On June 9, Memphis’ city utility, MLGW, hosted a joint meeting to the MLGW Board and Memphis City Council to present preliminary findings of their evaluation thus far of the bids MLGW received to provide electricity to Memphis. The bids are part of the multi-year process MLGW has been undertaking to assess whether it should continue paying about a billion dollars per year to its current electricity supplier, TVA, or find new suppliers that could reduce costs for Memphians.

Numerous studies conducted in recent years have demonstrated the potential for savings from Memphis switching energy supplies, but the studies needed to be ground-truthed with actual bids from electricity suppliers. That’s what MLGW did last year when it published a series of three requests for proposals (RFPs).

The June 9 meeting was the public’s first glimpse at the results of the bids and the results verify that there could be large benefits to Memphians from MLGW switching to new electricity supplies.

The presentation to the Board and City Council was informative and it was clear that the evaluations have been thoughtful and diligent so far, yet it lacked critical information that the community needs in order to make an informed decision, particularly when the decision is as monumental as what faces them.

Below are a few top takeaways from the presentation including benefits that were verified at the meeting and information gaps exist that need to be explored in the coming weeks before MLGW makes any decisions.

What the Presentation Verified Clearly

Big savings are available for Memphis and Shelby County

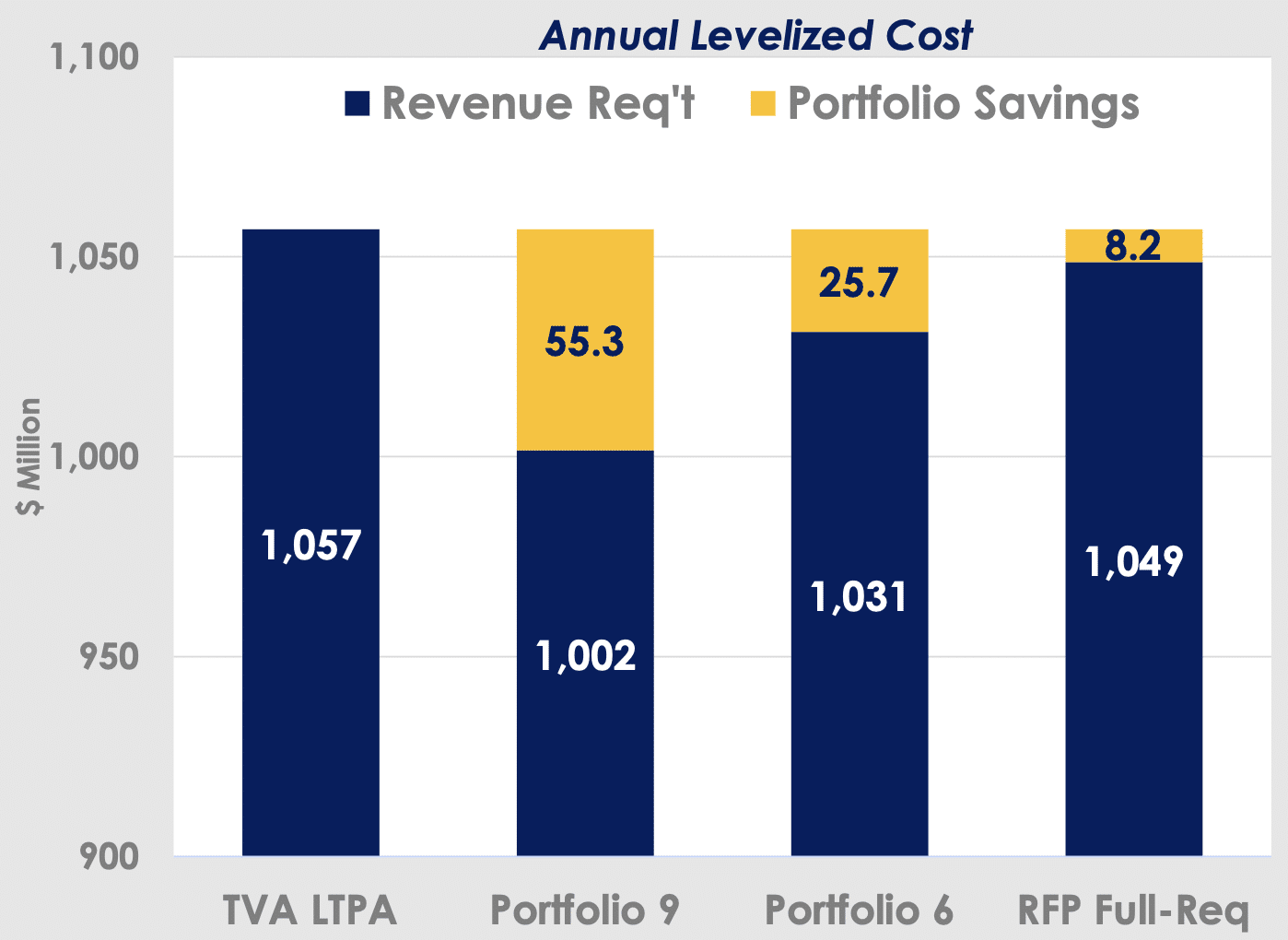

The initial RFP evaluation verified that Memphis could indeed save large amounts of money by switching electricity supplies, as numerous studies have shown. Initial analysis of the RFP bids discussed in the presentation showed that one of MLGW’s preferred portfolios of energy resources would yield about $55 million per year in savings compared to TVA’s lowest-cost offer. This level of savings is quite large and amounts to over a billion dollars over 20 years–a reality that shouldn’t be overshadowed by the fact that greater savings were predicted by previous studies. $55 million may actually be an underestimate due to cost-saving factors that were not incorporated into the tentative evaluation, however, as detailed below.

