TVA is trying to lock in the gas plants it wants to build at Cumberland and Kingston so that these decisions cannot be backtracked in the next IRP.

Maggie Shober | December 12, 2022 | Fossil Gas, Tennessee, UtilitiesUpdate: On January 6, 2023, the Tennessee Valley Authority (TVA) made a final decision to retire the Cumberland Fossil Plant northwest of Nashville and replace it with a new 1,450-megawatt fossil gas plant and 32-mile pipeline. This decision comes just over two weeks after TVA ordered rolling blackouts for millions of customers after coal and gas plants failed during the record-breaking winter storm Elliot. Read more.

The Tennessee Valley Authority’s CEO, Jeff Lyash, can soon make the final decision to replace the Cumberland coal plant with a large gas power plant and new gas pipeline northwest of Nashville, Tennessee. And he’s making this decision without any weigh-in from TVA’s regulator: the TVA Board of Directors. TVA is claiming a new gas plant and pipeline is the lower-cost option on the table, but the utility has failed to provide enough information about its cost analysis to back up such a claim. TVA is also using the comparison between the new gas plant and continuing to run the Cumberland coal plant to support the claim that building the new gas plant is environmentally beneficial. These are major decisions that should be made out in the open, in a comprehensive process where any stakeholder can participate, and based on transparent analysis.

In early December TVA published its final Environmental Impact Statement (EIS) describing the environmental impacts of four options in regard to the Cumberland coal plant:

- Leave the Cumberland coal plant operating

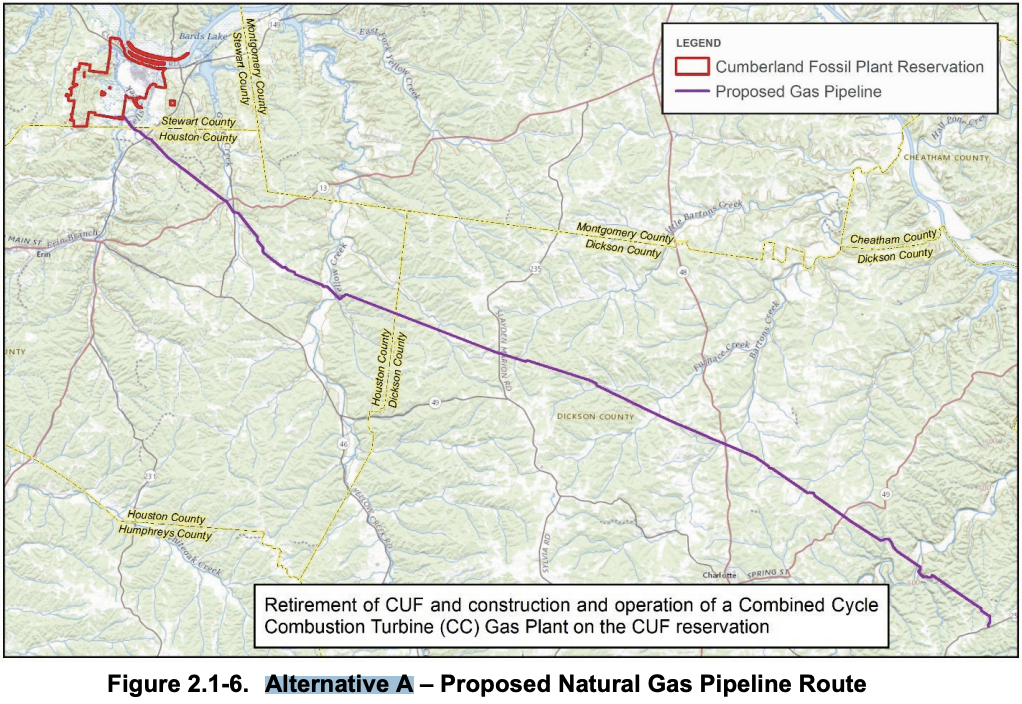

- Alternative A: Replace the coal plant with a gas combined cycle (CC) power plant that requires a new pipeline

- Alternative B: Replace the coal plant with a number of smaller gas combustion turbine (CT) power plants throughout Middle Tennessee

- Alternative C: Replace the coal plant with large-scale solar and storage throughout Middle Tennessee

The EIS claims Alternative A, the large gas plant at the same site as Cumberland, is the lowest-cost option. However, TVA does not provide key information on how it is comparing the costs. As is typical in the utility industry, TVA ran a set of models to simulate how power plants interact to provide power to the grid over the next 20 years. These modeling tools are highly dependent on the assumptions and inputs used to map out different scenarios. TVA has not published or shared any information about those assumptions and inputs, including how much demand for electricity TVA is forecasting, the assumed cost of building each type of resource, and the forecast for fuel prices – especially fossil gas.

