In even years, Duke Energy is required to complete a full Integrated Resource Plan (IRP) for its two utilities in the Carolinas: Duke Energy Carolinas (DEC) and Duke Energy Progress (DEP). For its 2020 IRPs Duke had a number of new requirements to consider, including:

- Modeling of economic retirement of coal power plants, as required by the North Carolina Utilities Commission (NCUC) order on Duke’s 2018 IRPs;

- Consideration of all resource options, also required by the NCUC order on the 2018 IRPs; and

- The potential for the South Carolina Public Service Commission (SCPSC) to reject an IRP for not meeting the new requirements of South Carolina’s Energy Freedom Act (EFA), as it recently did to Dominion South Carolina’s IRP.

Duke submitted two mirror images of an overall combined IRP for DEC and DEP to both the NCUC and the SCPSC in September 2020. Since then, we at SACE have been reviewing the over 2,000 page filing and conferring with experts and organizations that share our clean energy vision to develop both a detailed critique of the myriad of issues with Duke’s IRPs as well as an alternative future where customers in the Carolinas benefit from lower bills, cleaner energy, less pollution, and a stronger clean energy industry.

For all the details, we have posted the two sets of comments and expert reports submitted to the NCUC on March 1, 2021, by SACE in partnership with Carolinas Clean Energy Business Association, Natural Resource Defense Council, North Carolina Sustainable Energy Association, the Sierra Club, and Southern Environmental Law Center. Based on all this, here is my take on Duke’s 2020 IRPs for the Carolinas.

At first glance, the IRPs contain a lot more talk about greenhouse gas emissions than most IRPs. And with good reason: the utilities are feeling pressure from customers, the Governor of North Carolina, and their parent company to decarbonize. However, digging into the plans, it’s a lot of talking about greenhouse gas emissions without the end result: actual decarbonization. Instead, the plans are a way to justify Duke building new gas power plants that will provide more benefits to shareholders than ratepayers. So let’s break down how Duke does this.

Duke botched the coal retirement analysis

As commentary from Synapse Energy Economics, the expert consulting firm, shows, solving for the optimal times to retire coal plants is a complicated business. In its IRPs, Duke phoned this one in. Instead of a deep dive look at which coal plants are costing customers the most due to ongoing operating costs and environmental risks, Duke did a simple “sort capacity lowest to highest” that takes < 1 minute in Excel. Then they appear to stagger the retirements every year to few years based on a vague comparison to a single replacement technology: a simple cycle gas plant. The final step was to hard code these retirement dates into a capacity expansion plan to see what should replace them (if a replacement is even needed).

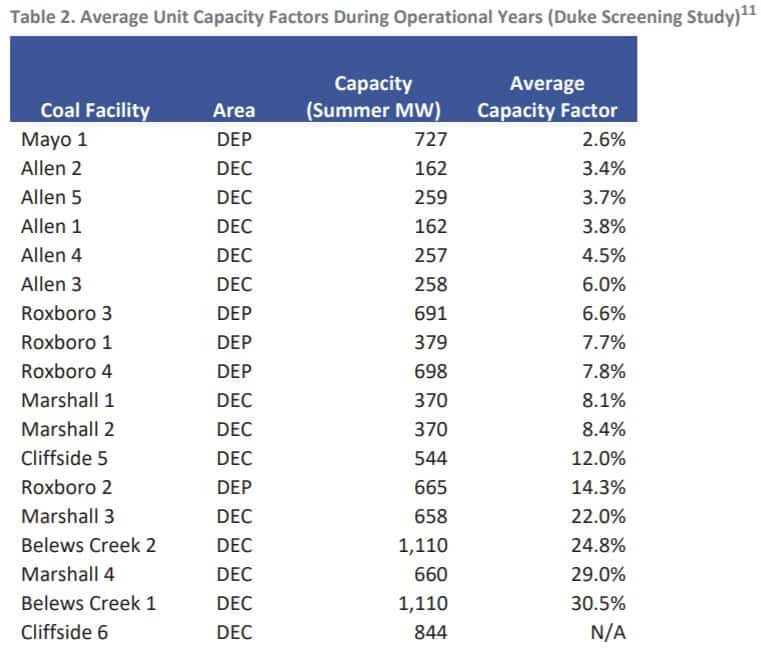

The result was a retirement schedule that claims many coal plants remain economic through the late 2020s and into the mid-2030s. In theory, this could be plausible if you know nothing about these particular coal plants. But by looking at the average capacity factors below, we can see how highly unlikely it is that most of these coal plants are economic today, let alone in 10+ years.

Capacity factors close to those of a peaking plant indicate that:

- A coal plant is likely not providing enough energy value to justify its fixed operating costs, and

- The inflexibility of these coal plants mean that they are likely experiencing significant wear and tear, increasing the need to invest in the plants in order to maintain reliability.

