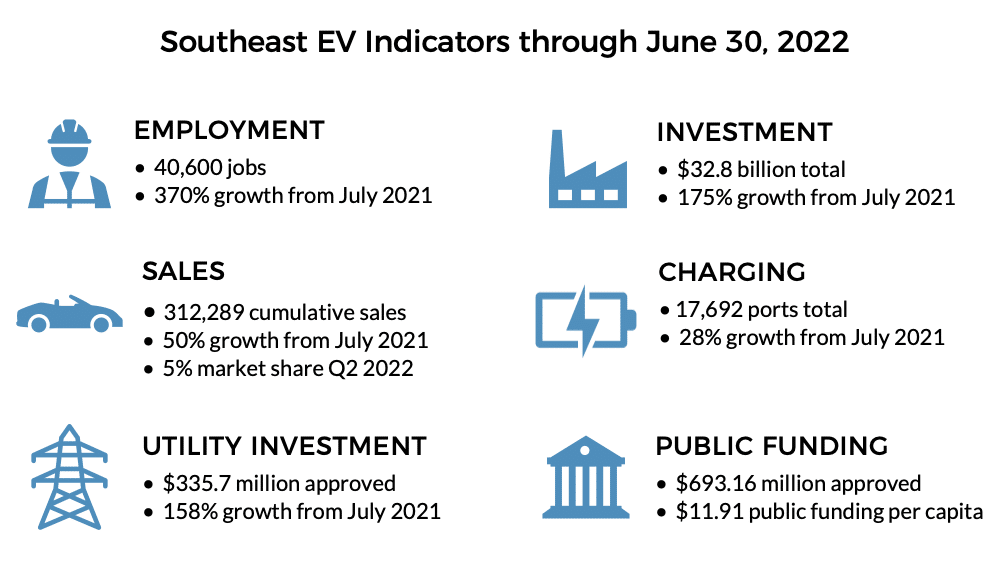

The region captured over one-third of America's EV manufacturing investments and jobs, and regional EV sales increased 50% over the past year. But the Southeast still lags, and regional policy needs improvement.

Stan Cross | September 8, 2022 | Clean Transportation, Electric Vehicles, Energy Policy, UtilitiesWe have reached the point where electrifying the nation’s cars, trucks, and buses feels inevitable. Automakers have committed over $500 billion globally to transition fleets to EVs. The U.S. federal government has unleashed hundreds of billions to incentivize swift automaker action, construct a national highway EV charging network, support consumer purchases, and onshore the EV supply chain.

Yet, every day the oil-dependant transportation system spews climate warming and health-impacting emissions at a time when we can afford neither. Additionally, America has been losing ground in the race to seize global EV technology leadership. The urgent question now is: how quickly can we achieve this transition?

The Southeast U.S. is where part of the answer lies.

SACE and Atlas Public Policy have partnered for the past three years to track and contextualize the Southeast’s EV market. As with the prior reports, this year’s “Transportation Electrification in the Southeast” report examines six key indicators across six states: Alabama, Georgia, Florida, North and South Carolina, and Tennessee.

Read the Report Watch the Report Webinar View State Pages

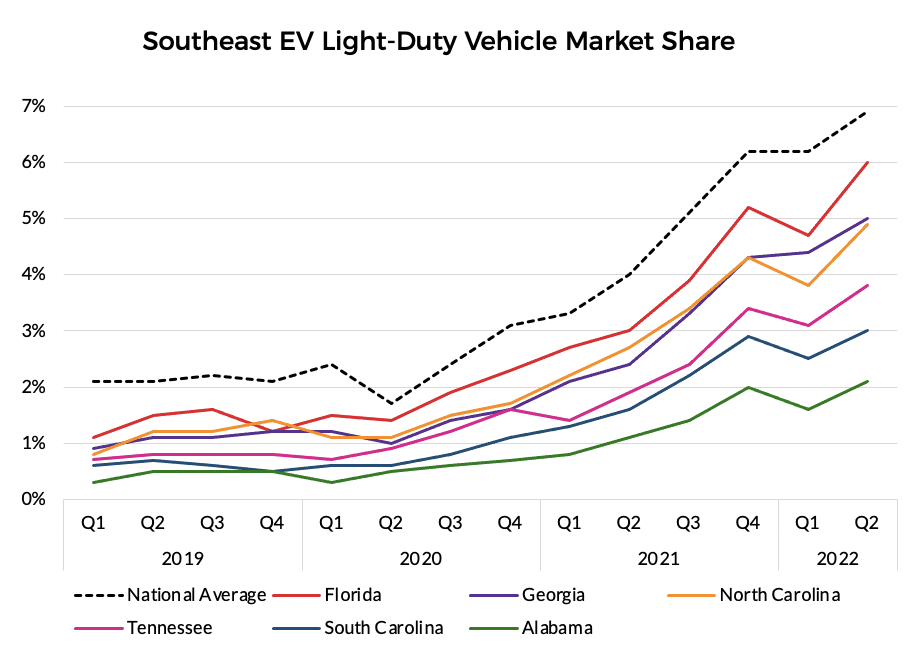

The report captures the regional EV outlook against significant national market and policy momentum. Nationwide, consumer demand pushed Q2 EV sales 14% higher than any other quarter – despite supply chain constraints. EVs captured nearly 7% of Q2 new light-duty vehicle market share, peaking at 8% in June. Meanwhile, after passing the Bipartisan Infrastructure Law (BIL) that earmarks upwards of $7.5 billion to deploy EV charging infrastructure, Congress passed the Inflation Reduction Act (IRA), which includes significant financial incentives for consumers and fleets to buy EVs and EV and battery manufacturers to produce them. And in California, the world’s fifth largest economy behind Germany and ahead of India, regulators agreed to ban the sale of new gas cars by 2035, following pledges by GM, and other automakers to stop producing them.

