After spending three years evaluating ways it can save its customers money by making changes in its power supply, Memphis Light, Gas & Water (MLGW) has recommended to its Board of Commissioners what appears to be a completely irrational decision to sign a forever contract with its current supplier, the Tennessee Valley Authority (TVA), based on a confluence of factors that are truly an anomaly. This forever contract is essentially a long-term contract that continually renews for another 20 years, locking Memphis and Shelby County into a never-ending relationship with TVA as its exclusive power supply.

If MLGW chooses to sign TVA’s forever contract, it would give up any control it currently has to negotiate more affordable and clean energy for Memphis at a time when so many are struggling to pay electricity bills. By our calculations, Memphis could still save at least $70 million per year but most likely over $200 million per year by switching to an independent power supply. And ultimately, millions of tons of pollution and most importantly the quality of life of hundreds of thousands are on the line with this historic decision.

MLGW’s best course of action is to do nothing, for now

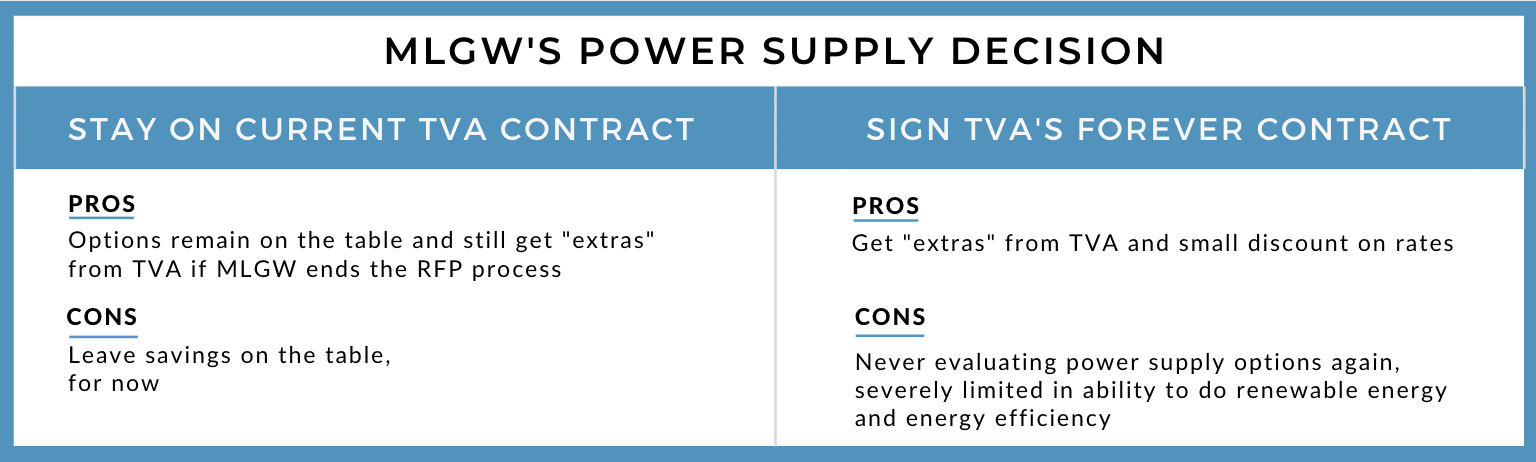

First, let’s be clear, MLGW does not have to choose between contracting for independent power supply based on the prices provided by Request For Proposal (RFP) bidders in early August and signing the forever contract with TVA. MLGW can remain on its current contract with TVA, the one that allows it to leave in five years without paying any stranded asset costs to TVA. In the meantime, MLGW can ask bidders to refresh their bids, to take into account what could be truly transformational benefits for Memphis that will be available through the recently passed Inflation Reduction Act (IRA), as well as further improvements in the supply chain. Memphis could also table the power supply issue for a few months or years.

Another reason to hold off on signing the forever contract is to wait until a current and pending court case that would ultimately decide if TVA utility customers, like MLGW, could pay TVA to use its transmission lines similar to the use of a toll road. If MLGW has access to TVA’s transmission lines, the cost of setting up an independent power supply portfolio would likely be significantly reduced.

If MLGW remains on its current contract with TVA, it has the flexibility to negotiate with TVA now and in the future, without having to sign the forever contract. In fact, the proposal that TVA submitted to MLGW as part of this RFP process proves this very point. Just by not leaving TVA, and without being required to sign the forever contract, MLGW can take advantage of numerous carrots that TVA dangled, including:

- TVA’s offer of $100 million over ten years for core community revitalization

- TVA’s offer to sponsor a forum on energy burdens, and up to $3 million in matching funds for programs to address energy burdens

- TVA’s offer for an extra $850,000 each year in matching funds to go to low-income weatherization

- An electric vehicle roadmap for Memphis, local EV workforce training, and funding for Memphis Area Transit Authority (MATA) to purchase 12 electric buses

And most importantly, by remaining on the current contract, MLGW reserves the ability to explore independent power supply options in the future.

What was – and wasn’t – in the bids: Prices and IRA implications remain to be seen

In 2021, MGLW issued a Request for Proposals (RFP) for generation and transmission with independent suppliers who were able to bid projects or sets of projects to meet the independent portfolios MLGW developed in its Integrated Resource Plan (IRP) that was completed in 2020. Because many factors have impacted the costs of both generation and transmission recently, MLGW allowed the shortlisted bidders to refresh their pricing, with those refreshed prices due at the beginning of August 2022. It is important to note that early August when the bids were refreshed, was before the Inflation Reduction Act (IRA) passed and near the peak of supply chain issues and inflation, and is likely the worst time in recent history and the foreseeable future to contract for new renewable generation projects.

