Ten years ago today, hundreds of thousands of gallons of crude oil were gushing into the Gulf of Mexico from BP’s Macondo oil well, following the Deepwater Horizon drilling rig’s catastrophic and deadly explosion. Over 87 days, from April to July 2010, painful uncertainty persisted for Gulf coast residents as more than 200 million gallons of oil dumped into the Gulf. Repeated attempts to stop the flow of oil failed, and ultimately, over a thousand miles of coastline were oiled from Texas to Florida. Livelihoods were threatened and lost, cleanup workers were sickened, and wildlife and the environment were terribly harmed.

The Risk Of Drilling Persists

The spill was a wake-up call about the need to transition away from offshore drilling, and the dangers associated with this very risky fuel source.

A number of rules have been enacted since the spill in an attempt to increase the safety of offshore drilling, but their efficacy is undermined by industry activity and regulatory rollbacks by the Trump Administration. Even strict compliance with regulations would not magically change the intrinsic calculus that another catastrophic drilling blowout is not a matter of “if,” but “when,” especially as regulations are undermined by politics. In recent years, the oil industry has been drilling increasingly complicated and risky wells at depths even greater than the Deepwater Horizon well; and the Trump Administration has rolled back key provisions for drilling safety that were centerpieces of the lessons learned from Deepwater Horizon – and is attempting to roll back bedrock environmental laws such as NEPA (the National Environmental Policy Act.)

Alternative Solutions Are Surfacing

The good news is that a separate trend is underway that may make offshore drilling obsolete. The electrification of transportation is in the beginning phases of displacing a whole lot of oil demand in the coming years. This view is shared by optimistic electric transportation advocates and big oil companies alike.

The potential for electric vehicle (EV) deployment to significantly offset oil demand inspired SACE to explore a key question: How many EVs would it take to offset the gasoline that could be produced by expanding offshore drilling into waters that are currently protected? We addressed this question initially in 2018, again in 2019, and now we are here to address it again today.

What’s New This Year?

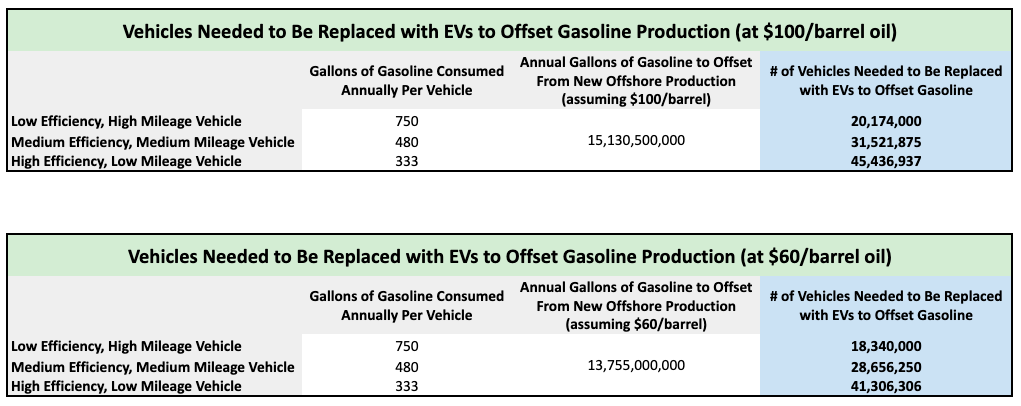

In previous years when we have looked at this question, we have found that it would take 20-45 million EVs replacing current gas-powered cars on the road from the early 2030s to the early 2050s to offset all of the gasoline that could be produced from the currently protected areas of the Atlantic, Pacific, and Eastern Gulf of Mexico combined at foreseeable oil prices. But due to the emerging trends of lower oil price forecasts and declining costs of deepwater oil production, we now find it could take as few as 18 million and as many as 48 million EVs on the road by the early 2030s to offset that potential gasoline production. Below we will further explore these two factors impacting our conclusion.

Lower oil price forecasts

One factor in our calculations that has changed significantly in the past year is forecasts for the price of oil. While some forecasts have held long-term oil price projections steady over the last couple years– for example, the World Bank Commodities Market Outlook has kept their projected 2030 oil price at about $59 per barrel–others are forecasting lower oil prices in the future. the U.S. Energy Information Administration (EIA) revised downward their estimated price of oil from $87-$100 per barrel in the 2030-2035 timeframe in last year’s Annual Energy Outlook report to $71-$83 per barrel in the 2030-2035 timeframe in this year’s report. Meanwhile the International Energy Agency (IEA) similarly revised downward their long-term oil price forecast from $96 in 2030 and $112 in 2040 in the 2018 World Energy Outlook report to $90 a barrel in 2030 and $103 a barrel in 2040 in last year’s report. It should be noted these projections were prior to the COVID crisis dramatically depressing oil demand, which may have profound effects on the long-term oil market. Lower oil prices mean less offshore oil would be economical to produce. According to the Bureau of Ocean Energy Management (BOEM), the amount of oil that would be economic to produce at $100 per barrel in the Atlantic, Eastern Gulf of Mexico, and Pacific would be 14.41 billion barrels, while at $60 per barrel, it would be just 13.1 billion barrels.

