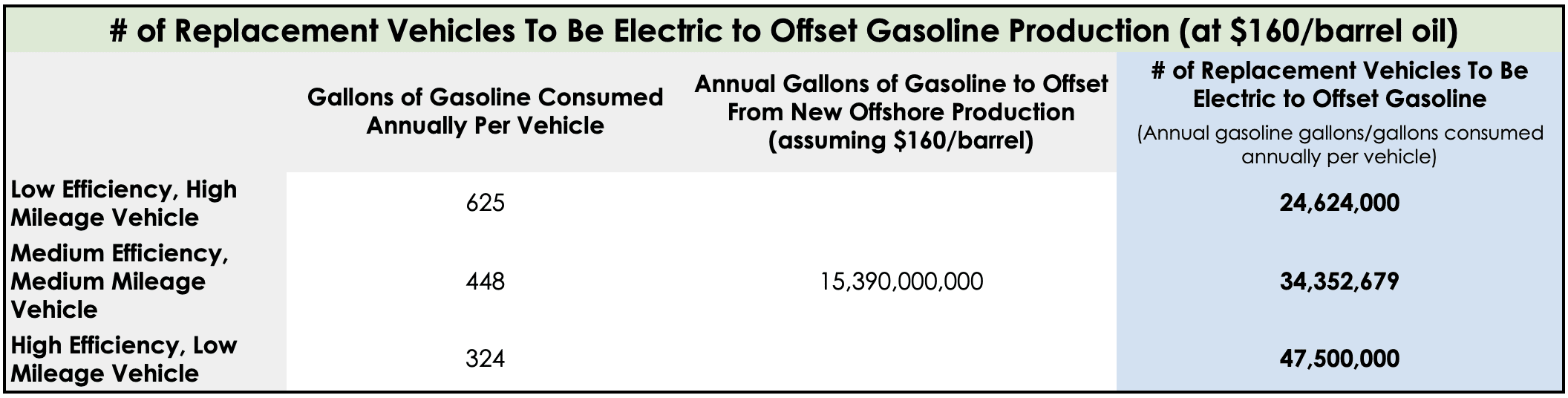

If Americans buy about 32 million EVs for their next vehicles, instead of gas-powered vehicles, by the early 2030s, gasoline demand would decrease enough to offset the amount of gasoline that could be produced from opening the Atlantic, Eastern Gulf of Mexico, and Pacific combined. Thirty-two million EVs represent a mid-point estimate–the range with sensitivities included is 20-48 million EVs–and largely depends on how much oil is economic to produce at various price points.