Companies are lined up to invest in Memphis and Shelby County

The presentation showed that there is strong industry interest in investing in Memphis and Shelby County. The RFP yielded more proposals from companies ready to build in Shelby County than would be able to be accommodated, meaning MLGW gets to selectively pick and choose only the best proposals. For example, while MLGW was seeking up to 1,000 megawatts (MW) of local solar in Shelby County and over 2,000 MW of solar from Arkansas and Mississippi, they received bids on 2,150 MW of local solar and 4,900 MW of out-of-state solar–twice as much as MLGW was seeking.

What the Presentation Verified, with Some Reading Between the Lines

MLGW’s integrated resource plan study (IRP) in 2020 clearly identified major economic development and environmental benefits as potential upsides of switching electricity suppliers. The presentation indeed verified these very important benefits, yet did not include these benefits as direct points in the presentation. Rather, the presentation left us needing to read between the lines to draw out these conclusions. As MLGW and their contractor GDS Associates finalize offers from bids and update their evaluation before making a recommendation to the MLGW Board, it is essential that they place the following big benefits back in the forefront of evaluations as they were in the 2020 IRP discussions.

Billions of dollars of investment are ready to flow into Memphis and Shelby County, creating local jobs, and generating local government revenue

MLGW’s integrated resource plan study (IRP) in 2020 indicated that leaving TVA would prompt nearly $3 billion of capital investment into the Memphis area through building power generation and transmission infrastructure. The RFP bore that out and identified specific companies that are ready and willing to do billions of dollars worth of projects in Shelby County. This investment would mean jobs for Memphians and tax revenue for the City and County to fund critical services for residents.

For example, solar farms can generate thousands of dollars per megawatt in property tax for local governments. If MLGW contracted for 1,000 megawatts of solar to be built in Shelby County, that would mean millions of dollars every year in property tax revenue to Shelby County and Memphis. These potential projects were not accounted for in the presentation.

