Increasing bill volatility is one of many drawbacks of a gas-reliant electric system. We need to change the way we regulate fuel cost recovery and move away from heavy gas reliance.

Maggie Shober and George Cavros | April 24, 2023 | Florida, Fossil Gas, Georgia, UtilitiesElectric customers across the Southeast have felt the increase and volatility of natural gas prices directly on electric bills in the last few years. Utilities in the region pass fuel costs directly on to customers, removing the risk of high and volatile fuel prices from a utility and placing it solely on the utility’s customers. This is a confusing process; in our latest whitepaper, “Decoding Fuel Costs in Electric Bills,” the Southern Alliance for Clean Energy (SACE) breaks it down with a focus on three utilities in Florida as examples.

The main reason fuel costs are so impactful in the Southeast, and in Florida in particular, is that utilities rely heavily on gas-fired power plants to generate electricity. Over the past two decades, utilities all across the Southeast have increased reliance on this volatile and climate change-inducing fossil fuel, and several utilities in the region are actually proposing more gas-fired power plants. Increasing our reliance on gas will only lead to more issues – like power bill volatility and unreliable electric systems in extreme weather – while slowing the transition to clean energy.

Fuel Cost Recovery 101

Electric utilities regularly go through a process called a rate case to set the rates needed to recover costs plus a return on investment for their shareholders. This process is overseen by a state-level regulatory body called a Public Service Commission (or something similar). But rate cases do not cover all of the utilities’ costs to serve customers, and utility expenses on fuel and purchased power are some of the items excluded from this process.

The regulations on how Commissions determine how fuel and purchased power costs are passed through to customers vary by state, but here in the Southeast, 100% of those costs are passed on to customers via electric bills. In Florida, for example, there is a portion of the bill called the “Fuel Cost Recovery Factor,” and for residential customers, there are two rates:

- For the first 1,000 kWh used in a month and

- Another rate (usually slightly higher) for any kWh used over 1,000.

These Fuel Cost Recovery Factors vary by utility and are typically set once a year by the Public Service Commission based on a forecast of these costs provided by the utility. However, in recent years, many Florida utilities have filed for what is called a “Midcourse Correction,” where the utility is either under-recovering or over-recovering based on its actual costs, and asks the Commission for permission to adjust the Fuel Cost Recovery Factor either up or down.

Recent Trends in Fuel Cost in Florida Electric Bills

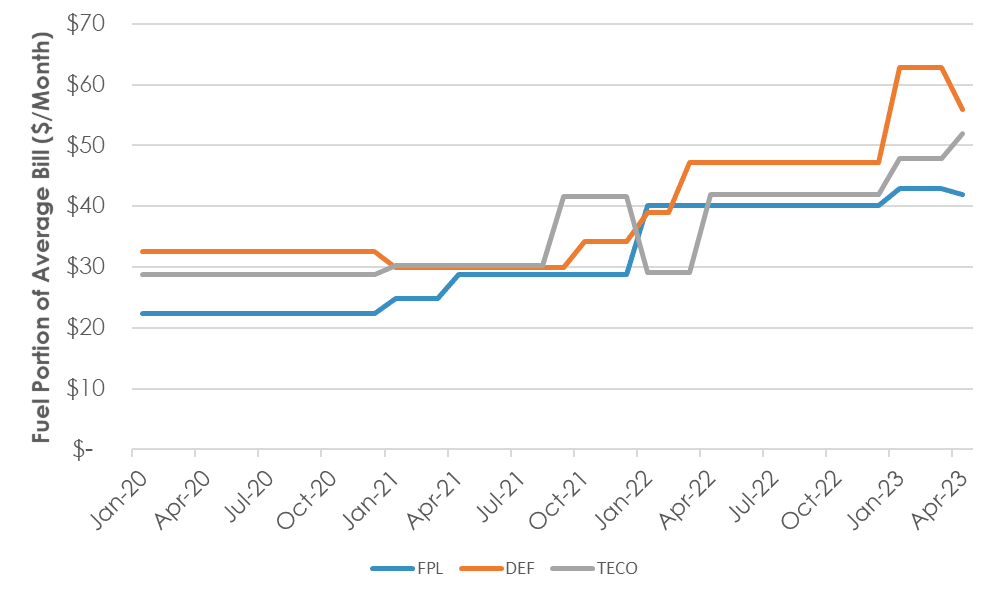

Our whitepaper uses the three largest investor-owned utilities in Florida to show just how much the fuel cost pass-through portion of electric bills has changed since 2020. The trends and timelines are similar: Florida utilities did not forecast the sharp increase in gas prices in 2021, and therefore were under-recovering costs and began filing for midcourse corrections in 2021. The utilities had significantly under-recovered gas costs in 2022, which were recently approved for recovery on customer bills starting this month. The impact on customer bills from the 2022 under-recovered costs were mitigated as the Commission allowed the utilities to offset those costs against projected 2023 over-recovery of fuel costs. But the Fuel Cost Recovery Factors today are still far above their levels in 2020, 2021, and 2022.

