The Clean Electricity Performance Program, or CEPP, which is a key climate provision within the larger Build Back Better Act, made a large step toward becoming law when it passed out of the House of Representatives Energy & Commerce Committee on September 15. While the policy still has a long way to go and could be amended before ultimately getting passed, we thought now would be a good time to take a look at how the policy could impact utilities in the Southeast.

CEPP Background

First, the groundwork around what is the CEPP. The proposed program is a set of financial grants and penalties administered through the U.S. Department of Energy (DOE) that could get the nation’s electricity sector as a whole to approximately 80% clean electricity by 2030, which puts us on the path to be able to achieve 100% clean electricity by 2035. These targets are critical for achieving the pollution reductions that scientists indicate are necessary for avoiding the worst impacts of the climate crisis, and are supported by a majority of voters. Below are key provisions in the CEPP proposal that passed out of the House E&C Committee.

- Clean electricity is defined as electricity from sources that emit less than 0.10 metric tons carbon dioxide equivalent emissions per megawatt-hour (MWh) of electricity. The definition is technology-neutral, meaning any technology that can generate power under the emissions threshold is qualified. Technologies that meet this standard include solar and wind.

- The baseline, or where each utility’s share of clean electricity starts, is calculated as the average percent of clean electricity in the calendar years of 2019 and 2020.

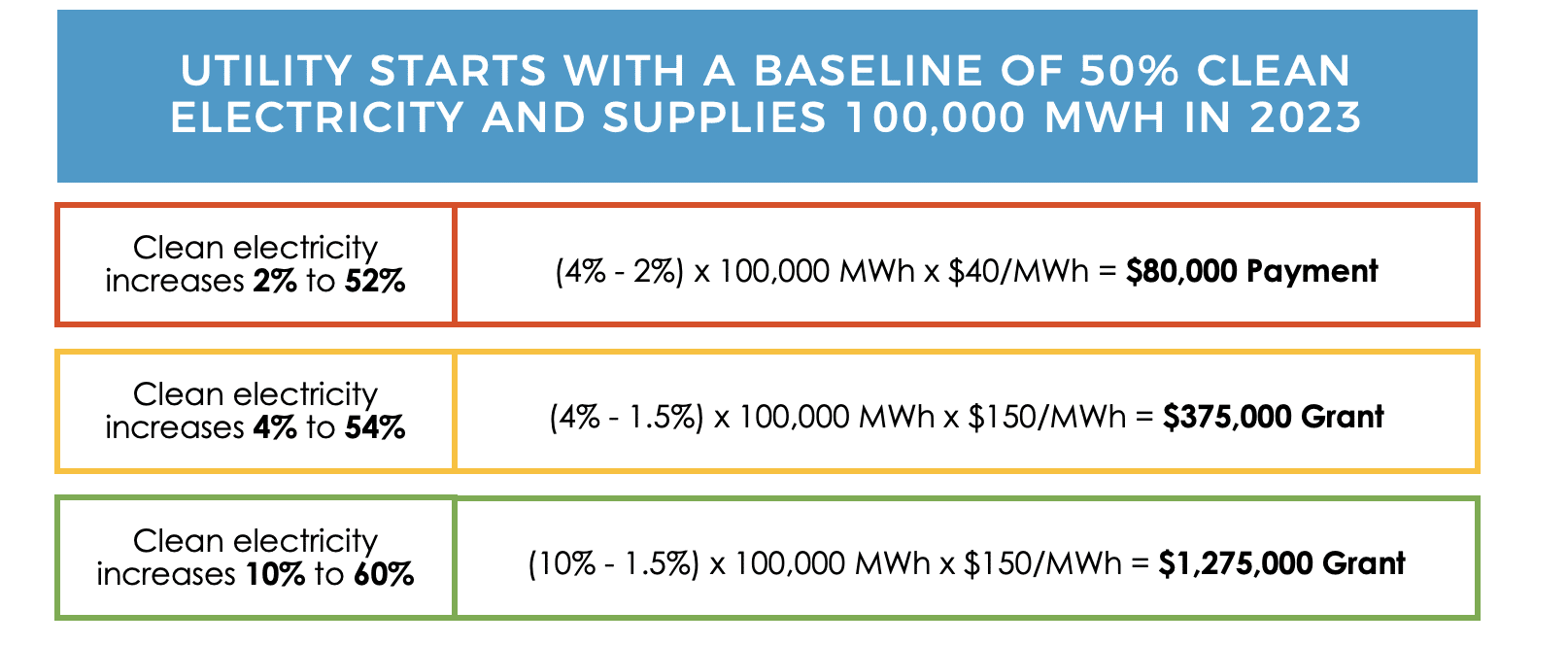

- Utilities receive grants from the DOE each year they increase the share of electricity met by clean sources by at least 4 percentage points; the grant amount is calculated by multiplying all MWh of clean electricity that exceed 1.5% above the previous year’s share of clean electricity by $150.