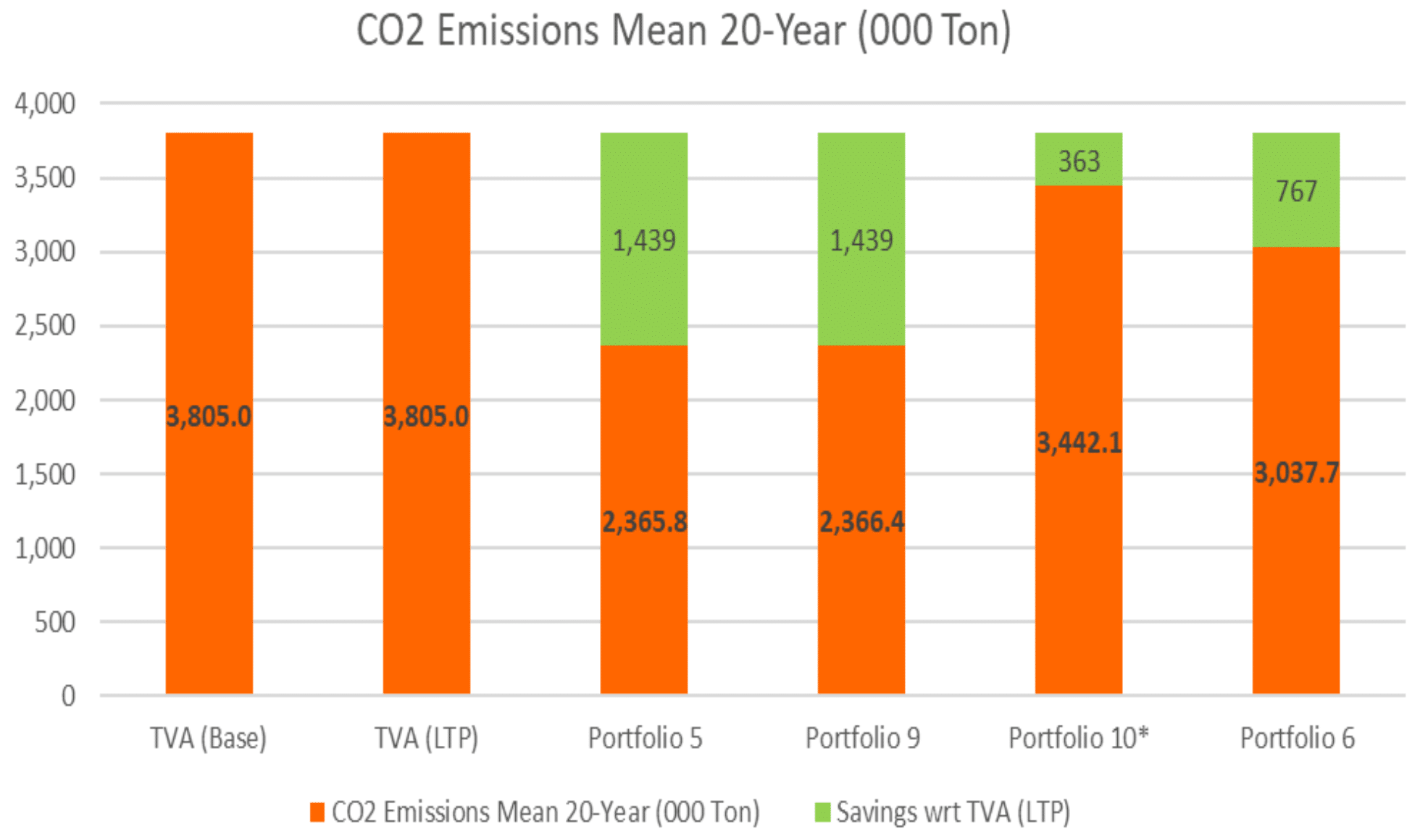

Memphis would become a clean energy leader and slash climate pollution while saving money with an alternative energy supply

MLGW’s energy supply would be about 75% renewable under the lowest-cost alternative energy portfolio considered in the RFP. Much of that would be local solar energy produced by solar farms in Shelby County while the rest would be solar energy brought in from Arkansas and Mississippi. In fact, a large part of the reason why the lowest-cost option of MLGW’s preferred energy portfolios is less expensive than TVA power is precisely because of taking advantage of low cost of solar, which TVA is failing to fully take advantage of. All this renewable energy would result in slashing the climate-warming pollution from Memphis’ electrical supply, to the tune of nearly 40% lower carbon emissions compared to what TVA is offering.

