SACE is an intervenor in a Florida Power & Light (FPL) 2025 rate case in front of the Florida Public Service Commission (PSC). After careful consideration of all the information in the case and current realities within the state and across the sector, we decided to support the settlement.

SACE’s joining the 2025 FPL Rate Case settlement is consistent with our continued support of FPL’s efforts to diversify its generation mix away from being approximately 70 percent dependent on methane gas power plants. We also support FPL’s growth of advanced storage technologies, which increase flexibility and reliability in its system. FPL’s investment in solar and storage will reduce fossil fuel consumption and improve environmental performance through lower carbon emissions — critical given Florida’s vulnerability to flooding and extreme climate events.

SACE also supports FPL’s efforts to improve electric-powered mobility, which can lower transportation energy costs for consumers by decreasing the demand for gasoline and diesel.

We share concerns about rising electricity costs to consumers. While the rate case is a contributor, SACE believes rising fuel costs, regressive state and federal tax policy, and ineffective energy efficiency policies are collectively more impactful on customers’ electricity bills. FPL’s long-term commitment to diversify away from reliance on methane gas is needed to avoid future electricity bill increases.

– Stephen A. Smith, Executive Director, SACE

Moving Off Fossil Fuels Leads to Lower and More Stable Electric Bills

With rising costs across the economy, affordability is rightly a discussion point, including in the electricity sector and particularly during rate cases. Electricity is a basic necessity in today’s society, and thus, rising electric bills are a concern for households. Electricity is also a unique commodity, so it’s important to understand exactly how electric bills are set and what is driving increases, now and in the future.

Most customers receive a bill from their electric utility with very little information about why they owe what they owe. This includes the amount of electricity used that month, the applicable rate(s), any riders or additional fees, and the total amount billed. But within those rates and fees are complicated calculations based on the utility’s spending and, if the utility is investor-owned, a portion that regulators allow the utility to make as profits for its shareholders. While discussions of how much profit monopoly utilities should be earning are important, there are other factors within the utility’s spending that are driving up bills and should not be ignored. One key factor that has raised bills in the past, and is likely to continue to raise bills, is the utility’s spending on fuels to power its power plants.

A key, but little-known, policy among most electric utilities is that utility customers, not shareholders, pay 100% of fuel costs. This policy is often called a “pass-through” because fuel costs are “passed through” from the utility to the customer. That means the utility has no financial skin in the game when fuel prices go up or down. If the utility has to pay double what they expected for gas or coal, it doesn’t change their financial situation. This is a moral hazard because the utility, not the customer, is the one deciding which plants to build and run.