- Utilities must submit a payment to the DOE for each year that its share of electricity grows by less than four percentage points. The payment is calculated as $40 for each MWh that the utility falls short of the 4 percentage points target.

- Utilities can defer both grants and payments for up to two proceeding years, essentially allowing two-year or two-year averages instead of basing grants and payments on a single year of data. In this case, as long as the utility has an average increase of 4 percentage points per year it receives a grant, and conversely, if the average falls short of 4 percentage points per year it owes a payment. This option would help utilities weather unforeseen fluctuations in load or clean generation.

- Grant funding through the CEPP will benefit customers directly because it is required to go to bill assistance, energy efficiency, distributed clean energy sources, worker retention, and similar programs. Conversely, the penalty payments cannot increase customer bills.

- Utilities that reach 85% clean electricity are no longer required to submit payments for increases under 4% per year as long as their share of clean electricity does not decrease. They are still eligible for grant payments.

Here are three hypothetical example scenarios to help us understand how this can work using a utility that starts with a baseline of 50% clean electricity, calculated as the average share of clean electricity in 2019 and 2020, and supplies 100,000 MWh in 2023. In the first example the utility increases clean electricity but falls short of the 4% threshold, so owes a payment on the amount it is short. The next two examples show how a utility’s grant amount is calculated if it meets or exceeds the 4% threshold.

Read more about how a CEPP is achievable in the Southeast, and how it would save lives, create jobs, maintain a reliable electric grid, and keep electricity bills flat in our previous blog posts.

Current Southeast Utility Plans and the CEPP

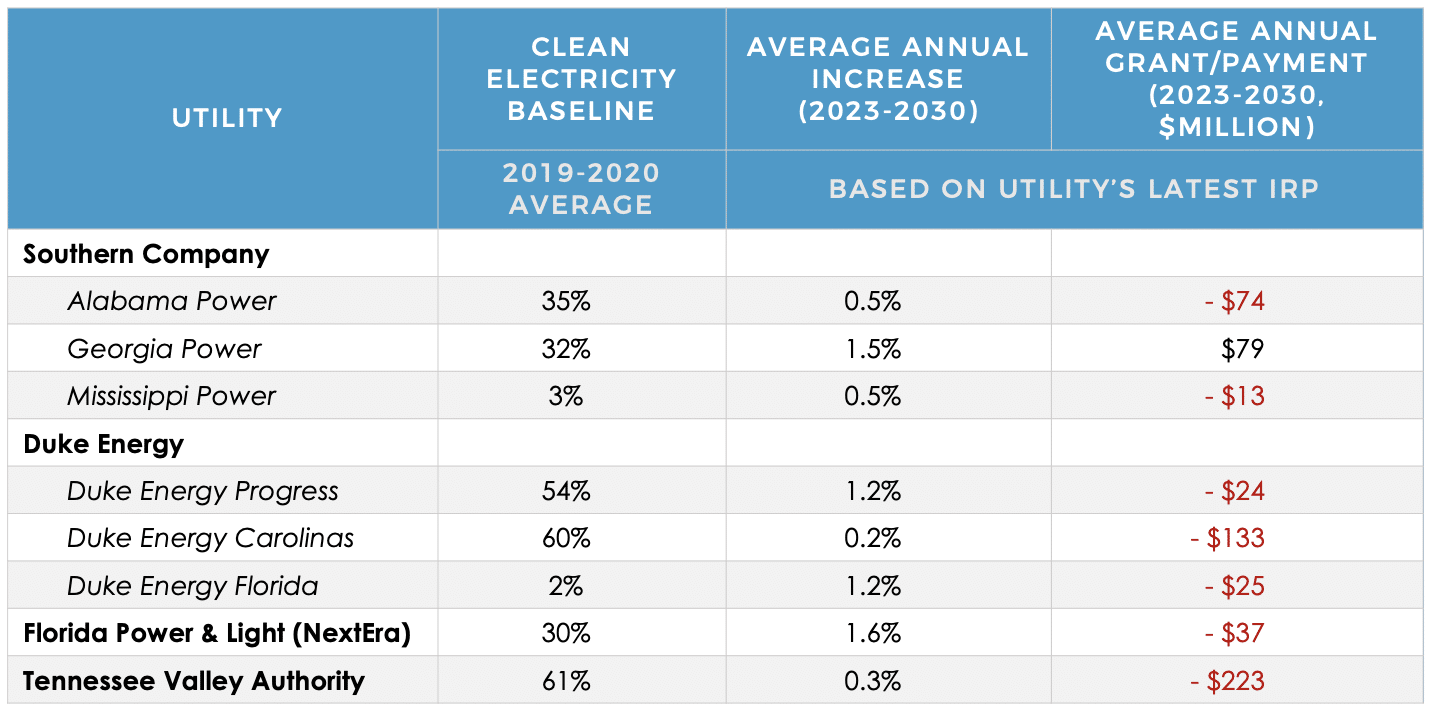

While utilities across the Southeast are increasing their use of clean electricity to varying degrees, a look at the four major utility holding companies in the Southeast shows that none are on track to meet the 4% per year average increase throughout the 2023-2030 timeframe under current utility resource plans.