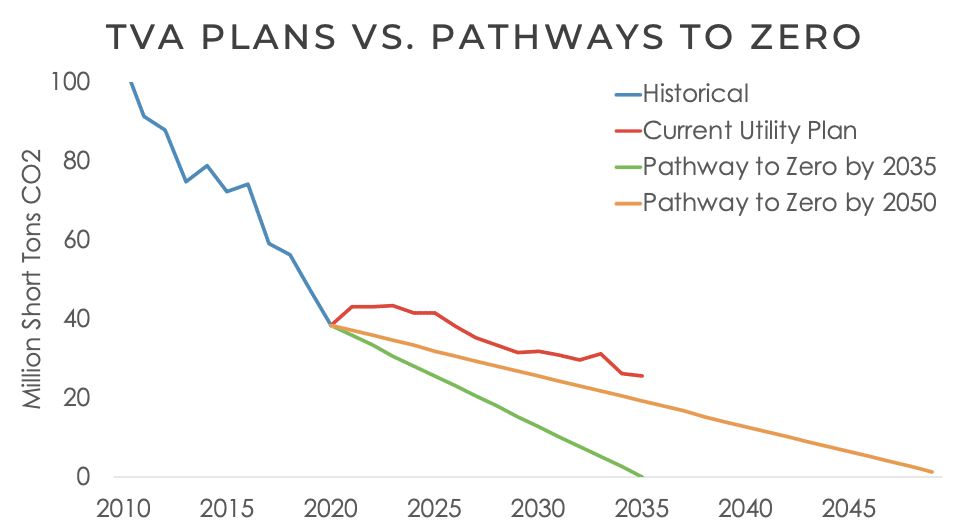

The carbon reduction offered by the alternative energy portfolio could be key to meeting the Memphis Area Climate Action Plan goals, championed by Mayor Strickland and Mayor Harris, which seeks to achieve 80% carbon-free electricity, particularly solar and wind, by 2035 and 100% by 2050. Meanwhile, TVA has expressed such targets as goals and aspirations but is failing to put actions behind its words and is on track to take until 2088 to get to net-zero.

Information Gaps Left Out of the Presentation

There were some other topics that were completely left out of the presentation, which left significant information gaps for Memphians and decision-makers.

Household-level savings and benefits from switching supplies were not discussed

It’s one thing to talk about how $55 million in projected annual savings from switching to an alternative power supply did not meet people’s expectations after numerous reports showed the potential for $100 million+. But what was not discussed at the June 9 meeting is how far tens of millions of dollars in savings could go for actual families in Memphis. For example, if MLGW dedicated just 10% of the savings to bill-lowering weatherization/energy efficiency and demand-side management programs, that would be a $5 million+ annual budget. Such a budget could annually fund over 700 average-sized home weatherization retrofit projects per year, or about 14,000 homes over 20 years. These numbers would only scale up if a higher percentage of savings were allocated to such programs. For context, because of TVA’s lack of investment in weatherization programs, MLGW had to work for eight years–from 2013 to 2021–to complete 500 weatherization projects through the ‘Share the Pennies’ program. Despite MLGW’s work to keep energy rates low, Memphis area residents still suffer some of the most unaffordable energy bills of major cities across the country. Being able to help make energy bills affordable for thousands of Memphis households would be an immense public service that could be facilitated by an alternative power supply.

Important factors that could increase the relative savings of switching supplies compared to staying with TVA were not discussed

While GDS’ initial analysis of the portfolios already showed large savings from Memphis switching to new electricity suppliers, it appears that numerous factors in the presentation may have been left out of consideration that could substantially increase annual savings from $55 million to a higher figure. Below are a few key areas of information that GDS and MLGW must clarify and include in further analysis in order to have a thorough understanding of the possible costs and benefits of leaving TVA.

Comparing the savings of portfolios to MLGW’s current five-year TVA contract rather than the long-term contract.