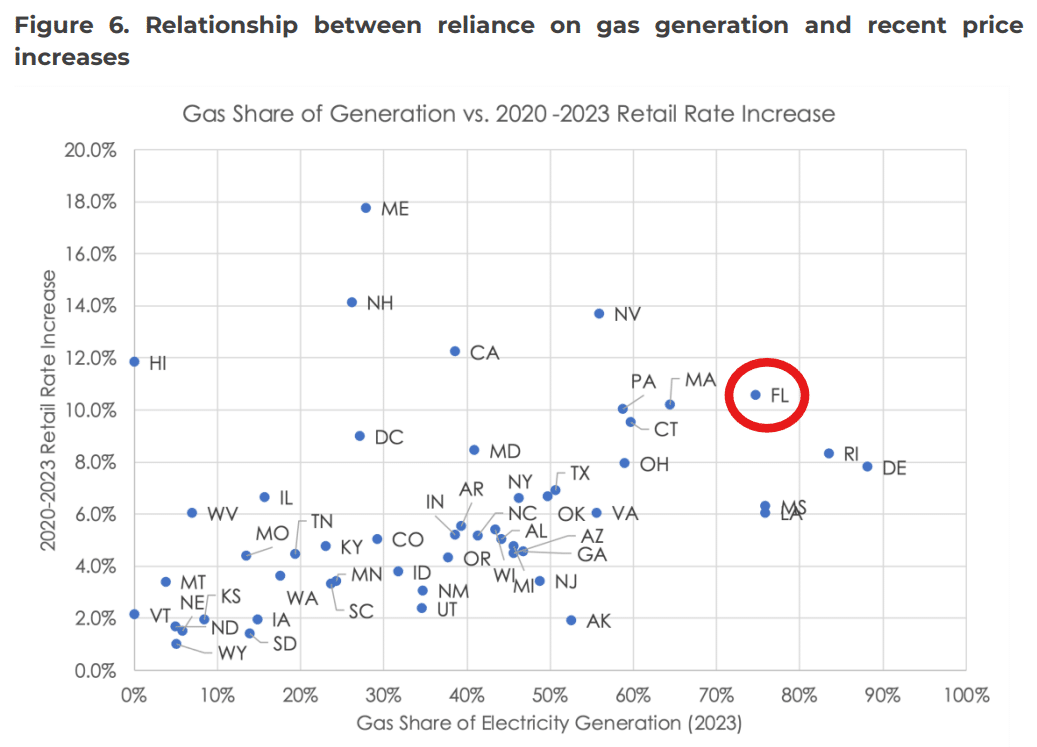

This pass-through policy was put in place in the 1970s, when most fuel-based electricity was generated through coal and nuclear, which have relatively stable prices. However, the pass-through policy has not kept pace with changing utility trends. Utilities are relying more and more on methane (i.e., “natural”) gas for generation, which exposes customers to the volatile gas price market. The more a utility relies on gas to generate power, the more exposed customers are to these rising prices. And utilities don’t need to file rate cases to increase customer bills when gas prices spike. We saw this firsthand when, following Russia’s invasion of Ukraine and the resulting spike in gas prices, utilities in Florida filed to increase the fuel cost portion of electric rates multiple times in a single year. This impact was especially prevalent in Florida because utilities are so dependent on gas. FP&L, for example, generated approximately 71% of its electricity from gas in 2024.

Florida’s reliance on gas has created competition with the liquid natural gas (LNG) export industry that is exploding along the Gulf. Florida is served by many of the same pipelines that feed LNG export terminals, and this competition invariably leads to supply risk and higher prices for Florida power plants because the lucrative LNG export industry can offer a higher price.

So what can utilities that are so dependent on gas do to protect customers? There are various ways these utilities can hedge, but the best hedge is to diversify their generation and add non-fuel-based resources to the mix. In Florida, that aligns well with the lowest cost generation resources: solar and storage.

FPL’s Solar and Storage Additions Reduce Gas Price Spike Exposure

It’s important to note that Florida utilities earn a return on investments in solar resources, and that financial incentive is aligned with the stabilization of customer bills by removing some of their exposure to gas price spikes.

FPL in particular is adding enough solar and storage over the next four years that it projects it will decrease its gas generation by ten percentage points. That means taking gas generation from 70% of the mix to 60%. Gas is still the biggest source of generation for FPL, but for the largest utility in the country, that’s a big step toward reducing reliance on fossil fuels generally and reducing gas price spike risk for FPL customers specifically.

With a push for increasing LNG exports through the current administration’s energy dominance agenda, protection of ratepayers from bill spikes driven by fuel costs is more important than ever.

Electrification Reduces Transportation Burden

Analysis shows that electricity and gasoline make up the bulk of the average energy spending for Floridian households, with gasoline accounting for more than half of that energy spending. The FPL rate case settlement advances electric mobility programs that can help families reduce their spending through electrification.

SACE Advocacy for Affordability and Clean Energy Continues

Overall, in addition to solar and storage, the best way to reduce customer electricity bills is through comprehensive and sustained energy efficiency programs. Customers throughout Florida and the Southeast are using more electricity than they should to keep homes and apartments comfortable throughout hot summers and cold winters. By helping customers reduce electricity usage and making homes and apartments more comfortable, the utility can avoid generating electricity from fuel-based power plants, particularly gas, and reduce the fuel cost portion of electricity rates for all customers. It’s a win-win-win. While not a part of this FPL rate case, energy efficiency remains an area where all Florida utilities can improve. SACE will continue to work within energy efficiency statutes in Florida and across the region to advocate for expanding energy efficiency to lower electric bills.

SACE is also participating in the regulatory docket in front of the Florida PSC to review utility fuel costs, including those incurred by FPL, and set new bill components based on the utility’s projections of future electricity sales, future fuel usage, and future fuel prices. We will keep you updated on that front as it develops.