With market momentum accelerating, the Southeast will see continued and increasing investments and job growth. But, although regional indicator trends all point in positive directions, the region still lags behind national averages for EV sales, charger deployment, utility investment, and public funding, with regulators, legislators, and governors reluctant to pass market-driving policies and reforms.

Report Highlights

Manufacturing Employment up 370% and Investment up 175%

The Southeast is becoming the Silicon Valley of EV and battery manufacturing. Vehicle and battery manufacturers have committed $32.8 billion regionally to expand production. These investments touch each of the six states’ economies and are anticipated to create over 40,000 jobs. Georgia leads the nation in anticipated EV manufacturing jobs and the Southeast is home to three of the top six states in the country – Georgia, Tennessee, and North Carolina. And these investments are just getting going, given the rise in consumer demand and federal incentives.

Massive investments are driving this growth. Take Georgia, for example, where successive announcements to build EVs in the state by Rivian and then Hyundai were each the largest economic development projects in the state’s history. Add to that Ford’s largest investment in the company’s history to build electric pickups and batteries in Tennessee. And then add North Carolina landing Toyota’s first North American battery manufacturing facility and Vietnamese EV maker VinFast’s first plant, and the large scope and scale of investment activity become clear.

Sales Continue to Trend Upward but Lag the National Average

There has been an increase in available EV makes and models, helping more buyers into the market despite supply chain headwinds. EVs accounted for 5% of all new light-duty vehicle sales in the Southeast in Q2 2022, up from 2.5% in Q2 2021. Despite 50% growth in market share, our region continues to remain behind the national average. Florida is close to the national average at 6% market share, but other states are far behind, like Alabama at 2%, South Carolina at 2.7%, and Tennessee at 3.5%.

The Region’s Policy Landscape Limits Consumer Access and Choice

The Southeast lacks favorable regulations and incentives adopted by leading EV states, putting regional consumers at a disadvantage. Automakers prioritize sending limited EV stock to where regulations require it, and consumer uptake is strongest. It is common across the region that auto dealers have limited EV stock on the lot reducing consumer access, especially in communities outside urban centers. The lack of new vehicles for sale also impacts the size of the local used EV market, where most consumers shop for cars. As federal tax credits approved in the IRA for new and used EVs stimulate demand, limited access to available EV makes and models may result in the region continuing to lag.

Additionally, the Southeast has regulations on the books that undermine growth. For example, all but two states in the region (Florida and Tennessee) restrict or disallow the sale and service of EVs by EV manufacturers like Tesla, Rivian, and Arrival, further limiting EV access for consumers and fleet operators. This limited access is despite surveys finding over 80% of consumers want the freedom to buy EVs in their state.

Where state auto dealer franchise laws prohibit manufacturers from selling to consumers, they also prohibit manufacturers from servicing vehicles. For example, suppose a consumer or fleet operator in Georgia wants to purchase a Rivian pickup truck that will be built in Georgia. In that case, they will have to buy the truck in Tennessee or Florida, where direct sales are allowed. And when the truck needs a repair or warranty issue resolved, they will have to drive or tow it out of state to a Rivian-owned dealership.

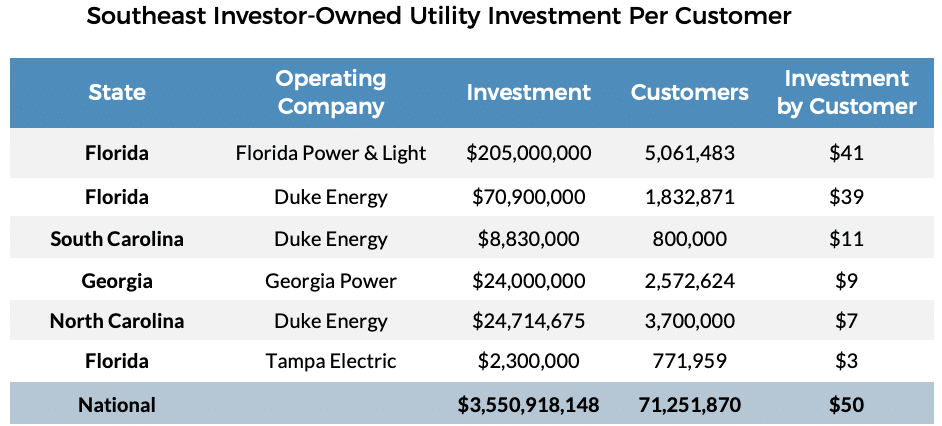

Utilities are Stepping Up, but Remain Behind the Curve

Nationwide, investor-owned utilities (IOUs) are investing in electric transportation programs and incentives to drive the adoption of electric cars, trucks, and buses. The current national average for IOU investments in electric transportation is $50 per customer. Besides Florida Power and Light (FPL) and Duke Energy Florida (DEF), Southeast utilities are significantly behind this average.

