Why are utility executives surprised by all-source procurement outcomes? And, more importantly, how can other utilities replicate these results? A new paper explores the application of all-source procurement for vertically integrated utilities which allows technologies to compete fairly against each other to best meet the utility’s need. The end result is cleaner utility portfolios and savings for customers.

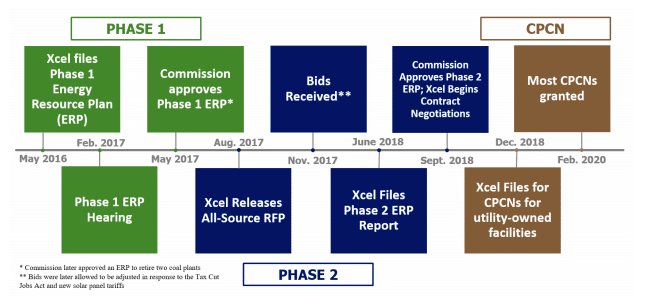

Bryan Jacob | April 20, 2020 | Energy Policy, Georgia, SolarThe Southern Alliance for Clean Energy (SACE) recently commissioned a team of experts to examine Xcel Colorado’s multi-year Electric Resource Plan (ERP), along with several other vertically integrated utility jurisdictions where similar models have been incorporated, including Georgia Power.*

Xcel (also known as Public Service Company of Colorado) received approval for its current ERP in 2018, noting the approved plan included what the utility called “shockingly” low wind and solar prices – median bid prices of $18 per megawatt-hour (MWh) for wind, $30 per MWh for solar.

Xcel Colorado’s ERP process shows when allowed to compete, renewable energy resources displaced natural gas in head-to-head matchups.

We have compiled the results of this study into a new paper in collaboration with Energy Innovation: Making the Most of the Power Plant Market: Best Practices for All-Source Electric Generation Procurement.

The paper explores several notable findings from the research. On Thursday, April 30, industry experts describe what makes an optimal all-source procurement policy, how it could apply to utilities of all types and sizes as well as their regulators. Watch a recording of the webinar.

Colorado Allows Competition

Colorado structured a workable, all-source competitive procurement process that provided unrestricted access to current market prices for available resources. The Xcel Colorado ERP ultimately includes a portfolio of wind, solar, battery storage, and gas turbine resources to replace two coal plants. This portfolio, and its respective pricing, benefits ratepayers and the public interest.

As one of the paper’s co-authors, Mike O’Boyle, pointed out in a related Forbes article,

“These low-cost competitive bid results didn’t just magically show up; they resulted from long-term hard work by regulators, utilities, and stakeholders.”

Basically, by updating rules and practices, regulators of vertically integrated utilities can enable effective all-source procurements. All-source procurement means that whenever a utility (and its regulators) believe it is time to acquire new generation resources, it conducts a unified resource acquisition process. In that process, the requirements for capacity or generation resources are neutral with respect to the full range of potential resources or combinations of resources available in the market. This process allows technologies to compete fairly against each other to best meet the utility’s need. The end result is cleaner utility portfolios and savings for customers.

Traditionally, utilities accommodate expected demand and replace retiring power sources by going out to the market for a specific power need. For example, a utility would identify a need to increase its capacity by 500 megawatts (MW) and subsequently seek a specific type of generation, like a 500 MW of gas-fired combined cycle power plant. Most states now use integrated resource planning to determine system-wide, long-term generation, and demand needs, but that alone doesn’t level the playing field for renewables. All-source procurement helps eliminate potential biases towards overprocurement, self-generation, and fuel-based generation.

How Long Does It Take to Do All-Source Procurement the Colorado Way?

All-Source Procurement was one of SACE’s core recommendations in Georgia Power’s 2019 Integrated Resources Plan (IRP). Mark Detsky, an expert witness who had represented the Colorado Independent Energy Association (CIEA) in the Colorado proceeding, testified on behalf of both SACE and Southern Renewable Energy Association (SREA) in Georgia. His testimony shared his experience from Colorado and demonstrated that all-source procurement led to a portfolio that would save ratepayers $200 million over the term of the portfolio. His primary recommendation for Georgia was, “the Commission rely on market-based solutions to deliver price discipline and technological innovation to benefit ratepayers by replacing the energy and capacity needs on the system in an economic fashion.” As Detsky testified, “[w]ithout an all-source RFP, ratepayers are potentially leaving money on the table.”

Five Best Practice Recommendations

After carefully considering the many case studies evaluated in the paper, and in particular the approach employed by Xcel Colorado, the authors recommend five best practices.

Regulators should:

-

- Use the resource planning process to determine the technology-neutral procurement need.

- Require utilities to conduct a competitive, all-source procurement process, with robust bid evaluation.

- Conduct advance review and approval of procurement assumptions and terms.

- Renew procedures to ensure that utility ownership of generation is not at odds with competitive bidding.

- Revisit rules for fairness, objectivity, and efficiency.

Taking it a step further, the paper includes a model bid evaluation process. This template complements the five best practices, ensuring transparency of the RFP, input from stakeholders, and application of the utilities’ system planning and cost modeling tools to ensure fair outcomes.

It is important to note that these best practices only focus on supply-side resources. While demand-side resources are addressed in the paper (and by some of the cases evaluated), additional investigation is necessary to thoroughly examine how demand-side resources might also be integrated into a unified, resource-neutral bid evaluation process.

Report Author Conclusions

With these suggestions in mind, utilities, regulators, and consumers can all benefit from competitive processes that reveal the best resource options available in the market at the time.

Xcel Colorado’s recent bid results ratify the notion that these results can be accomplished if:

- The right planning procedures are followed,

- Regulators regulate utility monopsony power in the public interest, and

- Competitors are motivated by adequate information and transparent process to risk their capital by submitting many bids at low costs.

These outcomes are not the work of a day or a week, but by paying attention to the lessons already learned, the pattern that works in Colorado can provide guidance toward a cleaner electric sector.

*The paper also includes case studies from, Public Service Company of New Mexico (PNM) and Minnesota Power, as well as brief comments on six other jurisdictions: Northern Indiana Public Service Co. (NIPSCO), El Paso Electric, North Carolina (Duke Energy), Virginia (Dominion Energy), California’s “Loading Order” and Florida’s bias toward self-build.