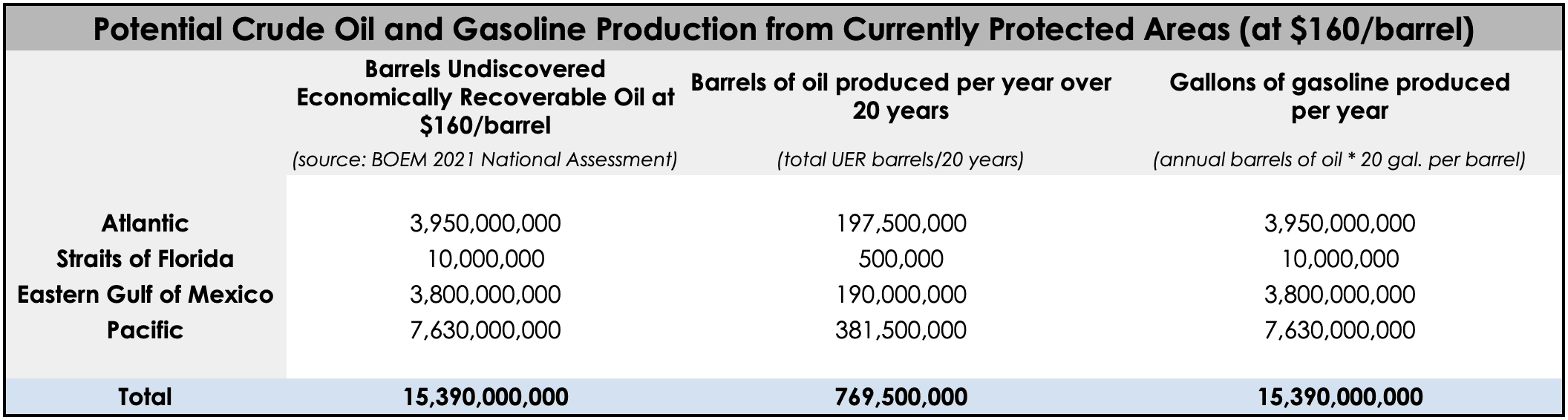

Notably, even in a world in which oil prices are high (which would allow oil companies to profitably drill for oil in more places that are relatively expensive to develop), EVs can still offset the gasoline that could be produced from currently-protected areas. When gasoline reached near-record prices last month, the price of oil was about $110-$120 per barrel on average over the month of March; using the data from BOEM’s new resource assessment informed me that even at $160 per barrel–a price well above the last month’s peak–it would take perhaps 34 million EVs on the road to offset the gasoline production potential.

View assumptions and calculations below.

Even more, when people switch fuel-burning vehicles for electric vehicles, they can save hundreds of dollars every year. Because electric vehicles cost less to fuel and maintain, significant savings can benefit electric vehicle owners over the lifetime of the vehicle, as has been found at a national level by Consumer Reports and Atlas Public Policy. The household savings potential holds true in the Southeast too: according to analysis from Energy Innovation’s Energy Policy Simulator, having an EV rather than a comparable conventional gas-powered vehicle could save residents of Florida, Georgia, South Carolina, North Carolina, and Tennessee hundreds of dollars per year or even $1,000+ per year in the case of the new electric F-150. Put together at a regional level, the savings from switching to electric vehicles are staggering. SACE analysis has found that consumers in the Southeast region would save $42 billion in fuel spending each year by electrifying transportation and keep an extra $5 billion in-region by relying on in-region energy sources versus sending our energy dollars out of the region to import fuel.

Public policy is needed to secure the future we want

Thirty-two million EVs on American roads by 2035 is entirely feasible, technically and economically, yet hitting this target and reaping the benefits associated with moving past offshore oil is not a guaranteed future. Expert opinions differ on how likely it is that the U.S. will get 32 million EVs on the road by 2035. For example, the U.S. Energy Information Administration (EIA) forecasts about 13 million light-duty electric vehicles on the road in 2035 under business-as-usual policies, while Energy Innovation forecasts about 64 million light-duty EVs on the road by 2035 under business-as-usual policies.

To help ensure people can benefit from the electrification of transportation–through a cleaner environment, less pollution and better health, avoided premature deaths, financial savings, and less dependence on volatile fuels that pad the pockets of oil executives and even authoritarians–we must enact policies to accelerate our clean energy and clean transportation transition.

At the federal level, Congress and the White House should advance clean energy and clean transportation tax credits, standards, or other policies. The Senate can help Americans secure the benefits of electric transportation and clean energy through the budget reconciliation process and deliver on major investments, like the policies that have already passed the House. Meanwhile, Congress and the White House can protect our shores from expanded offshore drilling for generations to come by enacting moratoria on new leasing.

At the state and local level, policies such as public fleet procurement, codes, incentives, and more can accelerate transportation electrification closer to home. SACE has assembled a toolkit of local policies for advancing electric vehicles in our Electric Transportation Toolkit for Local Governments to Accelerate Electric Vehicle Adoption, updated a couple of weeks ago.

When we come together to establish the policies needed to electrify transportation and deploy clean energy on a wide scale and at a rapid pace, we can reduce our reliance on risky fossil fuels and people will benefit.

