In this second blog post of our series about the "Solar in the Southeast" fifth annual report, SACE elaborates on the supply chain disruption currently impacting the solar sector and the resulting reduction in the near-term forecast.

Bryan Jacob | August 4, 2022 | Energy Policy, Solar, Utilities

Download the Report Read the Blog Series Watch the report webinar

We started the “Solar in the Southeast” fifth annual report with the following paragraph to emphasize that solar is resilient.

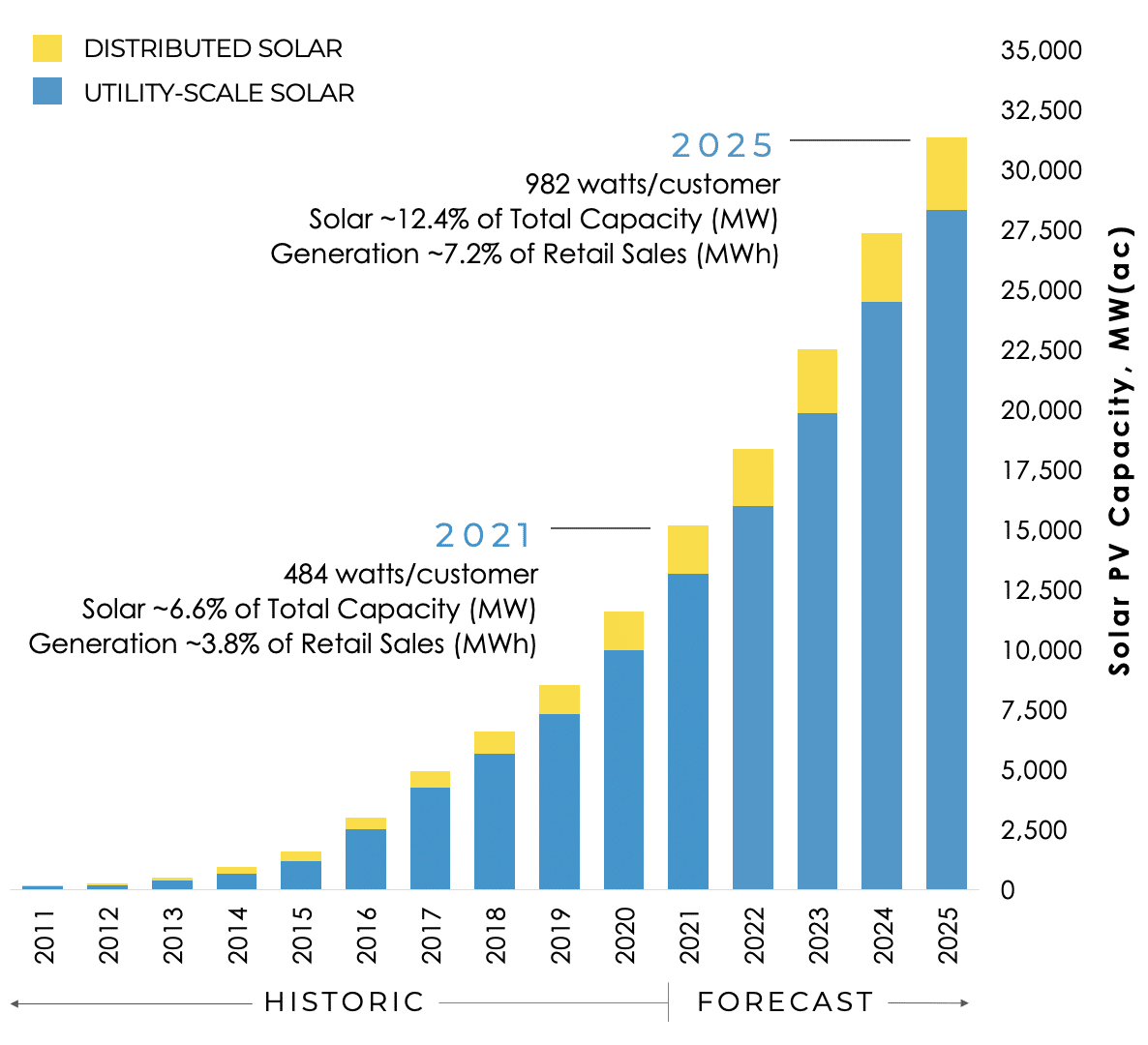

The Southeast is not immune to the various headwinds presently confronting solar across the USA. Yet, solar in the Southeast continued to exhibit substantial growth in 2021– exceeding 15 gigawatts (GW, or 15,000 megawatts) on a full-year operational equivalent basis. The Southeast achieved an average solar ratio of 484 watts per customer for 2021.

15 GW for 2021 is just a little bit lower than we forecasted in last year’s report, and that can be attributed to the ongoing COVID-19 pandemic. The present supply chain disruption is much more severe, resulting in a reduction of approximately 2 GW in our forecast for 2022 and 2023. Georgia Power alone announced a full-year delay of 970 MW due to the present supply chain disruption.

As we explain in the report, the Department of Commerce was forced to investigate the potential circumvention of the antidumping and countervailing duties imposed on crystalline silicon solar cells from China. This investigation and the uncertainty it created have paralyzed the international solar supply chain – at least temporarily.

The Southeast already contributes significantly to the domestic supply of solar modules – with Jinko Solar in Jacksonville, Florida, and Hanwha Q Cells in Dalton, Georgia – the largest solar module manufacturing facility in the western hemisphere. But the vast majority of solar modules are still sourced internationally. So while domestic manufacturing is scaling up to meet demand, we still need to rely on international supply.

To both expedite the transition toward domestic supply and to restabilize the market short term, President Biden announced a series of steps on June 6 including a 24-month moratorium on import duties for four key countries: Thailand, Vietnam, Malaysia, and Cambodia. Even so, it may be more than a year before the solar market gets back to normal. The updated SACE forecast (below) shows 2024 being the date the industry will be back to approximately the same level as we had been anticipating in last year’s report before the Auxin petition disrupted things.

In other encouraging news, even since we published this year’s solar report, Senators Manchin and Schumer reached an agreement on a budget reconciliation package, called the Inflation Reduction Act of 2022, that includes $369 billion for climate and clean energy. The solar industry supports the package of incentives for clean energy which includes extending the solar Investment Tax Credit (ITC) and offering a “direct pay” option to make it refundable in certain, limited circumstances.

We invite you to take action with us to help pass this consequential legislation that will help propel the solar – and clean energy – industry forward.

Take Action: Urge Your Members of Congress to Take Climate Action

Download the Report Watch the report webinar

#SSR2022