With the onset of the COVID-19 pandemic, efficiency performance in the Southeast fell substantially in 2020. Utility commitments to decarbonize will fall short without substantially more energy efficiency and clear plans to eliminate fossil fuel generation.

Forest Bradley-Wright | February 14, 2022 | Energy Efficiency, UtilitiesEach year SACE compiles efficiency performance data from nearly 500 electric utilities in the Southeast, which we now present in our fourth annual “Energy Efficiency in the Southeast” report.

Our latest report centers on utility efficiency savings from 2020 (the most recent year with complete data) taken as a percent of annual electric retail sales – which creates a standard metric to compare performance between utilities and states of different sizes. Our data findings are presented with both historical context and the most recent policy trends to give a sense of where efficiency savings performance will likely go in the coming years.

Download the Report

Watch the report webinar

Read the report blog series

Regional Perspective on Efficiency Performance in the Southeast

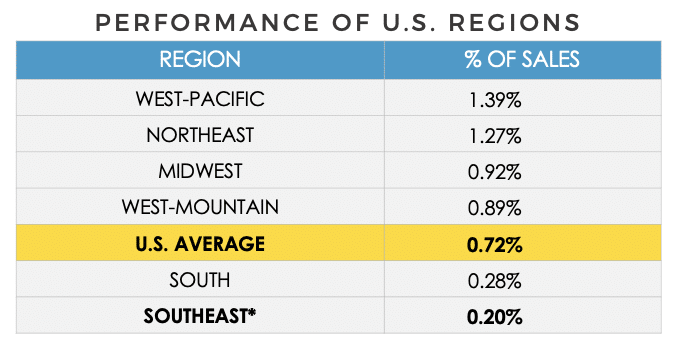

The Southeast has consistently underperformed other regions of the country by a considerable degree, often falling dead last in regional rankings. Between 2019 and 2020, efficiency savings as a percentage of retail sales in the Southeast slipped from 0.25% down to 0.20%.

Highly Uneven Efficiency Performance Between Southeastern States

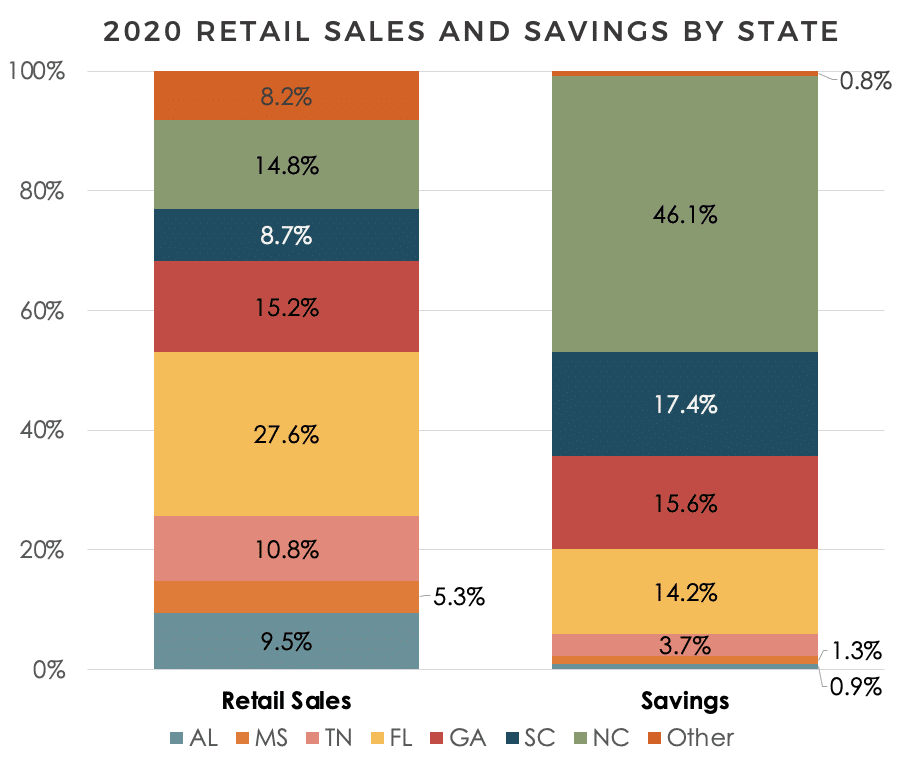

Big policy differences between Southeastern states greatly affect how much energy utilities save each year compared to their total annual retail sales. Other drivers include utility corporate culture and the ratio of investor-owned versus co-operative and municipal utilities. The effect of these differences can be clearly seen by comparing the percentage of total utility retail sales and efficiency savings between Southeastern states.

The only states whose relative savings substantially outperform their portion of the region’s retail sales are North Carolina and South Carolina. Alabama, Tennessee, Kentucky, and Mississippi drastically underperformed relative to other states in the region, while Florida delivered barely half as much efficiency savings compared to its share of retail electric sales.

