All signs point to a rapid increase in electric vans, trucks, and buses as public policies, market conditions, and consumer desire begin to align.

Stan Cross | April 26, 2023 | Clean Transportation, Electric VehiclesStan Cross, SACE’s Electric Transportation Policy Director, is headed to Anaheim, California, next week to engage with electric van, truck, and bus manufacturers and the fleet operators coming to see the latest offerings at the Advanced Clean Truck Expo. In Part 1 of this medium- and heavy-duty electric vehicle blog series, Stan examines the public policies supporting the market transition from diesel to electric. Part 2 will come after the Expo and focus on the technology and market state.

Tell someone you saw an electric vehicle and what’s likely to jump to their mind is an image of a Tesla, Chevy Bolt, or maybe a Ford F-150 Lightning. The images they are less likely to conjure are electric Bluebird school buses, Mack garbage trucks, Freightliner semi trucks, Amazon delivery vans, and Proterra transit buses, let alone Pierce electric fire trucks. EVs have been synonymous with light-duty passenger vehicles, but that’s changing quickly. The expansion of the electric medium- and heavy-duty van, truck, and bus markets has begun, and public policy is accelerating market momentum and increasing fleet operators’ interest.

Electrifying vans, trucks, and buses matters to everyone

The transportation sector is a major polluter of the air we all breathe and the leading emitter of carbon emissions accelerating climate change. Vans, trucks, and buses make up approximately 5% of the vehicles on America’s roads but spew 32% of ozone-causing nitrous oxide. Heavy-duty vehicles alone account for 25% of small particulate matter (PM2.5) that penetrates into our lungs and harms our health. Additionally, medium and heavy-duty vehicles are responsible for 26% of the transportation sector’s greenhouse gas pollution, adding significantly to the climate crisis. The American Lung Association found in its 2023 State of the Air report that nearly 36% of Americans—119.6 million people—live in places with failing grades for unhealthy ozone or particle pollution levels. And the burden of living with unhealthy air is not shared equally; people of color are 41% of the overall population but are 54% of the people living in counties overburdened with air pollution.

As with any new technology, public policy is a driver

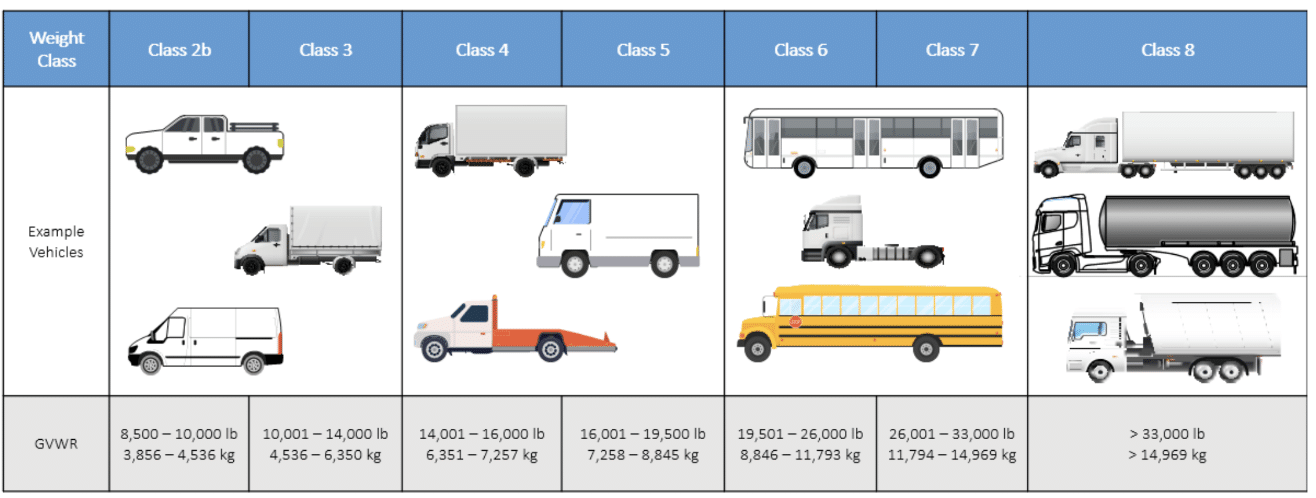

Fleet operators’ interest in replacing gas and diesel vehicles with EVs has grown steadily as EV technology has matured. Battery technology is improving, becoming more efficient, and providing extended vehicle range. Charging infrastructure options are expanding to serve fleet needs better. And vehicle manufacturers have begun rolling vehicles off assembly lines that meet fleet needs, such as electric pickups, box trucks, cab overs, chassis cabs, flatbeds, and semis. In 2019, only 20 models of Class 2b-8 zero-emission trucks were available for purchase in the US; today, more than 136 models are available.

