MLGW's Board of Directors will consider the next step in evaluating alternative supply options on August 19: issuing a Request for Proposals (RFP) to provide power. TVA has issued an ultimatum: issue an RFP or take our offer. Here we break down TVA's offer. Judge for yourself whether you think it's worth it.

Maggie Shober | August 14, 2020 | Tennessee, UtilitiesFor over two years, the Southern Alliance for Clean Energy (SACE) has been following along as Memphis Light, Gas, and Water (MLGW) considers alternative power supply options for some time now. We have written fairly extensively on the Integrated Resource Plan (IRP) that Siemens and MLGW put together to show the hundreds of millions of dollars the City could save every year by breaking free from TVA — and how these savings could be used to help lower customer bills and ease energy burdens.

Read more about our work in Memphis and take action at MemphisHasThePower.org.

MLGW is at a critical point in this process. On August 19, the MLGW Board of Directors will decide whether to move ahead in the process by issuing a Request for Proposals or RFP. This step is important because, while the IRP calculated potential savings available to Memphis based on the best available data, an RFP would allow MLGW to evaluate its actual options based on actual bids from energy companies to provide alternative supply. If the IRP is the equivalent of knowing generally what a gallon of milk costs, an RFP is the equivalent of going to your grocery to see what it actually costs in your neighborhood on a certain date.

As a reminder or for folks new to the situation: MLGW is currently a local utility customer of TVA. That means MLGW is required to purchase 100% of its power from TVA as directed by federal law under the TVA Act. MGLW represents 9-11% of TVA’s total annual revenues and is the largest (but not the only) utility customer currently considering leaving. TVA has a vested interest in keeping MLGW as a customer, and so has put an offer on the table for MLGW to either stick to its current self-renewing 5-year contract or to sign TVA’s “long-term partnership” contract, which is a self-renewing 20-year contract.

TVA recognizes the importance of this moment – and has issued an ultimatum: if MLGW issues an RFP it will take its offer off the table. We were frankly surprised by this tactic, but on closer look, it shows how terrified TVA is of Memphians learning how truly inexpensive it will be out from under TVA’s control.

TVA’s Offer: Not Much New

Much of what is included in TVA’s offer is already included in the IRP. This means the value TVA claims to add if MLGW stays under contract with TVA has already been evaluated against other options and it was still found that MLGW can save hundreds of millions of dollars every year.

Let’s break it down. TVA’s offer to MLGW proposes ‘value’ to MLGW in the following forms:

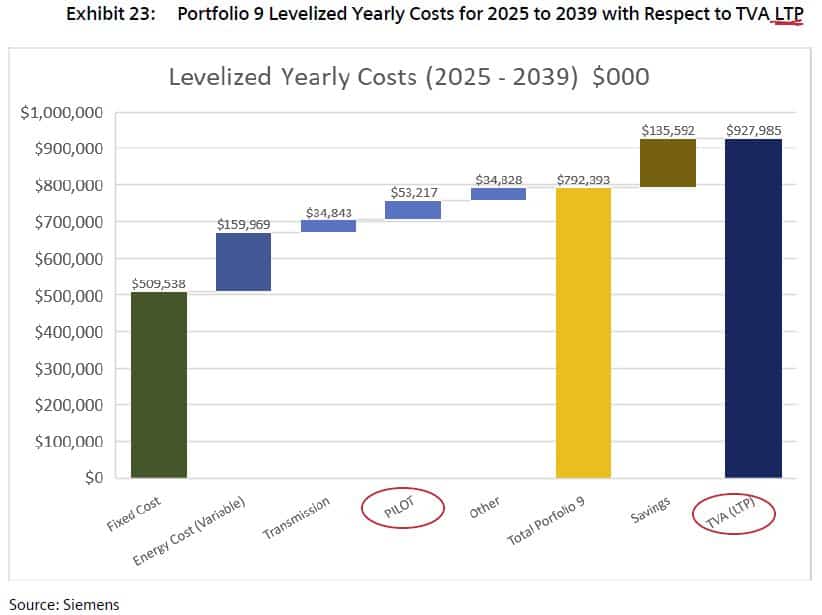

- A 3.1% credit on some of its rates. This represents nearly a fourth (25%) of the total value of TVA’s offer. TVA’s proposal is to give MLGW 3.1% back on its bill for wholesale rates (but not fuel charges). In order to get this credit, MLGW would have to sign TVA’s “long term partnership” (or LTP) contract. But guess what? The IRP already baked these savings into the baseline is used to calculate the savings provided by alternative supply options. (See below where Siemens compared one of the alternative supply portfolios to the “TVA LTP” scenario.) Even taking this partial rate credit into account the IRP found MLGW could save at least $135 million every year.