COVID-19 Upended Utility Energy Efficiency Performance in 2020

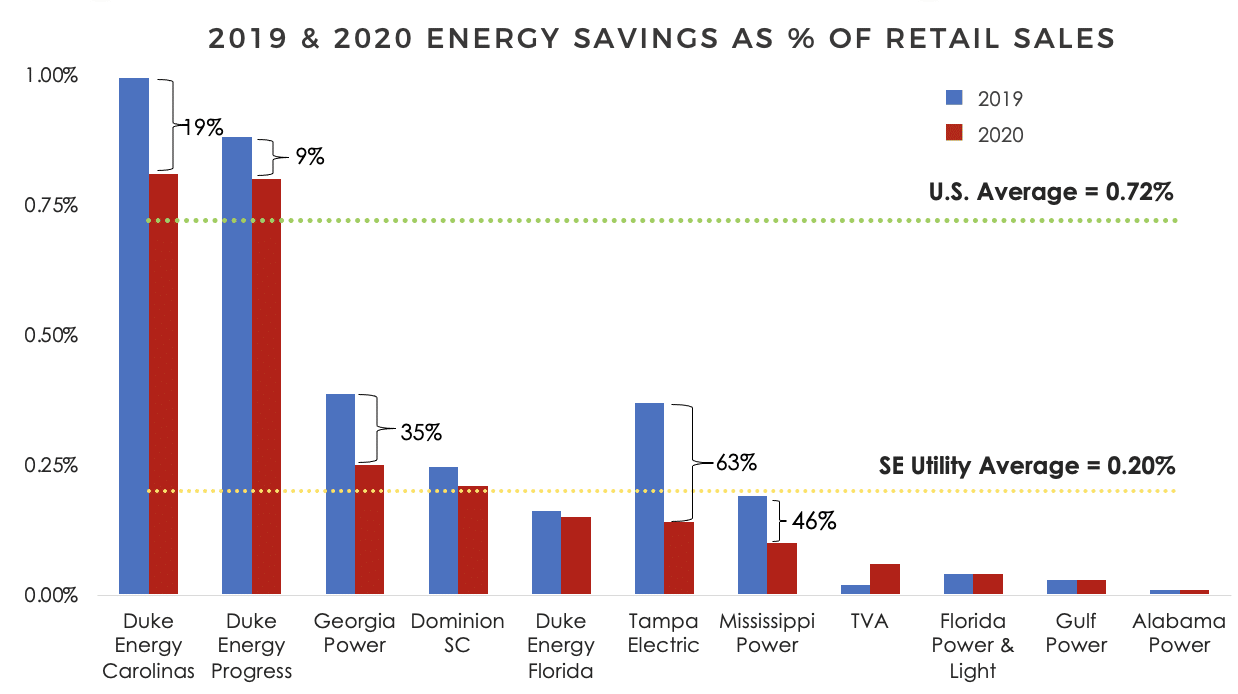

COVID-19 fundamentally disrupted Southeast efficiency programs, while intensifying energy insecurity for millions of already-vulnerable households – this despite policy developments that should have driven efficiency savings higher in 2020. Instead, nearly every utility system in the Southeast saw significant efficiency declines and average savings for the region as a whole fell 20% from the previous year, down to barely a quarter of the national average.

The region’s top-performing utility, Duke Energy Carolinas, saw a 19% savings drop from 2019 to 2020, bringing it essentially even with second-place Duke Energy Progress. Efficiency programs for low-income customers at both of these utilities were especially hard hit, with savings falling by 75-84%. Even as a leader in the Southeast, Duke’s performance continues to hover around the national average, trailing behind roughly half of the nation’s other large utilities. Still, these two companies had annual savings that were more than twice as high as the next utility in the region, Georgia Power.

All of the Southern Company utility affiliates – Georgia Power, Mississippi Power, and Alabama Power – continue to show highly uneven efficiency performance, which appears to be driven both by corporate culture and significant policy differences in the states where they operate.

The U.S. House of Representatives’ Committee on Energy and Commerce has recently sought information from TVA regarding its poor energy efficiency performance. Despite misleading statements in the utility’s formal response, the data plainly shows that efficiency spending and savings at TVA have fallen, and its performance is now among the worst compared to the nation’s other major utilities. After eliminating all of its efficiency rebate programs in 2018, TVA’s annual percentage of efficiency savings fell to a mere 0.02%. The average for major utilities was 50 times higher. TVA claimed minimally higher savings in 2020, but it is not nearly enough.

New Policy Developments Could Impact Future Efficiency Levels

In 2020, the South Carolina Public Service Commission rejected Dominion Energy’s Integrated Resource Plan (IRP), or long-term energy resource plan, on the basis of five words in the state’s landmark 2019 Energy Freedom Act that say utility resource plans must be “the most reasonable and prudent means of meeting the electrical utility’s energy and capacity needs.” Finding Dominion had failed to meet this standard, the company had to quickly increase its planned efficiency levels to 1% of annual retail sales. Dominion’s next full IRP must evaluate efficiency savings up to 2% of annual sales – more than six times what it has delivered in previous years.