Appendix

Assumptions

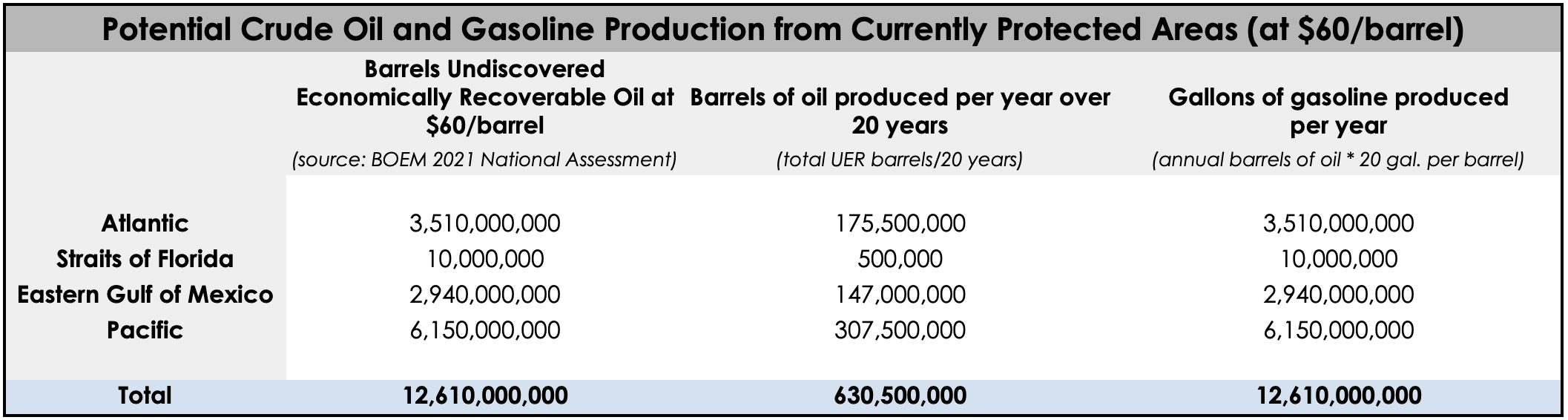

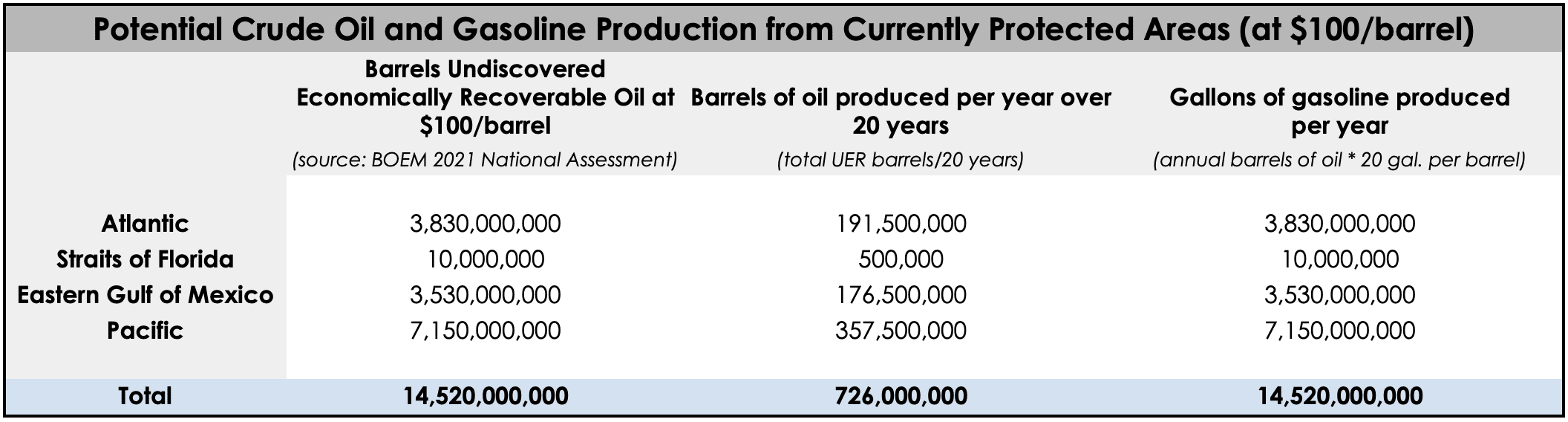

- The amount of gasoline that could feasibly be produced from currently-protected Atlantic, Eastern Gulf of Mexico, and Pacific:

- Risked mean-level undiscovered economically recoverable resources (UERR) of barrels of oil at $60, $100, and $160/barrel, per BOEM’s 2021 Assessment of Undiscovered Oil and Gas Resources of the Nation’s Outer Continental Shelf

- Oil resources, once developed, would be extracted over the course of 20 years, so the average annual production of gasoline from newly-developed areas would be one-twentieth of the total UERR

- Each barrel of oil produces about 20 gallons of gasoline, per U.S. Energy Information Administration (EIA)

- The long term price per barrel of oil:

- Before the Russian attack on Ukraine, EIA AEO 2022 forecast an average cost of $69-72/barrel, 2021-2035 (WTI-Brent, constant dollars)

- Before the Russian attack on Ukraine, World Bank Commodity Markets Outlook, October 2021 forecast the cost per barrel of oil to drop over time from $72 on average this year to $57.20 in 2030 and then rise to $59 in 2035.

- After the Russian attack on Ukraine began and the cost of oil spiked, Fitch Ratings forecast on March 21, 2022 that oil prices would experience about three years of higher prices due to the conflict before returning to baseline levels in 2025 and beyond. They wrote, “Fitch’s long-term price assumptions are unchanged, reflecting the impact of the energy transition on demand and the marginal cost of production.”

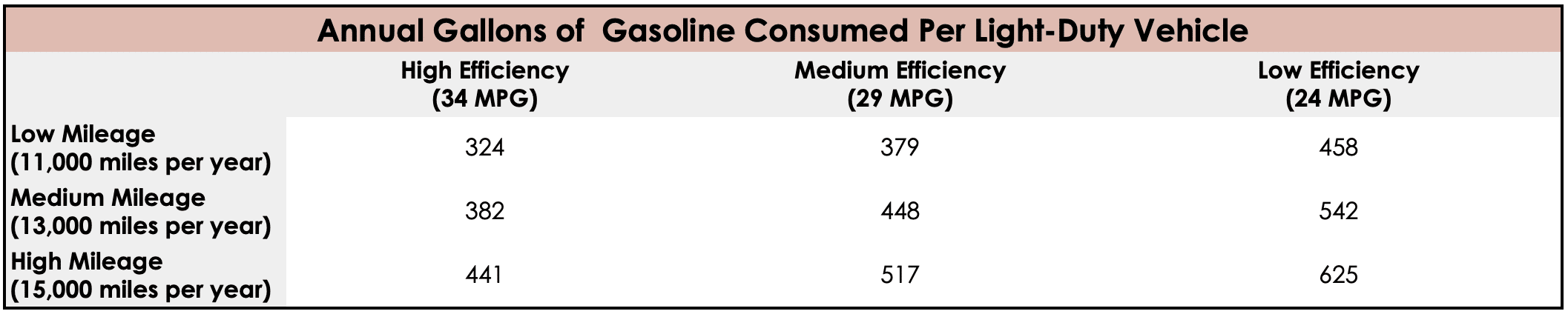

- Purchase of an EV would offset a new internal combustion engine (ICE) light-duty vehicle (LDV) purchase.

- The fuel economy is on average 29 miles per gallon, inclusive of on-road efficiency degradation factors, for new ICE LDVs sold 2021-2035, per EIA, Annual Energy Outlook 2022 (AEO 2022).

- New ICE LDVs sold 2021-2035 are about 30% gasoline cars, and about 70% gasoline light trucks, per EIA, AEO 2022.

- To reflect a range of possible ICE vehicles that could be offset by EV purchases, hypothetical high-efficiency and low-efficiency vehicles are analyzed at average fuel economy values of 34 MPG and 24 MPG respectively

- The average driver drives 13,000 miles per year 2021-2035, per EIA AEO 2022.

- To reflect a range of possible ICE vehicle miles traveled (VMT) that could be offset by EV purchases, hypothetical low-mileage and high-mileage drivers are analyzed at VMTs of 11,000 and 15,000 respectively.

- The lead time needed to get oil onto market from a new offshore development is 10-15 years after leasing, per American Petroleum Institute.

Calculations

#EVsDriveDownOil