Tennessee Valley Authority (TVA) utilities (known as Local Power Companies or LPCs) are responding to TVA’s rate structure change by increasing fixed fees for residential and small commercial customers. This runs contrary to TVA’s claims that these customers would see little to no impact on their bills. Since LPCs are required to purchase all power from TVA at wholesale prices, increasing fixed fees is the simplest and least-risky way to pass TVA’s new Grid Access Charge (GAC) through to customers.

Tennessee Valley Authority (TVA) utilities (known as Local Power Companies or LPCs) are responding to TVA’s rate structure change by increasing fixed fees for residential and small commercial customers. This runs contrary to TVA’s claims that these customers would see little to no impact on their bills. Since LPCs are required to purchase all power from TVA at wholesale prices, increasing fixed fees is the simplest and least-risky way to pass TVA’s new Grid Access Charge (GAC) through to customers.

TVA is again attempting to mask the impacts of rate changes by making several small changes over a period of time, in an apparent attempt to avoid the outrage that a bigger, larger change would surely invoke. (In fact TVA’s initial proposal was twice the size it actually made, and it considered a change five times larger; fortunately, it was dissuaded after considerable public outcry from small businesses, advocates, and LPCs themselves.) TVA’s rate approval process continues to be behind the scenes. If TVA is allowed to continue, it will have substantially and covertly transformed TVA rates to the detriment of customers, particularly low-income, fixed-income, solar, and efficient customers.

What is the Grid Access Charge again, and why do I care?

In May, TVA’s Board approved a rate structure change that moves a portion of what LPCs pay TVA from variable rates (based on actual usage) to fixed charges (an annual fee based on the previous 5 years of usage). This is called the Grid Access Charge (GAC) and SACE raised questions about the substance of the rate change and the way that TVA pushed it through in our public comments and previous blogs. TVA is adjusting rates to ensure recovery on investments made under the assumption that load would continue to grow unchecked into the future. Now that load growth is flat (and declining in some areas), TVA is at risk of not recovering on those investments, and so is shifting that risk onto LPCs – and their customers – via the GAC.

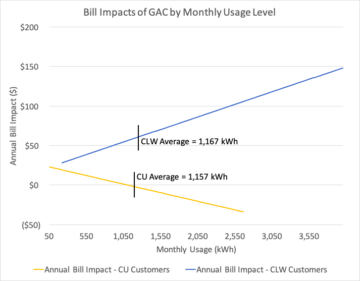

The initial impacts of the GAC will not be very significant for most customers of two of the early LPCs to pass the GAC on to their customers: Cleveland Utilities and Columbus Light and Water. But there’s good evidence that while impacts start low, they will grow. TVA has stated that it would like the GAC to be at a level 5 times what was approved. It is currently at $0.005/kWh, but SACE’s comments on the draft proposal discussed a private 2017 presentation where TVA stated that it expects the GAC to have a “trajectory” to $0.025/kWh. TVA’s response (Appendix D) did not rule out this trajectory, and stated that “additional rate changes… are reasonably foreseeable.” As LPCs phase-in implementation and TVA ratchets up the GAC, the impacts to customers, the economy, and the environment also grow.

Although hard to tell because of a lack of transparency, TVA may also try to slow down LPC recovery of the GAC by delaying the release TVA’s promised default rates and by allowing LPCs to delay implementation until October 2019. In the final Environmental Assessment (EA) on this rate change, TVA stated it would develop default rates for LPCs to use to pass through the GAC to their customers. TVA has not made any default rate structure(s) public; it is still blocking public access to its rate approval process and these default rates, if they even exist at all. In the final EA, TVA claimed that these default rates would limit the customer impact to $2/month. By SACE’s calculations it will be difficult for LPCs to recover the GAC while also limiting the increase in fixed fees to $2/month. (Our calculations related to the $0.01/kWh are presented Appendix A of SACE’s comments on the Draft EA. Results for the $0.005/kWh GAC would be roughly half of those found using a $0.01/kWh GAC, or approximately $6/month average across LPCs.)

Most (86%) of LPCs have seen retail sales decline in the last 5 years, including Cleveland Utilities and Columbus Light and Water. Since the GAC is based on previous usage, an LPC will pay more to TVA under the new rate structure than it would have under the old structure unless the LPC’s usage is at or above the 5-year annual average. Only LPCs with retail sales growth (21 of 155 LPCs) will pay less under the new rate structure. Retail sales will likely continue to decline and LPCs will need to pass the GAC through to customers in the form of a fixed fee to secure recovery.