Major resource decisions (such as how to replace retiring coal plants) are best evaluated through an Integrated Resource Planning (IRP) process. Federal statute governs how often TVA has to do an IRP, at least every five years, and what it must consider: energy efficiency and demand-side options alongside supply-side resources like renewable and fossil energy resources. TVA finalized its last IRP in August of 2019 and did not evaluate the retirement of Cumberland and Kingston coal plants. TVA could have easily begun the ~2-year process of the next IRP in 2022 to evaluate these retirement plans. Instead, TVA is trying to conduct two mini-IRPs behind closed doors so that it can lock in the gas plants it wants to build to replace the coal plants at Cumberland and Kingston, and so these decisions cannot be backtracked in the next IRP. In fact, TVA has said it won’t start its next IRP until late 2023, leaving it an unusually short timeframe to finish an IRP in time to get Board approval in 2024.

The TVA Board delegated the ability to make a final decision on how to replace both the Cumberland and Kingston coal plants to CEO Jeff Lyash in November of 2021. TVA has yet to publish a draft EIS on the Kingston replacement, but we expect it to be very similar to the process to replace Cumberland: draft EIS, final EIS, then decision.

More on what is in the final Cumberland EIS

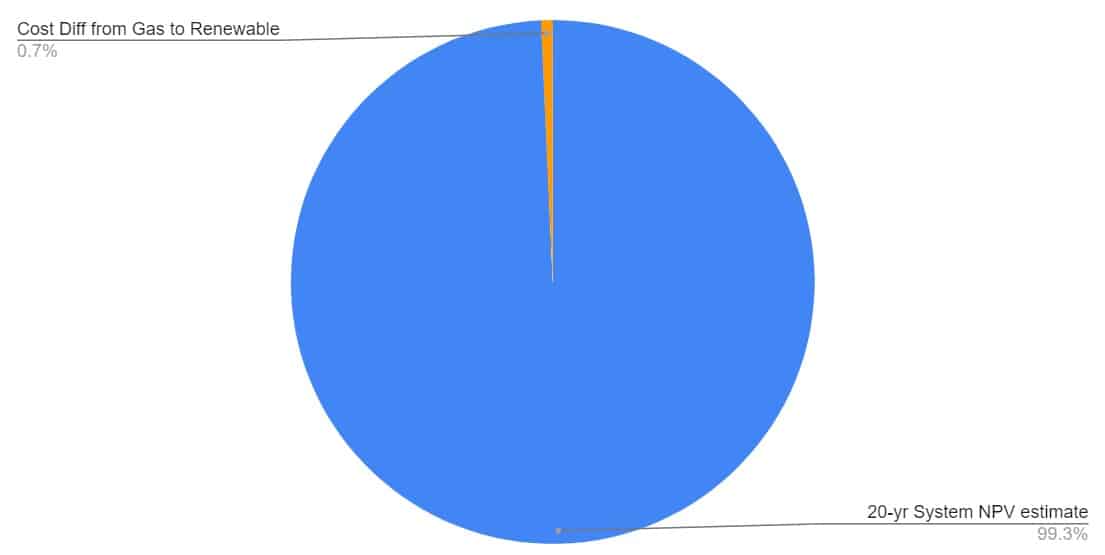

As described above, TVA ran a system-wide analysis to determine the difference in the system costs between the various alternatives. That means TVA simulated its system over 20 years with the gas combined cycle plant operating in Alternative A, and with the solar and storage operating in Alternative C. While TVA does not provide the overall system costs of either scenario, it does state that its modeling produced a 20-year net present value (NPV) system cost for Alternative C that was $1.8 billion higher than that of Alternative A.

Let’s break that down a little:

- To get a 20-year NPV, a discount factor is applied to the annual system costs for each year to account for the assumption that money today is more valuable than money next year, which is more valuable than money the following, etc.

- To put the $1.8 billion in context, in 2022 TVA’s total revenue was $12.4 billion.

- Ignoring the NPV calculations and assuming no growth in TVA’s revenues (e.g. budget) and no discount of future funds, just keeping that $12.4 billion flat for 20 years, the difference between the two scenarios represents a cost difference of approximately 0.73% of TVA’s total revenue. Assuming no growth and not adjusting for NPV means this is likely a conservative estimate.

By presenting the cost difference in NPV dollars instead of the percent difference in total system costs, TVA is attempting to make the difference in cost between a gas CC and solar and storage appear much larger than it really is.

In addition, TVA has not shared the resource cost, fuel price, or load forecasts it used to get to this $1.8 billion NPV system cost difference between the two scenarios. For all we know, TVA continued to use unreasonably low fuel prices. Adjusting just that one assumption could swing the cost difference enough so that the solar and storage scenario has a lower system cost than the gas CC.

I have already reached out to TVA asking for these assumptions, and have been told I must go through the Freedom of Information Act (FOIA) process. The last time we filed a similar FOIA, it took three months to get a response, and that response was woefully inadequate. Some FOIA responses from TVA have taken as long as two years. Needless to say, it is highly unlikely we will get anything useful from TVA on these assumptions and results before its CEO makes the final decision in early January.

