2020 saw a number of electric transportation economic development highlights across the Southeast, producing some winning utility engagements and state actions.

Stan Cross | December 29, 2020 | Clean Transportation, Electric Vehicles, UtilitiesThe year has come and gone. And what a year it has been. A global pandemic, economic crisis, political unrest, and social justice strife have exposed our nation’s vulnerabilities, shortfalls, and divides. These challenges have also shown the resilience of our health care system, democracy, and communities.

The EV Market

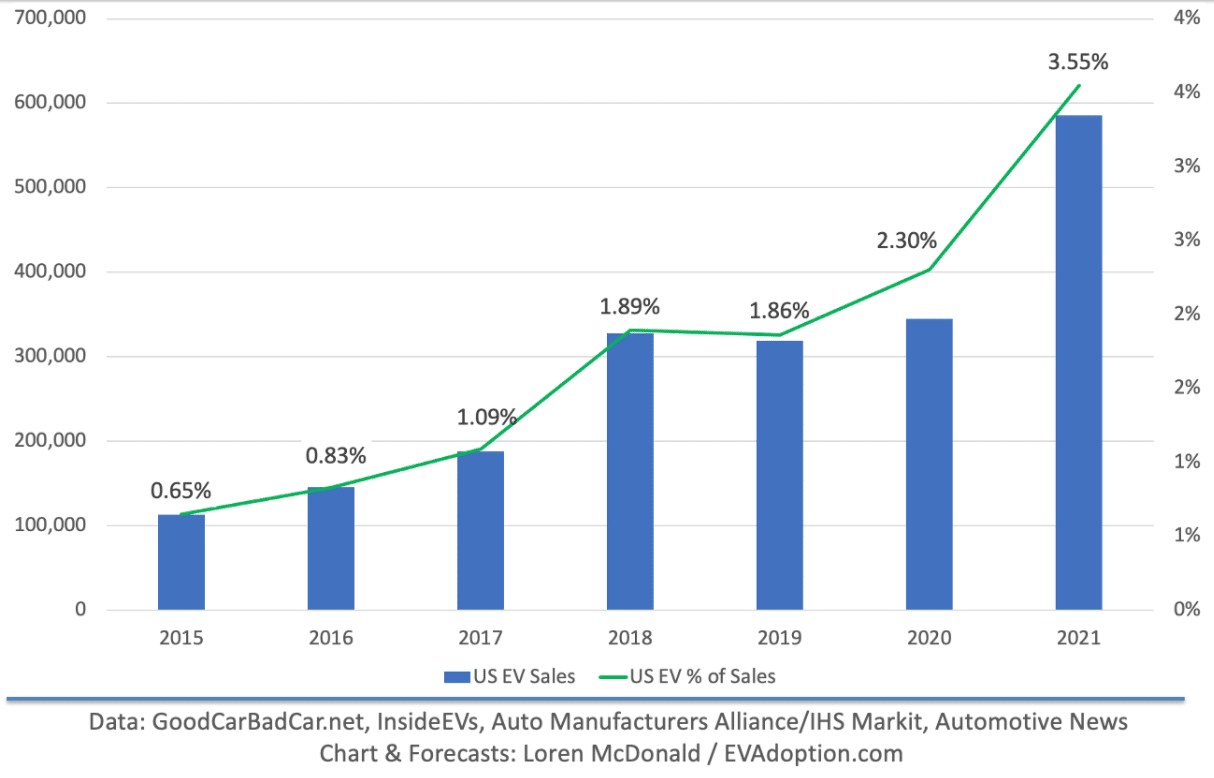

The electric vehicle (EV) market also proved resilient. Over the course of 2020, the global, national, and regional EV market continued to expand. According to Bloomberg New Energy Finance, the global EV market is on track to hit 10% of passenger vehicle sales by 2030 and nearly 60% by 2040. Though the Trump Administration’s rollback of the clean car standards added uncertainty to the U.S. auto market, there are now over 1.6M EVs on America’s roads. EV sales continue to gain market share with upwards of 350,000 sold in 2020 and forecast pointing to EVs accounting for 3.5% of new car sales in 2021.