Cleveland Utilities is phasing in the GAC

Cleveland Utilities (CU), on June 22, announced that starting in October residential customers will see a $2 “TVA Grid Access Charge” on their bills. That fixed fee will be somewhat offset by a $0.00181/kWh reduction in energy charges. However, customers that use less than the average amount of electricity monthly will see a slight increase in their bills. CU is phasing in the GAC to avoid any large increases in a single year, but is at least transparent about its trajectory. According to a June 23 article in the Cleveland Banner, this first phase recovers most of the GAC from the energy rate (based on consumption), and it will implement the next phase in October of 2019. It is likely that the next phase will include another hike in the fixed fee.

The chart to the right shows how much a customer’s annual electric expenses will increase or decrease for CU customers (yellow line) due to the LPC’s new rates. The x-axis is monthly customer usage; the average CU customer uses 1,157 kWh per month and will pay $1 less per year under the new rates. A customer that uses half of the average (578 kWh/month) will pay an additional $11 per year under the new rates, a 1% increase.

This rate change is a good example of how shifting charges from consumption-based rates to fixed fees takes away customer’s control over their own bill through measures like energy efficiency and self-generation.

In 2018 we expect a small difference for customers with usage close to the average. But the lowest CU customer uses approximately 60 kWh each month and will pay more than $22 more each year under the revised tariff, a nearly 8% increase. This impact is still within TVA’s $2/month limit. However, as CU implements the next phase, TVA increases the level of the GAC, and annual sales continue to decline in CU territory, the impact on customers will increase.

Columbus Light and Water is addressing the GAC as part of a rate hike

The Columbus Light and Water (CLW) Board, on June 21, approved a budget that includes an increase in both the energy rate and the fixed fee. These increases are to offset TVA’s GAC and to address CLW’s last three years of deficits, which have drawn down reserves. CLW would be increasing rates even in the absence of TVA imposing the GAC on LPCs, but the way and degree to which CLW is adjusting rates is certainly influenced by the GAC.

The chart above shows how much a CLW customer’s bill will increase (blue line). The CLW proposal differs from the CU rate change because CLW is increasing both the fixed fee and the energy charge, thus the blue line does not cross the x-axis. All CLW customers will see higher bills. The lowest users will see an approximately 6% increase, nearly $30 a year, whereas the highest users will see an approximately 3% increase, nearly $150 a year. The average CLW residential customer uses just under 1,200 kWh each month. This average customer’s annual electricity bill would increase by nearly $60.

TVA has not approved CLW’s proposed rate hike, so it could change prior to implementation. CLW plans to institute the rate change starting October 1.

Both CU and CLW responded to TVA’s GAC with an increase to customer fixed fees. Both utilities have seen load decline by an average of 1.7% each year since 2014. Load has declined in CU despite an increase in total number of customers. CLW has seen a slight decrease (0.4% annually) in total number of customers, but load is still declining faster than customers. TVA’s GAC is essentially a fixed fee imposed on LPCs. As mentioned earlier, the GAC is designed to shift the financial risks associated with declining customer demand from TVA to LPCs. LPCs ensure a more stable income for themselves even as demand declines by recovering the GAC through higher fixed fees. Unfortunately, customers literally pay the price, with high fixed fees regardless of their usage.

TVA continues to incrementally shift rates to stay under the radar

TVA’s costs are increasing because it made a series of bad investments under the mistaken assumption that the need for electricity would continue to grow. Across the US, demand for electricity has remained flat for a decade. In the absence of load growth TVA is at risk of not recuperating its bad investments. Now, by implementing the GAC and limiting the ways LPCs can pass it through to customers, TVA is passing that financial risk on to LPCs. TVA is forcing LPCs to make a hard choice between increasing fixed fees (which have been increasing steadily in the TVA territory already) or taking on additional risk by attempting to recover a fixed charge via consumption-based rates.

TVA rammed the Grid Access Charge through Board approval with very little public input. TVA declined to perform an adequate assessment of the impacts of the GAC, claiming the impacts are unknowable because the impacts depend on how LPCs pass the GAC on to customers. Now that LPCs are beginning to make those decisions, we are seeing exactly what the GAC means for customers, and how widely the impacts can vary between LPCs.

TVA has given LPCs the option of implementing the GAC in October of 2018 or October of 2019, so we will see LPC implementation decisions trickle out over the next fourteen months or so. Residents of the Valley are on the verge of a significant change in the way they are charged for electricity, yet have little to no information about how it will impact them individually. The diffuse nature of the LPC announcements and the opacity of TVA’s stakeholder process are keeping customers in the dark when it comes to electricity charges. TVA has been quietly but steadily changing its rates and rate structures to the disadvantage of residential customers since at least 2011, and this appears to be another way for them to continue that trend.