Not all of EPA’s concerns are addressed in this final EIS

Notably, the US Environmental Protection Agency (EPA) filed comments on TVA’s draft EIS and worked as a coordinating agency in developing this final EIS. Despite being a coordinating agency, it appears that several of the EPA’s recommendations were not addressed in the final EIS. The EPA asked that TVA disclose the modeling and underlying assumptions in its analysis, and as discussed above, TVA chose not to share this information.

“The EPA also finds that the DEIS does not fully disclose modeling and underlying assumptions for the alternatives considered, nor those alternatives that were considered and eliminated from further discussion. The EPA recommends TVA transparently disclose its modeling methodologies and assumptions to better enable a comparison between the alternatives.” – Mark J. Fite, Director of Strategic Programs Office at U.S. EPA, in a letter to TVA dated June 30, 2022.

In its response presented in Appendix P of this EIS, TVA appears to claim the EPA engaged too late in the process and therefore risked delaying the decision timeline with its involvement. This is ridiculous. For such a major decision, a few months to get the analysis right are more important than sticking to an arbitrary timeline.

Unless of course, the timeline is not so arbitrary because TVA is indeed trying to finalize this decision before it begins its next IRP.

Glossing over the impact of the IRA, benefits of transmission

The Inflation Reduction Act (IRA), legislation that explicitly mentions TVA’s ability to directly take advantage of federal incentives for solar and storage, passed Congress in August of 2022. However, it appears to have had little impact on the cost analysis performed by TVA. Again, we do not have enough information about the assumptions TVA used to properly evaluate. In the draft EIS, TVA claimed the difference between the 20-year NPV system costs for Alternatives A and C was $2.311 billion in 2021 dollars. Remember that difference in the final EIS is now estimated to be $1.8 billion in 2021 dollars. That 20% difference could be a result of lower assumed solar and storage costs because of the IRA, or more reasonable fuel cost assumptions made Alternative A more expensive. We just can’t know without the assumptions TVA used in the analysis.

In response to several comments asking TVA to rerun the analysis to account for the passage of the IRA, TVA states in Appendix O that “the IRA does not alter TVA’s selection of the preferred alternative (Alternative A) nor does it change the least-cost planning analysis that led to TVA’s adoption of the target supply mix in the 2019 IRP.” In the final EIS, TVA claims a large portion of the cost difference between Alternatives A and C is that the solar and storage option requires investments in TVA’s transmission infrastructure. My eyeball estimate (because TVA refused to provide the numbers behind the figure presented in Appendix B of the EIS) is that the transmission investment would be in the $600-700 million range.

Smart, proactive transmission planning and investment has been proven time and again as a way to improve the reliability of a grid while integrating low-cost renewables without the need for one-to-one backup from fossil fuel generation. However, TVA is clear in the EIS that instead of a comprehensive transmission plan to integrate solar and storage onto its grid, it is assuming a certain amount of transmission infrastructure is needed for each 100 MW of solar, and simply multiplying that by 30 to get to 3,000 MW of solar. As we’ve seen in jurisdictions that have much higher levels of installed solar that have used this project-by-project approach to integrating solar, it tends to cost a lot more and result in a less reliable grid in the long run than proactively investing in transmission infrastructure to meet the needs of the current energy transition.

All-in-all, it’s unclear whether TVA fully accounts for the benefits of the IRA in its analysis of the alternatives in its EIS, especially the programs being set up to help utilities proactively plan and build transmission to reduce emissions across the regional grid.

Final decision in January

The final EIS ran in the federal register on December 9, which means that TVA CEO Jeff Lyash can issue a final decision 30 days after that, so after January 8, 2023.

Why does TVA want to build these gas plants?

The question I’m getting a lot lately is: why does TVA want to build these gas plants? Unlike investor-owned utilities, TVA doesn’t earn a profit for its shareholders for building this kind of infrastructure, because it doesn’t have shareholders. And as a federal corporation, with the Administration pushing to decarbonize the electricity sector by 2035, it is an uphill battle for TVA to lock in fossil fuels that will be expected to operate well past 2035.

The truth is, I don’t know why TVA is so set on building these two gas plants to the point that the utility would go through a separate process prior to an IRP to lock them in. Likely it is at least in part because TVA’s leadership consists of executives that come from private utilities and energy companies, and building new central power plants is what they have historically done, so it’s familiar. Another potential factor is that they see a window closing: if any utility is going to build new fossil infrastructure, it is only going to get harder in the future, so might as well push it through quickly. Climate scientists are clear that we cannot keep building new fossil fuel infrastructure and still meet reasonable climate targets. Voters are increasingly listing climate change as an urgent issue. Electric customers are feeling the direct impact of the volatility of gas prices on their bills.

So maybe TVA recognized a window closing, and thus has insulated itself from any potential impact of Biden-appointed Board members and is pushing these decisions through before it begins its next IRP process. Will it work? Maybe, but advocates like us are doing what we can to keep TVA from pushing through a bad deal for TVA customers.