Duke’s coal retirement analysis ignores all of this and does not account for the potential environmental risks associated with these plants. The continued operation of these coal plants for another decade or more is too costly and too risky. See Section 2 of Synapse’s report, which starts on page 32, for more on how Duke got this critical piece of its IRP wrong, and which utilities have better methods.

Duke inflated its winter peak forecast to justify new capacity

Analysis from noted expert Jim Wilson, of Wilson Energy Economics, shows that Duke relied on an overly-simple analysis that overly inflates its forecast for winter peak load. The flaws appear in both what kinds of temperature and weather extremes to expect and how those drive peak load. On the first, Duke cherry-picked weather data and failed to take into account recent trends to come up with a forecast that shows extreme winter temperatures are more likely. On the second, Duke assumes a linear correlation between temperature and load that continues even at very low temperatures. This makes sense to a certain point: when it’s colder, heating systems will ramp up to keep homes and businesses warm. However, at some point, those heating systems are all working full throttle, and the load-to-temperature correlation bottoms out. For more on these two insights and additional analysis about how Duke determined what it needs for resource adequacy, I recommend taking a look through Jim Wilson’s report, which starts on page 297.

Duke downplays customer-oriented solutions

A review of Duke’s energy efficiency study by expert Jim Grevatt, of Energy Futures Group, highlights a variety of omissions, unreasonable assumptions, and arbitrary limitations in the study. As a result, Duke severely underestimates the potential for energy efficiency and demand-side resources to meet winter peak loads. Because this study is used as an input to the IRPs, the IRPs then are too light on these resources that are proven to save customers money, reduce energy burdens, and develop local jobs. For more on how Duke underestimated its energy efficiency potential see Jim Grevatt’s report, which starts on page 26.

Duke’s assumptions lead to a false claim to need new gas

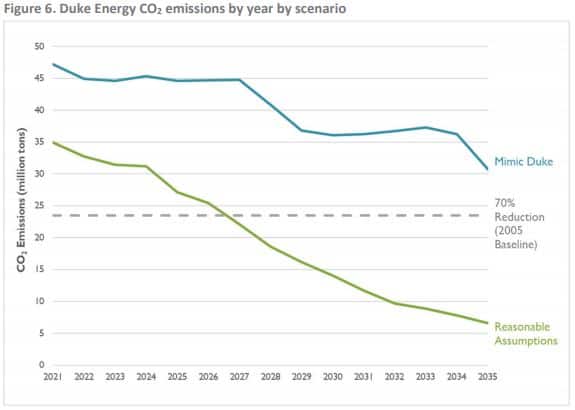

A Synapse team led by Rachel Wilson modeled Duke’s IRP assumptions and came up with a similar portfolio to Duke’s Base Case with Carbon Policy. Then Synapse reviewed these assumptions and came up with reasonable fixes to Duke’s problematic assumptions. The result? A clean energy portfolio with costs 10% lower than Duke’s Base Case that meets the Clean Energy Plan 70% reduction of carbon by 2030 goal a few years early.

What assumptions did Synapse correct? For starters, they updated the impact of energy efficiency. They also used more reasonable cost assumptions for battery storage, onshore wind, and offshore wind. Oh, and they retired coal plants earlier. Note that this corrects many of the flaws described above, but not all: they still used Duke’s inflated winter peak forecast and problematic reserve margin. So that means there is likely even more savings and the potential to retire coal plants earlier.

For the full analysis, and more great charts, I encourage you to check out the report from Synapse, which starts on page 28.

Duke could be doing so much more on clean energy

To tie this all together, up to this point we have focused on how Duke could improve its IRP. But what if we could go further and layer in additional competition between resources that want to fill the needs identified in Duke’s IRPs? Enter all-source procurement. A method proven by utilities like Xcel in Colorado, all-source procurement is a medium-to-long-term goal in the Carolinas, making it a good place to end this walk through our Duke IRP comments.

We brought in John Wilson to show both the why and how Duke could use a competitive procurement to save customers money and reduce single-sourced gas procurements that unnecessarily increase direct costs and expand the risk of future costs associated with stranded gas power plants. While it doesn’t replace the benefits of near-term renewable procurements, working toward an all-source procurement process by 2026 could have far-reaching benefits for customers in both Carolinas. For more on all-source procurement see John’s report that starts on page 340.

What’s next?

Duke’s 2020 IRPs are still under review by the Commissions in both North Carolina and South Carolina. SACE’s joint comments filed with the NCUC on March 1 and the SCPSC on February 5 both ask the Commissions to reject Duke’s 2020 IRPs and refile an improved plan.

Duke will have a chance to respond to comments and testimony filed, and we will have a chance to respond to Duke’s response. This back-and-forth will culminate in a hearing in front of the SC PSC, currently scheduled to start on April 26, and decisions from each Commission on whether to accept the IRPs and if not what changes need to be made. Stay tuned with us as we work to improve Duke’s plans to reflect the cost savings and emission reductions potential of clean energy resources.