Then, in 2021, North Carolina became the first state in the South to set a clear vision for eliminating carbon pollution, with House Bill 951, which directs the North Carolina Utilities Commission (NCUC) to develop a plan this year to reduce emissions from the state’s electric utility sector 70% by 2030, and to achieve carbon neutrality by 2050. Many are waiting to see if this will drive further expansion of energy efficiency in the state that already leads the Southeast.

Another state to watch is Florida, which is still in the process of revising its long outdated energy efficiency rules for the first time in 30 years. After more than a year since the rulemaking was announced, it remains to be seen whether real reform is coming. There is currently no clear path to a final decision and, more importantly, the Commissioners themselves have yet to weigh in during the rulemaking process.

Efficiency and Decarbonization

In recent years, the push to reduce carbon emissions from fossil fuels has gained ever greater urgency. In response, some states and most major investor-owned utilities have issued carbon reduction commitments. Energy efficiency is a crucial and affordable tool for attaining climate reduction goals. In 2020, for instance, efficiency eliminated an estimated 26,666-gigawatt-hours (GWh) of energy waste across the nation. In the Southeast, the 1,597 GWh offset was enough to power over 120,000 homes’ electricity for a year. This also translates into carbon emissions reductions of over 600,000 tons per year.

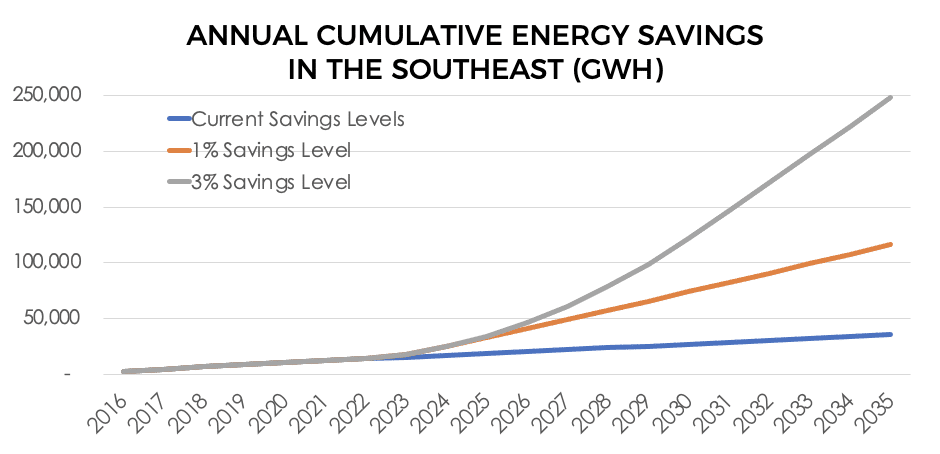

To date, utilities in the Southeast have failed to meaningfully incorporate carbon reduction strategies in their resource plans to actually achieve their climate commitments – nor have they harnessed efficiency potential for this purpose. If the region makes energy efficiency a priority, the cumulative savings impact could be enormous. If the Southeast increased annual efficiency savings to 1%, by 2035 the region could eliminate the carbon emissions impact of 11.4 million homes for 10 years. Savings at the level of the nation’s top utilities would be even more.

Like energy storage, energy efficiency and demand response can also ease the transition to renewable energy by lowering demand at times when less renewable power is available, or when demand is highest, thereby reducing the total amount of renewable power generation required to reliably meet consumer demand.

Untapped Potential in the Southeast Means Opportunities

The bottom line is that energy savings in the Southeast are far lower than the rest of the country, largely because efficiency policies in the region are insufficiently rigorous or simply outdated. But it is not too late for local policymakers to take advantage of enormous untapped efficiency savings potential.

North and South Carolina have already laid the foundations for higher levels of efficiency, with additional momentum coming from recent policy moves to reduce emissions and improve utility resource plans. Meanwhile, Florida is at a crossroads where regulators will soon decide whether to double down on failed policies of the past or embrace modern practices that support energy efficiency. In the states with the lowest efficiency performance, there is much work to be done, and success will only be achievable if local policymakers step up and establish new policies for a better clean energy future.

Tapping the enormous potential for efficiency in the Southeast is the only way utilities can affordably retire their outdated fossil fuel power plants and meet their decarbonization commitments.

The Southern Alliance for Clean Energy is a leader in advancing energy efficiency throughout the Southeast. We promote cost-effective utility-funded energy efficiency programs to reduce customer utility bills, stimulate local job creation, and reduce the need for fossil fuel power plants. SACE is committed to ensuring the benefits of energy efficiency are equitably distributed, especially for those who struggle with the cost of their monthly energy bills.

Stay tuned for more blog posts in our upcoming series going deeper into the report results.

Download the Report

Watch the report webinar

Read the report blog series

#SEEnergyEfficiencyReport2022