U.S. EV Share of New Vehicle Sales

In the Southeast

In October, the Southern Alliance for Clean Energy (SACE) and Atlas Public Policy collaborated on a brief, “Transportation Electrification in the Southeast,” to examine the Southeast EV market. The brief focused on state-by-state EV sales, policy, regulatory, economic development, and investment activity. The findings demonstrate economic development momentum across the region, but also highlight lackluster state and utility investments in our region.

Now, utilizing these findings, our “2020 Electric Transportation Year in Review” provides economic development highlights and selects utility and state action ‘winners’ worthy of celebration.

Economic Development Highlights

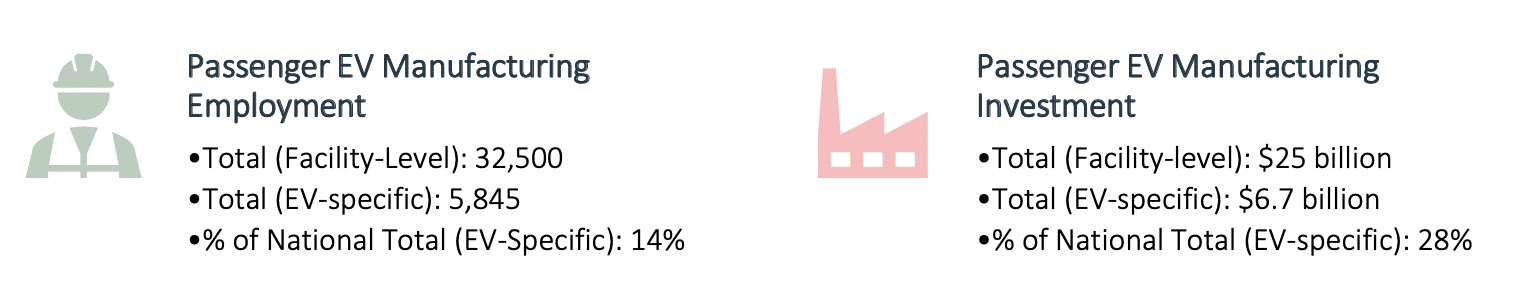

The Southeast represents a significant share of the nation’s EV manufacturing jobs and investment: Alabama, Georgia, South Carolina, and Tennessee lead the region in light, medium, and heavy-duty EV manufacturing, with North Carolina home to many automakers and charging infrastructure corporate headquarters.

Economic Development Indicators through August 2020

2020 saw notable investments and job creation in EV manufacturing, battery production, and research:

- In October, General Motors (GM) announced it would spend $2B to change its Spring Hill, Tenn, factory into its third U.S. EV plant to build the electric Cadillac Lyriq. The Spring Hill plant, GMs largest, will be the automaker’s third EV manufacturing site and the first outside of Michigan.

- South Korea-based SK Innovation began construction on a $1.7B EV battery production facility in northeast Georgia; its first in the U.S. The investment represents the largest economic development deal in the state in over a decade. The facility will employ 2,000 workers to supply batteries for upwards of 250,000 EVs annually.

- UK-based Arrival, an innovative electric bus and van manufacturer, is opening its first U.S. production facility in Rock Hill, South Carolina, and setting up its North American headquarters across the border in Charlotte, North Carolina. The Rock Hill facility represents a $47M investment and will create 420 jobs. The Charlotte corporate headquarters will bring 150 jobs and $3M in investment.

- In Chattanooga, Tennessee, Volkswagen broke ground on its $ 22M Battery Engineering Lab. The new lab is also the $800 million expansion of the Volkswagen Chattanooga Assembly Plant underway. Combined, these facilities will form VW’s hub for EV production and engineering and create 1,035 jobs.