In calculating the number of EVs it would take to offset any potential gasoline production from opening up currently-protected areas to offshore drilling, we have previously assumed a price of $100/barrel in the early 2030s. While long-term oil price forecasting is highly speculative, it is worth looking at how many EVs it would take to offset any potential gasoline production from opening up currently-protected areas to offshore drilling in a $60/barrel market. Using this assumption in our calculations (shown in the tables below and with methods detailed in previous years’ blog posts), we find that it would take 18 to 41 million EVs on our nation’s roads by the early 2030s.

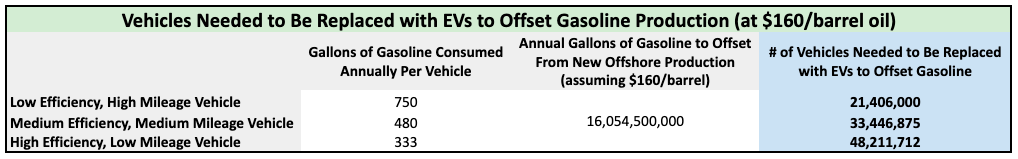

Declining costs to develop new offshore oil projects

On the other hand, offshore oil companies have dramatically reduced the price to develop new deepwater projects, such that projects that could have only been justifiable to develop at $100 per barrel previously may now be developed at a much lower oil price. For example, Wood McKenzie research in 2018 found that the cost to develop new deepwater offshore oil projects dropped by 50% between 2013 and 2018. However, just how much oil development these cost-savings would make economically viable in currently protected areas is not apparent in publicly-available estimates. To account for these cost declines, we can use as a proxy the estimated production of oil that previously would only have been considered economic at higher oil prices. According to BOEM, the amount of oil that would be economic to produce at $160 per barrel in the Atlantic, Eastern Gulf of Mexico, and Pacific would be 15.29 billion barrels. Using this assumption in our calculations (shown in the table below), we find that it would take 21 to 48 million EVs on our nation’s roads by the early 2030s.

Bringing It All Together

Incorporating the sensitivities outlined here reflecting lower long-term oil prices and declining costs of developing new deepwater offshore oil projects, we find a range of 18 to 48 million EVs would need to be on the road in the early 2030s in order to offset any gasoline that could be economically produced by opening the currently-protected areas of the Atlantic, Eastern Gulf of Mexico, and Pacific to offshore drilling.

Can We Deploy Enough EVs to make Expanded Offshore Drilling Moot?

The short answer is yes.

But public education and supportive policies may be needed to get us there.

Forecasts for EV deployment in the U.S. vary greatly from one forecasting group to another, depending on what assumptions are made about consumer preferences, environmental policies, and economics:

- EIA conservatively projects about 8 million EVs on the road by 2030 and 13 million by 2035.

- Research firm Energy Innovation models about 19 million EVs on the road in 2030 and 49 million by 2035 under a business as usual policy scenario, and under other scenarios with more environmental policies enacted, many millions more EVs on the road.

- Bloomberg New Energy Finance expects even more EVs on the road than Energy Innovation: they expect more than half of U.S. light-duty vehicle sales will be electric by 2035, meaning millions of new EVs on the road every year.

Once again it is important to consider that these estimates were made before the coronavirus crisis, which is having a big impact on the auto market. Auto sales, including EV sales, will be down significantly in 2020, though there are reasons to believe EVs will rebound faster than gas cars. The crisis will temporarily slow EV sales and will delay the introduction of new models from manufacturers, but it is ultimately not expected to change the long-term electrification trend.

In short, our ability to get 18 to 48 million EVs on the road in the early 2030s and offset any gasoline that could be produced by opening the Atlantic, Eastern Gulf of Mexico, and Pacific is entirely feasible, but is not a given. We must actively pursue this future with purchasing decisions and public policy. For example, SACE’s Electrify The South local policy toolkit outlines dozens of policies that local governments can enact to accelerate our future to clean electric transportation and away from risky offshore drilling.

In a clean, electric transportation future, not only can we save our shores from the impacts of expanded offshore drilling, but our communities could enjoy less air pollution, better public health, and lower transportation costs. This future is attainable if we proactively make it happen.