IOUs justify ratepayer investments because EVs use a lot of electricity, mostly at night, charging at home when there is abundant excess electricity capacity. This is key: at scale, EVs will turn that excess capacity into new revenue for utilities without utilities needing to build new powerplants, resulting in downward pressure on electricity rates for EV owners and non-owners alike.

The electrification of medium and heavy-duty trucks and buses and the mass-market adoption of passenger EVs will significantly increase the transportation systems’ electricity demand, putting pressure on the system. To deliver downward rate pressure, meet expanding EV charging demand and optimize grid performance, IOUs need to plan for and manage EV charging smartly. Meeting this rapidly emerging challenge will require increased investments that Southeast utilities have been slow to ask for and regulators resistant to approve. This needs to change for our region’s primary electricity providers to keep up with demand.

Additionally, utilities and regulators are failing to adequately address equitable access challenges across the region, which has seen low levels of identified equity investment from IOUs. Through Q3 2022, around $1 million in the region was approved for underserved communities or less than 1% of all approved IOU investments to date. For reference, nationally, 28% of utility filings were marked as equity investments.

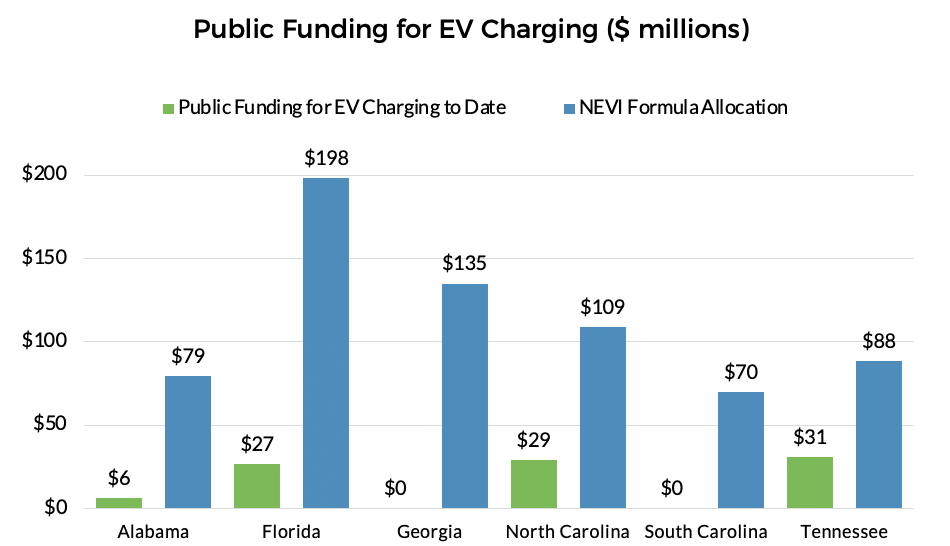

Public Funding Shifted from Scarce to Abundant

Regional charging infrastructure deployment grew 28% over the past year, led by Tennessee and North Carolina. As 250-330 mile long-range EVs become standard, consumers can drive their EVs further from home for pleasure and business, creating the need for increased public fast charging along the way.

National EV Infrastructure (NEVI) funding from the Bipartisan Infrastructure Law will change the public EV infrastructure landscape: Southeast states will receive $680 million, which will far outstrip existing public investments in EV infrastructure. NEVI funding will target public fast charger deployment along the region’s highways to enable intrastate and interstate travel.

Challenges remain across the country and in the region to ensure that EV charging is accessible to all communities, that EV infrastructure investments are made equitably, and that charging stations provide long-term reliability. To receive NEVI funding, the federal government requires that states address these challenges through careful planning and implementation.

In addition to funding charging infrastructure, BIL also created the Clean School Bus Program, which provides $5 billion in zero-emission school bus funding. BIL also provides $5.5 billion to support state and local government purchases of zero- and low-emission transit buses through the Low or No-Emission Bus Program. We will track the number of regional electric school and transit bus purchases that result from this new funding.

Conclusion

The Southeast leads the way in battery production and EV manufacturing. There are opportunities for the region to translate that success into EV adoption and charging station deployment growth. NEVI funding and other national investments, including the BIL and the IRA, will be critical drivers of this transformation. Still, change at the scale and pace needed will also require more investment, supportive policies, and expanded utility engagement. If successful, residents in the Southeast stand to benefit from the positive public health, economic, and climate outcomes that come with transportation electrification. There is no time to waste.

Electrify the South is a Southern Alliance for Clean Energy program that leverages research, advocacy, and outreach to promote renewable energy and accelerate the equitable transition to electric transportation throughout the Southeast. Visit ElectrifytheSouth.org to learn more and connect with us.