- In Alabama, Mercedes-Benz is in the midst of a $1B transition to EV manufacturing in the state that includes a new $54M parts facility in Tuscaloosa County that is expected to add 373 new jobs.

Utility Engagement and State Action Winners

Utility Actions

Southeast investor-owned utilities (IOUs) and regulators have been slow to propose and approve significant utility investment in electric transportation; Southeast utilities currently account for less than 1% of utility investment nationwide. However, 2020 provided a few winning advances:

- The Carolinas win for the largest approved utility investments. 2020 ended with regulator decisions in North AND South Carolina that reflect a growing desire among advocates, EV drivers, and utilities to permit ratepayer-funded investments to test technology, develop best practices, and accelerate market growth. In North Carolina, Duke Energy received approval to invest approximately $26M to deploy 40 public fast chargers, 160 public Level-2 chargers, 80 Level-2 chargers at multifamily dwellings to support home charging, and help fund and provide charging infrastructure for 30 electric school buses. As part of regulators’ approval, Duke will work with a broad group of stakeholders over the next 6-months to develop a second pilot program. In South Carolina, Duke Energy received approval to invest $10M to deploy 60 fast chargers and provide 400 customers $1,000 residential EV charger rebates.

- Florida wins for the most innovative rate design program. Florida Power & Light (FPL) is in the process of rolling out 1,000 Level-2 chargers and a network of 75 fast chargers across its territories and received approval from regulators for an innovative rate design program. FPL will implement what is known as a ‘demand charge limiter.’ Demand charges are triggered when power consumption exceeds thresholds over a set period of time. These charges are very costly and for fast charger owners and lead to electricity bills exceeding station revenue. FPL’s pilot program aims to limit demand charge impacts on station owners’ bottom lines to remove this barrier and de-risk private sector investment.

- Duke Energy wins for the boldest commitment. By 2030, Duke Energy pledged to convert 100% of its light-duty vehicles to electric and 50% of its combined fleet of medium-duty, heavy-duty, and off-road vehicles to EVs, plug-in hybrids, or other zero-carbon alternatives. Additionally, the company pledges to reduce greenhouse gas emissions by 60,000 metric tons annually.

State Action

Southeast state governments have also been historically slow to act, accounting for only 4% of state government investment nationwide. But, like with utility engagement, some states stepped up in 2020, producing notable winners on both the regional and national stage:

- Tennessee wins for the most meaningful investment in workers. In support of GM’s Spring Hill factory conversion, the Tennessee State Funding Board committed $35M to retrain 2,000 Spring Hill workers to shift from internal combustion to EV manufacturing.

- North Carolina wins for the most meaningful 2020 executive action. Governor Roy Cooper joined the Multi-State Medium, and Heavy-Duty Zero Emissions Memorandum of Understanding that brings together fifteen states plus DC to achieve 100% tailpipe pollution-free electric trucks and buses by 2050. The MOU marks the largest-ever state partnership to slash vehicle pollution.

- Florida wins for the most public policy-related action. Driven by Florida Senate Bill 7018’s requirement that state agencies develop an EV Master Plan, the Public Service Commission that oversees regulated utilities, Florida Department of Transportation (FDOT), and the State Energy Office convened stakeholders in a six-month-long planning process. The result is a status report authored by FDOT and delivered to state legislators for review.

- Alabama wins for the most significant EV education budget allocation. Alabama ranks #3 in the nation for auto exports and relies on the auto industry for 40,000 manufacturing jobs. So it makes sense for the state to support the industry’s transition to EVs. Building off of the 2019 Rebuild Alabama Infrastructure Plan, Alabama’s 2020 state budget included $2M to educate the public about EVs’ benefits and promote adoption.

As we roll into 2021, SACE will continue to advocate across the region for the rapid and equitable transition to electric transportation to improve public health, create jobs, save consumers money, and address climate change. Stay tuned and stay connected! Visit ElectrifytheSouth.org to learn more and connect with us here.