On October 12, 2021, the Southeast Energy Exchange Market (SEEM) proposed in Docket No. ER21-1111 “became effective by operation of law” because of the “absence of Commission action on or before October 11, 2021,” according to a notice issued by the Federal Energy Regulatory Commission (FERC).

The Federal Power Act’s Section 205, under which SEEM was filed, states that if the Commissioners are deadlocked or in the absence of a decision by FERC, it “shall be considered to be an order issued by the Commission accepting the change.” Therefore, because of FERC’s inaction, SEEM is set to move forward. In other words, for SEEM to not have been approved, a majority of FERC Commissioners would have had to vote against it on the grounds it is not a just and reasonable proposal. In fact, the failure of some of the largest monopoly utilities in the country to convince a majority of commissioners that SEEM is legal is yet another reason why it cannot be the last step towards wholesale market reform in the Southeast.

FERC commissioners may file statements explaining their views on the SEEM proposal in the docket. We will update this blog post if/as those become available.

What is SEEM?

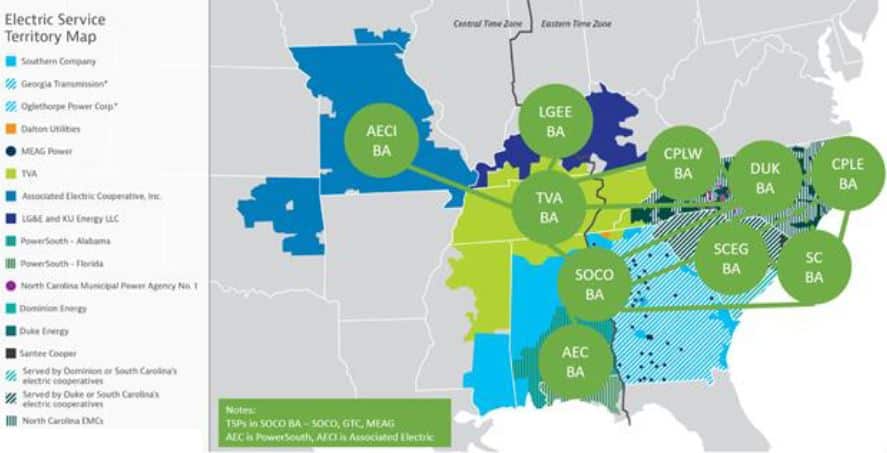

SEEM is a proposed change to the bilateral market among Southeast utilities that allows for trading in 15-minute increments, on a voluntary basis, with free transmission, and a split-the-difference price-setting mechanism (meaning ultimate price is halfway between the bid and offer prices). SEEM does not propose to have a market monitor, voting to change SEEM can be dominated by large utilities, and SEEM utilities can choose which other SEEM utilities that will/won’t trade with.

For more see our previous blog post. And catch up on all of our blog posts on SEEM.

How did we get here?

In July of 2020, news broke seemingly unintentionally that a number of the large utilities in the Southeast had been talking behind closed doors for months about a potential market structure in the region. While many speculated on what would emerge from those talks, criticism of the lack of collaboration and transparency around the development of SEEM was a common first reaction. It is a theme that would continue throughout the SEEM timeline.

A few months later, in September 2020, we at SACE reviewed a report by Guidehouse comparing some of the costs to the potential benefits of SEEM. We still hadn’t seen the official filing documents but were getting a clearer picture of how SEEM was being constructed to have as little oversight from FERC and state regulators as possible.

Next up, North Carolina Utilities Commission. Duke Energy, as part of the stipulations around the merger of Duke and Progress, had to file SEEM at the North Carolina Utilities Commission before it could be filed at FERC. This “preview” of the SEEM filing took longer than the utilities had hoped. While the NCUC ultimately didn’t order any changes to SEEM, the process likely pushed back the FERC filing by a month or two.

In February 2021 a number of utilities submitted filings asking FERC to approve of SEEM, and in March we joined with a number of public interest organizations to file a protest asking the FERC not to approve SEEM. We broke this down in our SEEM Q&A blog post, and dive deep into why a number of filers (not just our group) asked FERC to hold a technical conference on Southeast market reforms.

In May 2021, FERC issued an extensive deficiency letter, detailing the areas where SEEM filing falls short or could have problematic outcomes like market manipulation among members. While the deficiency letter was pretty technical, we again broke it down in a blog post. The SEEM utilities filed a response 10 days early on June 8, 2021, showing their eagerness to get the FERC process done so they can move forward with setting up SEEM. We followed up with a response detailing to FERC how the utilities’ response did not adequately address the issues FERC had raised in its deficiency letter.

On August 6, 2021, FERC issued another deficiency letter, however, this one was not as extensive as the first and utilities only had 10 days to respond. Again beating the deadline, the SEEM utilities filed a response on August 11.

SEEM “Became Effective”

That brings us to today. FERC let the clock run out on issuing a decision on SEEM because the Commissioners were “divided two against two as to the lawfulness of the change.” Commissioners may submit to the docket an explanation of their views on the proposal, and we will update this blog post if or as those come in. There is also the potential for intervenors to request a rehearing of the proposal, which might allow President Biden’s FERC nominee, Willie Phillips, a chance to weigh in and break the tie.

As we have stated previously, the implementation of SEEM may slightly reduce the curtailment of solar among SEEM utilities, but could also potentially be used as a way for utilities to sell off excess generation that is a result of overbuilding fossil gas resources.

One intention for SEEM may have been to shield Southeast utilities from more meaningful market reforms, but could that backfire and speed up the transition of the Southeast toward true electricity competition? Only time will tell. Moving forward, we will continue to advocate for market reforms in the Southeast that recognize the value that clean energy resources provide to customers, and for a reform process that includes transparency, oversight, and meaningful engagement of stakeholders throughout.

Read all of our blog posts on SEEM.

#SoutheastEnergyExchangeMarket