Medium and Heavy Duty Vehicle Classification

A fleet operator’s purchasing calculus differs from the typical consumer’s because fleet vehicles either make money for businesses or provide critical services for communities: reliability, performance, and total cost of ownership are crucial considerations. Today’s electric vans, trucks, and buses check the reliability and performance boxes but come with a bigger sticker price than diesel equivalents. Even though EVs are much cheaper to operate and maintain–electricity is cheap and price-stable compared to gas and diesel, and EVs are more durable without transmissions, exhaust systems, and engines needing constant maintenance and repair–that bigger sticker price is an adoption barrier for many fleets.

But upfront costs for medium and heavy-duty EVs are coming down rapidly, expected to drop 44% by 2027, mainly due to falling EV battery pack costs, which have come down from more than $1,000 per kilowatt-hour in 2010 to approximately $132 per kilowatt-hour in 2021.

And here’s where public policy comes in. The federal Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law (BIL) provide incentives to support EV and battery manufacturing and fleet purchases, resulting in the purchase price of many medium and heavy-duty EVs costing the same or less than their diesel counterparts as early as this year. These incentives include:

- Tax credits that support buyers, including commercial vehicle tax credits for public and private fleets up to $40,000/vehicle and charging infrastructure tax credits up to $100,000/charger

- Tax credits and incentives that support domestic manufacturers, including battery manufacturing and critical mineral production tax credits, $2 billion for the Domestic Manufacturing Conversion Grant program, and $3 billion for the Advanced Technology Vehicle Manufacturing program

- Grant programs that fund electrification, including $1 billion to public entities to electrify class 6 and 7 heavy-duty vehicles, $5 billion to school districts to electrify school buses, $1.6 billion for the Low of No Emissions Program to support transit bus electrification, and $60 million for the Diesel Emission Reduction Act program.

A new push to reduce tailpipe pollution is underway

Two regulatory actions over the past thirty days could have significant bearings on the pace of medium and heavy-duty electrification:

The first was when the Environmental Protection Agency (EPA) granted the state of California a waiver allowing the state to set stricter tailpipe pollution standards for medium and heavy-duty vehicles than the current federal standards. The Clean Air Act allows California to set more stringent auto emissions standards, per EPA approval, because its unique coastal and inland valley geography traps air, creating unhealthy smog conditions in its cities. The new standards, known as the Advanced Clean Trucks (ACT) Rule, will require medium and heavy-duty van, truck, and bus manufacturers to sell an increasing percentage of zero-emissions vehicles annually to reach 55% of Class 2b-3, 75% of Class 4-8, and 40% of truck tractor sales by 2035.

But what happens in California doesn’t stay in California. Now that the EPA granted California the green light to implement ACT, any state can also choose to adopt the standards. Already, New York, New Jersey, Washington, Oregon, Massachusetts, and Vermont have adopted ACT, and eight additional states, including North Carolina here in the Southeast, have initiated ACT rule-making hoping to adopt it. These states and California represent nearly a quarter of the nation’s truck, van, and bus markets.

The second was when EPA announced new proposed federal pollution standards for light, medium, and heavy-duty vehicles. The proposed standards, which would go into effect in the model year 2027 in every state in the country, would require automakers to attain significant reductions in vehicle tailpipe air pollution and carbon emissions. Though the proposed standards would allow automakers flexibility in meeting pollution targets, including advancing gas and diesel engine innovation and efficiency, it’s expected that the standards, should they be adopted as drafted, will make it attractive for automakers to electrify rapidly. The EPA estimates that these proposed standards would result in 67% of all new light-duty passenger vehicle sales and, more relevant to the discussion here, 46% of all new medium-duty vans, trucks, and buses would be electric by 2032. Medium-duty vehicles are Class 3-6; think box truck, delivery van, garbage truck, fire truck, and school bus. Most medium-duty vehicles operate locally and return to a depot at night, making them ideal use cases for electrification.

With the region capturing over 40% of the EV market investments and jobs created nationally, federal policies that benefit the EV market benefit economic and workforce development in the region. These policies and investments aim to reduce tailpipe pollution, scale domestic EV, battery, and supply chain manufacturing, and boost medium and heavy-duty EV adoption. Here in the Southeast, these policies will deliver tangible benefits. Cleaning up tailpipe pollution will benefit public health in the region, with many metropolitan areas and communities along transportation corridors overburdened with air pollution. Accelerating the transition to clean energy will reduce carbon pollution and lessen the long-term economic and public safety impacts from severe weather that climate change already delivers to the Southeast. And electrifying the region’s light, medium, and heavy-duty vehicles will provide significant transportation cost savings by switching the region’s transportation fuel from imported gas and diesel to locally generated electricity, which would deliver a $60 billion boost to the region’s economy annually.

Coming in Part 2: How innovation and technology are pairing with policies to expand EV markets and growing consumer desire for electric vans, trucks, and buses.

Electrify the South is a Southern Alliance for Clean Energy program that leverages research, advocacy, and outreach to promote renewable energy and accelerate the equitable transition to electric transportation throughout the Southeast. Visit ElectrifytheSouth.org to learn more and connect with us.