MLGW is currently in a five-year rolling contract with TVA, meaning that MLGW would have to give five years’ notice to TVA before switching suppliers. MLGW can continue with this contract indefinitely rather than switching to TVA’s practically neverending 20-year contract. It appears that the long-term contract is a nonstarter with at least some leaders in Memphis. For example, at the presentation, Memphis City Councilman Martavius Jones said, “I am not in favor of the 20-year contract,” and asked if the analysis had been done to compare the potential savings of leaving TVA with the costs of staying under MLGW’s current five-year TVA contract. The answer was “no,” even though this type of comparison is precisely what MLGW’s IRP did in 2020. In the IRP, such a comparison of potential savings of leaving TVA with both the current MLGW-TVA five-year contract and the long-term contract showed that MLGW’s preferred alternative supply portfolios yielded 25-31% more annual levelized savings in comparison to the five-year contract than the long term contract:

- Portfolio 9 estimated annual savings: $153M against the five-year contract vs. $122M against the long-term contract

- Portfolio 6 estimated annual savings: $130M against the five-year contract vs. $99M against the long-term contract

Pending tax policy that could dramatically lower costs of solar, transmission, and battery storage, even for tax-exempt entities.

The U.S. House of Representatives passed legislation last November that would provide a 30% tax credit for the costs of solar energy installations, battery storage, and certain transmission infrastructure. Notably, the policy also made tax-exempt entities like Memphis eligible for the tax credit, when historically only private entities with enough tax liability could fully monetize the credits. This legislation has not yet passed the U.S. Senate, but news reports indicate that there is a significant likelihood that these policies may become law this summer or fall–perhaps before the MLGW Board would vote on whether or not to switch to alternative power suppliers. While some of the solar projects that bid into the RFP probably included some amount of existing tax credits to lower the delivered cost of energy to MLGW, they likely did not include the full 30% value that could be soon available, and the transmission projects in the RFP almost certainly did not include tax credits since that would be a brand new, previously unavailable credit. Overall, pending legislation on clean energy policy could lower the cost of an alternative power supply portfolio by hundreds of millions of dollars.

Energy efficiency and demand-side management could begin lowering Memphians’ costs immediately.

While MLGW will need to give TVA at least five years’ notice before taking power from other providers, Memphians could start to benefit immediately from investments in energy efficiency. Energy efficiency can pay for itself by lowering the amount MLGW has to pay TVA in the interim and reducing the need for purchasing power should MLGW leave TVA.

The effect of a partial resolution of the U.S. Department of Commerce solar investigation on the cost of solar.

It was mentioned in the presentation that one factor driving up the price of solar compared to when the IRP was undertaken in 2020 was the U.S. Department of Commerce’s investigation into solar tariff compliance. The investigation created a huge amount of uncertainty in the solar market over the past few months and temporarily drove up the cost of solar. President Biden partially resolved the issue at hand in early June 2022, enabling better market certainty for solar development. It is unclear if either the Commerce investigation or President Biden’s resolving action affected the RFP solar bids, but it will be important for MLGW to true up any costs in the final bids compared to cost assumptions during the initial evaluation.

Risk factors of staying with TVA

The presentation did a decent job of communicating that there are variables that could affect the overall price tag of MLGW choosing one path forward or another. This was covered in the presentation’s “Sensitivity Analysis” section. But shockingly, the sensitivity analysis did not discuss any factors that would increase MLGW’s risk by staying with TVA. Rather, it presented a one-sided picture that ignores important considerations by exclusively outlining scenarios in which alternative power supply portfolios would lose value for Memphis while failing to consider scenarios in which staying with TVA would lose value for Memphis. Below are a few of those considerations that must also be included in the risk analysis in order to portray a more complete view.

Effect of fossil gas price on TVA.

The sensitivity analysis appeared to indicate that MLGW would be insulated from future higher-than-forecast gas prices were it to stay with TVA, but this would be inaccurate since the risk applies to TVA also. The vast majority of TVA’s gas procurement is non-hedged, meaning it is subject to the volatility of the fossil gas market. The risk of gas price on TVA is particularly pronounced since TVA is proposing to build a new large combined cycle gas plant at the Cumberland power plant which would increase TVA’s reliance on fossil gas from 29% of total annual energy (using 2020 annual load as an example) to 34% in 2026, which would actually be more reliance on gas than one of MLGW’s preferred alternative energy supply portfolios. TVA is also proposing to replace the Kingston coal plant with even another large combined cycle gas plant, which would further increase TVA’s reliance on fossil gas and expose MLGW’s customers to market volatility.

Future TVA rate hikes.