Monthly Fuel Charge on Average Florida Power & Light, Duke Energy Florida, and Tampa Electric Residential Customer Bills from January 2020 – April 2023

The fuel cost portion of the average bill, which we calculated using the average monthly usage for residential customers for each utility in 2021, jumped from $22-33/month in 2020 to $39-55/month in 2023. That’s an additional $17-25/month, or nearly double the 2020 fuel cost, even after accounting for slight drops in fuel costs in the second quarter of 2023.

Current Fuel Cost Regulations Create a Moral Hazard

Regulations that allow utilities to pass 100% of fuel costs on to customers have stayed in place since the 1970s under the incorrect assumption that utilities cannot control fuel costs. Utilities do have tools to manage fuel costs, such as fuel price hedging, and non-fuel resources like include energy efficiency, renewable energy, and energy storage. However, these non-fuel resources are not always considered as a tool for mitigating fuel costs since resource decisions occur in a separate process from those that handle fuel costs. Resource decisions by Southeast utilities tend to be made in Integrated Resource Plans (IRPs). In Florida, these are called Ten Year Site Plans.

In testimony in front of the South Carolina Public Service Commission in a fuel cost proceeding, Ron Binz, former Commissioner in Colorado, calls this separation of resource decisions from fuel cost decisions what it is: a “moral hazard.” Building a new power plant is the primary way electric utilities grow profits for shareholders, creating a bias for the utility to invest in fuel-based power plants instead of lower-cost options such as demand response, energy efficiency, and renewable energy. The moral hazard exists because resource decisions are separate from fuel costs; utilities are biased toward fuel-based resource investments, and utilities bear none of the risks of fuel cost spikes. Binz goes on to explain that,

To further explain this moral hazard concept, Binz uses the example of a car salesman that wants to earn a higher commission and thus pushes customers toward more expensive cars regardless of the fuel efficiency of the car. The salesman only cares about the purchase price, whereas the customer will pay the purchase price and ongoing fuel costs.

Where do we go from here?

We can make changes both within the current utility regulatory regime and to update the utility regulatory regime to ease the burden of fuel costs on customers.

- First, within the existing current regime, utilities could invest more in non-fuel resources and stop building new gas plants. This would likely come as a result of pressure from their regulators through advocacy from organizations like SACE. At the very least, Commissions should consider the moral hazard of utilities having no exposure to fuel cost risk when considering utility proposals to expand fuel-based resources.

- Second, we could update the regime by updating utility regulations such that utilities share some portion of fuel costs. A complete shift of all fuel costs from customers back to utilities is likely not a good option at this point, since utilities have made 50 years of decisions under the current regime, but even shifting a small amount (some proposals are around 10%) of fuel costs to the utility could dampen the impact of the moral hazard created by the current utility regulatory regime.

SACE is already working on both of these approaches throughout the Southeast. For instance, Georgia Power recently asked the Georgia Commission to increase the fuel cost portion of customer bills significantly. The impact on residential customers would be an increase of approximately $17-23/month. In this fuel cost docket, SACE and Sierra Club recently co-sponsored testimony from two experts, Jeremy Kalin and Brent Alderfer, that also highlight the issues with the current fuel cost regulatory regime. Among other recommendations, Kalin suggests that the Georgia PSC open a Fuel Cost Recovery modernization docket to explore fuel-cost sharing. Alderfer discusses the effectiveness of renewable generation for fuel savings. A hearing on this issue in front of the PSC will begin May 2, and a decision by the PSC is expected by the end of May.

Ultimately, the increasing volatility of electric bills is one of many drawbacks of an electric system that is too reliant on gas. In addition to changing the way we regulate fuel cost recovery, clearly, we need to move away from relying so heavily on gas for electricity – and its financial and climate risks.