Only one proposal seemed to offer pricing with or without the IRA. That proposal was submitted on August 5, 2022, just three days after the Inflation Reduction Act text was published, and two days before it was amended and passed by the U.S. Senate. How could bidders have incorporated all the relevant potential savings from the legislation over such a short timeframe?

While the prices for solar projects increased from the original bids in January to the refresh at the beginning of August, that increase went from an average price of $32/MWh to $42/MWh, which is still well below the costs presented for staying with TVA at more than $80/MWh. Now, we know that these solar costs cannot be compared to TVA’s all-in cost because they are not apples to apples, so we combined these renewable power purchase agreement (PPA) costs with the costs of gas and transmission from the RFP documents. Even adjusting various assumptions to try to get the cost of an independent portfolio based on the August 2022 RFP results, we were not able to get an all-in cost above $76/MWh, and the most likely all-in cost is in a range of $60-65/MWh. That means that even with the increase in costs because of the terrible timing of the RFP refresh, Memphis could still save at least $70 million per year but most likely over $200 million per year by switching to an independent power supply.

It’s important to note that our findings are not in line with what MLGW’s consultant presented on September 1. We have submitted questions to MLGW to try to resolve some of these differences and will update this blog post if we learn anything that will materially change our results. While MLGW can claim transparency because it made bid documents available, however the evaluation process is not replicable without also sharing more information. In such an important decision, based on numbers that are not subjective, everyone should be able to come to the same conclusion.

MLGW CEO departure supports no rash actions

Friday, September 23, we learned that MLGW’s CEO, JT Young, will be leaving his position at MLGW to take a new role at Florida Power and Light (FPL). This gives even more reason for MLGW not to rush into signing a forever contract with TVA. Before this announcement, it was expected that MLGW would submit a resolution to the MLGW Board in October asking for permission to sign the forever contract. Now that Young’s last day at MLGW is October 14, it is unclear whether or how that impacts the timing of that resolution.

Of note is that Young is departing MLGW to for a new role with FPL, is a sister company to NextEra Energy, which submitted bids for all three of MLGW’s RFPs. NextEra Energy also submitted a proposal for a 30-year full requirements contract, but it is unclear from the bid documents how interested MLGW was in that particular proposal.

MLGW’s CEO is appointed by the mayor, so this move by Young gives Mayor Strickland the opportunity to make his stamp on the power supply decision before his term is up next year.

Despite remaining questions, it is clear TVA’s forever contract is a bad deal for Memphis

While we have had the RFP documents, including the one submitted by TVA, since September 1, we at SACE have yet to be able to recreate the calculations that were presented in support of MGLW’s choice to recommend the forever contract. It is unclear how GDS, the consultant working for MLGW, got from TVA’s proposal to the $80-83/MWh assumed in the evaluation. It appears that GDS took the 20-year figures provided by TVA in its proposal and plugged them in without much if any adjustment. We noted that while solar costs increased ~35% among RFP respondents during the August refresh, GDS adjusted the benefit of the small amount of solar allowed under TVA’s forever contract by only ~20%, with no explanation given. It’s also unclear if GDS applied the 3.1% wholesale credit offered under the forever contract to the Grid Access Charge, or just to the wholesale energy rate, as reflected by the contract language. While these assumptions sound small, there’s the potential for these to all add up to the difference between the independent portfolio based on RFP responses and the two TVA options.

In all scenarios, MLGW is exposed to fuel cost risk, but in the independent portfolio scenario, MLGW would be able to craft its own hedging policies and practices and increase the local solar and energy efficiency, to manage the impact of fuel costs on its customers. Under each TVA scenario, those are managed by TVA, which has no incentive to minimize the impacts of fuel costs on customers. One important analysis step that has not been done thus far is to look at a range of future gas price scenarios, and how MLGW could or could not respond depending on whether it is still in a contract with TVA and using the results of these scenarios to quantify the benefit of MLGW being able to adapt to future energy trends. We have no indication that MLGW plans to do this kind of analysis.

Unfortunately, even with access to the RFP responses, we have more questions than answers on what the best option is for MLGW over the long term. What is clear, however, is that TVA’s forever contract remains a bad deal for Memphians. We recommend that MLGW remain on its current contract with TVA for now, and explore whether to refresh the current RFP in the coming months or to issue a new RFP in the coming years.

Take Action

On September 1, MLGW began a comment period to hear from Memphians. Now is the time for you to raise your voice and let the MLGW board know why the future of Memphis and Shelby County’s energy supply matters to you personally and why the MLGW board should not sign a forever contract with TVA.

Memphis Has the Power is a campaign to ensure Memphians have affordable, equitable, and clean energy. The campaign has worked in the Memphis community for several years, backstopped by the Southern Alliance for Clean Energy (SACE). Our work has lifted up Memphians who struggle with unaffordable energy bills and has helped result in large increases in funding to help Memphians with lower incomes reduce their energy bills. SACE is an appointed member of MLGW’s Power Supply Advisory Team, the community advisory team that helped shape MLGW’s integrated resource plan.