We compared the Integrated Resource Plan (IRP) or equivalent for the four largest utility holding companies in the Southeast to show how their current trajectory lines up with the 4% clean electricity increase in the CEPP. The utilities included in the analysis were Florida Power & Light (FPL) (including Gulf Power), Duke Energy’s three utilities in the Carolinas and Florida, Southern Company’s three utilities, and the Tennessee Valley Authority (TVA).

The baseline, or starting point, for the utilities, varies from Duke Energy Florida (DEF) and Mississippi Power at approximately 3% to TVA and Duke Energy Carolinas (DEC) at approximately 60%.

Annual Increases in Clean Electricity Fall Short of 4% Threshold

The good news is that, from 2023 through 2030, all utilities average an increase in clean electricity. The not-so-good news is that none of the utilities meets the 4% threshold to receive grants from DOE in all the years.

The annual increases in clean electricity also vary from utility to utility, ranging from 0.2-0.3% at TVA and DEC to 1.5% at Georgia Power and 1.6% at Florida Power & Light (FPL). Georgia Power, FPL, Duke Energy Florida (DEF), and Duke Energy Progress (DEP) all have at least one year with an increase of over 4%, usually the first year because it is compared to the baseline of 2019-2020.

Two of the utilities analyzed, TVA and DEC, have a baseline of around 60%. Therefore, if TVA or DEC (or both) were to increase the share of electricity from clean sources by 4% per year it would hit 85% clean electricity on or around 2028. At that point, they would no longer be subject to the penalty payments as long as they don’t backslide, or decrease the share of clean electricity. If the utility expects demand to grow, it would need to at least match that demand with new sources of clean electricity to maintain the same share of clean electricity.

Total Grant or Payment Amounts Vary by Utility

We also calculated an approximate grant or payment amount for each utility under the existing IRPs, including a rough optimization for 2-year or 3-year averaging. Only Georgia Power has a high enough increase in the first year that its grant funds offset payments it would be required to pay in the later years of the program if it keeps to its 2019 IRP. The early increases in Georgia Power include both Vogtle units coming online as well as solar build-out under the 2019 IRP. Some of the utilities, like FPL, see modest payment amounts compared to their size, while utilities with plans for clean electricity to remain largely flat, namely TVA and Duke Energy Carolinas, would have a higher level of payments due.

The key difference between Georgia Power and FPL, which have similar average annual increases, is that Georgia Power sees a high increase in the first year and then clean electricity increases level off, whereas FPL sees higher increases in clean electricity throughout the timeframe even though most of those fall short of the 4% threshold. Also, since the grant amount is higher on a per-MWh basis than the penalty payment, Georgia Power’s increase above the 4% threshold allows them to offset the payments beyond the first year. It is important to note that the grant payments Georgia Power would see from the Vogtle project are just one-tenth of the cost overruns of the project to date. Investments in solar energy, storage, and energy efficiency remain the most cost-effective way for utilities to increase clean electricity, either with or without the CEPP.

The CEPP Would Drive More Clean Electricity in Utility Plans

To end on a high note, the fact that current resource plans already have clean electricity increasing shows it’s possible. Additional studies have shown that it’s possible, and hugely beneficial. Opponents of a CEPP claim it would pay utilities for what they are already doing, but this is not the case. The CEPP would provide rewards for utilities to accelerate an increase in clean electricity. If the CEPP becomes law by the end of the year, each of these utilities has a process to update its resource plans to be able to take advantage of the potential for grant payments (and the expanded clean energy tax credits in the same bill) by accelerating the increases in clean electricity.

Data sources for the analysis include EIA and FERC data, announcements from the utilities, the 2020 IRPs for Duke Energy Carolinas and Duke Energy Progress, Georgia Power’s 2019 IRP, TVA’s 2019 IRP and its goal of adding 5,000 MW of solar by 2030, and the 2021 Ten Year Site Plans for the combined Florida Power & Light and Gulf Power utilities and Duke Energy Florida.

#InflationReductionAct #HR5376 #BBBA