- Payment in lieu of taxes (PILOT). This represents nearly a fifth (20%) of the total value of TVA’s offer. Because both TVA and MLGW are public entities, they do not pay local taxes. Instead, they donate an amount equivalent to what they would pay in taxes to support local governments. The IRP also already accounted for making up for TVA’s PILOT payments if Memphis leaves TVA by MLGW taking up these payments and providing the same value for local government, while still costing Memphians less every year. (See below where Siemens includes PILOT in the total cost of Portfolio 9: a combination of local renewable energy projects in Shelby County and purchases from the MISO market.)

- Weatherization programs. A relatively small portion of the value of TVA’s offer comes from funds TVA says it will commit to easing energy burdens in Memphis through home weatherization for low-income customers. Weatherization means making the home more efficient to cool in the summer and heat in the winter. Memphis already matches all TVA dollars in this program through its Share the Pennies funds. MLGW could put a fraction of the savings from leaving TVA toward expanding this effort and make an even bigger dent in energy burdens than what is proposed in TVA’s offer and have a hundred or hundreds of millions of dollars left over in savings every year. TVA’s offer does not commit any funds to energy efficiency programs beyond the existing low-income weatherization program that focuses on single-family homes that are owner-occupied (i.e., not rentals). If MLGW exits TVA, it could invest in energy efficiency for all residential, commercial, and industrial classes, lowering bills across the region and lowering how much power generation it would have to procure through an RFP.

- Infrastructure purchase. TVA proposes to buy MLGW’s transmission infrastructure and includes that value as 20% of the total value of its offer. However, TVA already pays MLGW annual rent for the use of that same transmission infrastructure, and if MLGW sells this infrastructure, MLGW will 1) loose equity in its investment, and 2) make it harder for MLGW to leave TVA in the future. In our opinion, this doesn’t really count as an additional or new value provided to MLGW by TVA, and actually it would deprive MLGW of a very valuable asset that is a key enabler of the possibility of Memphis saving billions of dollars by leaving TVA.

- Flexibility. TVA includes the value of allowing MLGW to self-supply for its customers with up to 200 MW through its “flexibility” program. This program represents 15% of the total TVA-calculated value of its offer. This is fairly straight-forward, but if Memphis can get some value from 200 MW of solar over 20 years, can’t it get even more value from being unconstrained in the amount of solar energy it can build or purchase for its customers?

Reliability Scare Tactics

TVA is also using a scare tactic to try to make Memphians believe an alternative supply would somehow be less reliable than TVA, leading to increased outages. This is just false. Any alternative supply provided to Memphis would meet the same reliability standards that TVA meets. The reality is that most power outages are caused by damage to local power lines and substations by things like storms and squirrels. If MLGW leaves TVA, reliability will not decrease. If anything, MLGW would be able to invest some of the savings from leaving TVA in improving local power infrastructure, and thus cut down on power outages in Memphis.

Greenwashing

In its offer, TVA also claims to be the greener option. This is some serious greenwashing, and have dedicated an entire blog to fact-checking TVA’s claims.

MLGW should move forward with an RFP

If a salesperson offers you a “tremendous” deal just so long as you take it now and don’t shop around, it’s a big clue that the “deal” they’re offering you really isn’t so good. If TVA is so confident that it is the best deal for Memphis, why disallow Memphis the ability to shop around?

Clearly TVA’s offer pales in comparison to the value of a new power supply for the people of Memphis. The MLGW Board and Memphis City Council should move forward with an RFP to get the best deal for Memphians.

We need as many Memphians as possible to raise their voices and take action to demand a cleaner, lower-cost energy future. Join us in raising your voice by taking action at MemphisHasThePower.org.