MLGW’s integrated resource plan (IRP) estimated the costs of staying with TVA based on TVA’s 2019 IRP. Yet future cost drivers for TVA not accounted for in their IRP that is now apparent could include ratepayer obligations to pay for stranded assets, environmental compliance, and speculative nuclear construction, detailed below.

TVA ratepayer obligations to pay for stranded assets.

One large potential driver of future TVA rate hikes is the risk of stranded assets that TVA is exposing ratepayers to in its large buildout of fossil gas generation facilities. TVA is currently proposing to invest billions of dollars to build 2,900 megawatts of fossil gas combined-cycle generation at the Cumberland and Kingston power plants, accompanied by 157 miles of new gas pipelines. However economic and regulatory trends may render much of this investment bad, well before the anticipated end of the projects’ lifespans. Higher-than-expected long-term gas prices, cost reductions in clean energy alternatives, and environmental policy may turn the gas plants into costly burdens. For example, a large and growing body of experts recommend that the United States reach a zero-carbon electricity system by 2035, a target that has been formally adopted by the Biden Administration. In such a scenario, the gas plants would run for less than ten years before needing to be retired, leaving TVA ratepayers to pay billions for unused, obsolete power infrastructure.

TVA ratepayer obligations to pay for environmental compliance and obligation costs.

The Memphis community is well aware that TVA has a major coal ash problem. As historically one of the largest coal plant operators in the country, TVA has tremendous amounts of toxic coal ash to clean up and safely dispose of. TVA CEO Jeff Lyash has characterized this task as, “dealing with 100 years of the deferred costs,” and it is expected to cost billions of dollars.

Nuclear cost risks.

As last week’s presentation accurately stated, many power supply risks cannot be quantified. One of those concerning risks for MLGW should it stay a TVA customer is TVA’s dedication to pursuing speculative new nuclear power technology while ignoring cost-effective clean energy resources. TVA is investing in unproven small modular reactor technology as part of its stated long-term aspirations to reach net-zero carbon emissions, even while it gives short shrift to the lowest-cost clean energy technologies of energy efficiency, solar, and wind. The track record of nuclear construction in the twenty-first century shows that it has been spectacularly expensive and slow going: the price tag of the two nuclear power units under construction in Georgia has ballooned to $30 billion, which is $16 billion over budget and is six years behind schedule. In South Carolina, construction on two nuclear units was canceled after $9 billion was invested–without the benefit of receiving a single kilowatt-hour–a move to cut losses and avoid paying the rest of the estimated $25 billion total it would have taken to complete construction. The other nuclear construction in recent history is TVA’s completion of Watts Bar Unit 2, which was completed 37 years late and billions of dollars over budget. The new generation of nuclear reactors that TVA is interested in are smaller and less expensive, so the financial risks may not quite reach the same levels as past projects, but it is worth MLGW bearing in mind the industry’s current track record and whether or not it wants to hitch Memphians’ wallets to TVA’s nuclear aspirations for decades to come.

What Needs To Come Next

MLGW has been rigorous in its IRP and RFP processes yet there are still very important information gaps that exist in the RFP evaluation. The evaluation so far has verified that there are large savings available to Memphians by switching electricity supplies and that companies are ready and willing to make huge investments in Memphis and Shelby County. MLGW’s validation of their preferred alternative energy portfolios also verifies that Memphis and Shelby County could benefit from billions of dollars of investment, new job opportunities, and major progress toward environmental goals by switching electricity suppliers. Yet the presentation last week overlooked key elements that need to be considered before MLGW makes decisions one way or another. Incorporating these elements outlined above will help the community better understand the benefits and risks of moving to new electricity suppliers and staying with TVA.

Memphis Has the Power is a campaign to ensure Memphians have affordable, equitable, and clean energy. The campaign has worked in the Memphis community for several years, backstopped by the Southern Alliance for Clean Energy (SACE). Our work has lifted up Memphians who struggle with unaffordable energy bills and has helped result in large increases in funding to help Memphians with lower incomes reduce their energy bills. SACE is an appointed member of MLGW’s Power Supply Advisory Team, the community advisory team that helped shape MLGW’s integrated resource plan.