At its business meeting on Thursday, June 17, the South Carolina Public Service Commission had some things to say about Duke Energy’s Integrated Resource Plans (IRP). The Southern Alliance for Clean Energy (SACE) SACE intervened in both North and South Carolina to push Duke to improve its IRPs, particularly around its coal retirements analysis and assumptions on energy efficiency, load forecasts, and clean energy resources.

“The standard is not their opinion of whether or not they did a great job, the standard is most reasonable and prudent. And the General Assembly instructed us to determine what is most reasonable and prudent. And I don’t believe it is most reasonable and prudent for Duke not to model any third party solar PPAs in their IRP.” – SC PSC Chair Justin T. Williams

Modifications to 2020 IRP described in Motion 2

- Model high and low load scenarios

- Update ELCC

- Use gas price forecast based on: 18 months market-based (i.e. “forwards”), 18 months to blend forwards with a fundamental forecast, two fundamental forecasts for the rest of the forecast

- Include a solar PPA at $38/MWh, with sensitivities at $36/MWh and $40/MWh (doesn’t indicate whether these are nominal/real $ amounts), with contracts at least 20 years and operational characteristics used in Duke’s Competitive Procurement for Renewable Energy (CPRE)

- Account for the ITC extension, which came in Dec. 2020

- Adjust assumptions to account for increase in single-axis tracking solar

- Use NREL’s Annual Technology Baseline (ATB) low case for battery costs (Note: the 2021 ATB is expected by the end of the month)

- Include a 750 MW annual limit on solar and storage interconnections

Requirements in all IRP Updates described in Motion 2

- Model high and low load scenarios

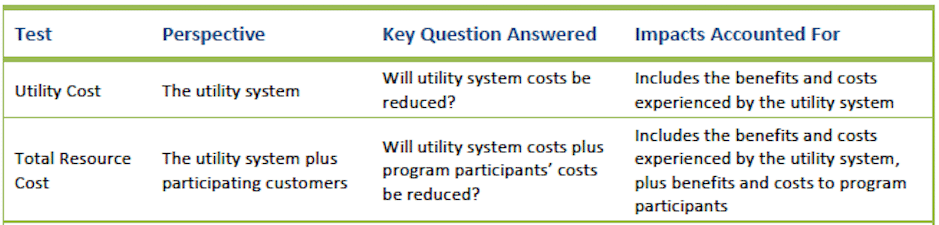

- “Use of the Utility Cost Test (UCT) when developing Energy Efficiency/Demand Side Management (EE/DSM) scenarios and savings projections in its future IRPs, IRP updates and market potential studies.” Note: the Commissions in both North and South Carolina had already approved this cost-effectiveness test, which should lead to new savings opportunities.

- “Collaboration with the EE/DSM Collaborative to identify a set of reasonable assumptions surrounding 1) increased market acceptance of existing technologies and 2) emerging technologies to incorporate into EE/DSM saving forecasts.”

- “Evaluation of high and low EE/DSM cases across a range of fuel and carbon dioxide (CO₂) assumptions to better understand what level of EE/DSM should be implemented if fuel costs rise or higher CO₂ costs are imposed.”

- Study potential future impacts of extreme winter weather on load

- A comprehensive coal retirement analysis to inform 2022 IRP

- Assess risks of gas transportation and delivery, including rejection of pipeline projects, and quantitatively address risks of gas availability and pricing

- Justified and nondiscriminatory limitation that estimates the impact of queue reform

- Solar power purchase agreement (PPA) resource option as sensitivity

- Implement all commitments made in response to ORS’s recommendations, as described in the Rebuttal Testimony of the Companies’ witnesses, and as set forth in Tables 1 and 2 or ORS Witness Hayet’s Surrebuttal Testimony

Requirements for all future IRPs described in Motion 2

- Technical appendix that describes models and load forecasting method

- Method for synthetic load for extreme low-temperature periods

- Further development of a method to model extreme low-temperature periods

- Continued engagement with stakeholders to identify additional cost-effective EE/DSM programs to achieve greater levels of energy savings, and if additional EE/DSM sensitivities could be modeled

- Review of gas price method, including investigation of alternative approaches

- Enhanced coal retirement method

- Corrected capital cost assumptions for CTs, batteries

- Generic solar PPA option

- Solar capacity value, solar plus storage capacity value, as part of the stakeholder process

- Minimax regret analysis and other risk analyses

- Revised calculation of the average retail rate impact on customers so that the assumptions and methodologies are consistent with the calculations of the Present Value Revenue Requirement (PVRR), except for the levelization of the capital-related costs.

- Status of SEEM, including monetary benefits that have been or could be achieved

- 42:25 – Docket introduced

- 42:25 – Commissioner Casten introduces motion 1

- 51:20 – Vote on motion 1

- 51:58 – Commissioner Powers introduces motion 2

- 58:50 – Vote on motion 2

Looking Forward

The South Carolina Public Service Commission handing back Duke Energy its IRPs is a clear example of why utilities should execute their resources planning process properly initially. We look forward to continuing to work with our allies on this issue and reviewing the final order.