Next planning process to be influenced by Inflation Reduction Act and recent winter storm blackouts.

Maggie Shober | December 31, 2022 | North Carolina, UtilitiesFor the past fourteen months, as directed under North Carolina HB 951, the North Carolina Utilities Commission (NCUC) has been evaluating options to meet carbon reductions of 70% from 2005 levels by 2030 and net-zero by 2050 for the state’s major electric utility: Duke Energy. This process has informed the Commission’s first Carbon Plan order, which was released late on December 30, 2022.

SACE, along with our co-intervenors Sierra Club and Natural Resources Defense Council (NRDC) and the North Carolina Sustainable Energy Association (NCSEA), argued that the proposed carbon emission reductions could be achieved cost-effectively and reliably through a combination of energy efficiency, demand response, solar, storage, and wind resources. In its initial Carbon Plan order, the NCUC is largely aligned with the proposed plan from Duke Energy, including the potential for new gas power plants before 2030. But the order is also clear that the Carbon Plan is flexible, and the next process (to start in September 2023) will be influenced by the Inflation Reduction Act (IRA) of 2022.

Here’s an overview of what is and isn’t in the Commission’s first Carbon Plan order, some context for the order coming out just after Duke initiated rolling blackouts to meet winter peak demand in extreme cold weather, and what to expect when this process starts over again in a mere nine months.

What’s in the Carbon Plan

The Commission is clear that it is focused on the least cost path to compliance, and states that “the Commission has expected and will continue to expect Duke to pursue every opportunity that may arise through tax incentives or federal funding to benefit its customers.” The order goes on to state that the passage of the IRA in August was “a bellwether for the significant escalation of the transformation and very likely a reduction in cost,” but is clear that the implications of the IRA are still unknown.

No single portfolio, CPCN still required

The Commission’s order concludes that it does not need to select a single portfolio at this time but recognizes that as the 2030 and 2050 emissions targets get closer, it may be reasonable for the Commission to select or create a single portfolio plan. Instead, the Commission focuses this Carbon Plan’s supply-side resource on near-term actions that provide flexibility for longer-term decisions.

The order also makes it clear that inclusion of near-term supply-side actions in its Carbon Plan is not a substitute for the Certificate of Public Convenience and Necessity (CPCN) process that Duke must go through for approval of new generating plants.

Transmission approved, sort of

As part of the Carbon Plan, Duke and many intervenors argued for the construction of transmission upgrades to facilitate the integration of solar in the “red zone,” an area covering parts of North and South Carolina where interconnecting generation projects have triggered the need for transmission upgrades that are too expensive for one generation project to bear. The Commission Order directs Duke to “take all reasonably necessary steps to construct the fourteen 2022 RZEP projects.”

The order also states that “Duke shall make all reasonable efforts in accordance with state and Federal law to update and improve its local transmission planning process including increasing transparency and coordination.” A point of confusion during the proceeding was how exactly to deal with transmission planning, which Duke frequently stated is under FERC jurisdiction. Duke’s two utilities are two of the four participants in the North Carolina Transmission Planning Collaborative (NCTPC), and also participate in the Southeastern Regional Transmission Planning (SERTP) process.

Even if there was not agreement on how transmission planning should be approved, it was clear that proactive transmission planning is absolutely critical for deep decarbonization of the electric grid in North Carolina, as in most parts of the country. Updates to the transmission planning process, such as using scenarios and long-term planning, are part of the FERC Notice of Proposed Rulemaking (Docket RM21-17).

Demand-side options remain focused on eligible sales

The Commission order “approves or planning Duke’s target of 1% load reduction through demand-side management and energy efficiency measures, while setting an aspirational 1.5% target.” However, that 1% is applied to eligible sales, not total retail sales. Duke’s non-residential customers are able to opt-out of energy efficiency funding, and Duke argues that retail sales to those customers should not be included in the denominator when calculating energy savings as a percent of sales since they are not eligible to participate in Duke’s energy efficiency programs. However, in recent years a majority of non-residential load has opted out, skewing the appearance of Duke’s annual energy savings from energy efficiency.

Separately, the Commission order specifies that other demand-side issues will be dealt with in a new docket, such as: “(i) updating the inputs underlying the cost benefit test in the mechanisms; (ii) using the as-found baseline for EE measures; (iii) changing the definition of low-income customer; and (iv) developing guidelines for expedited regulatory approval of DSM/EE pilot programs.”

Further, the Commission order states that Duke should engage with stakeholders for expedited regulatory approval of customer pilots and programs that fall outside of the traditional energy efficiency realm but enable load management, including rate design and electric vehicle programs.

Near-term actions on supply-side resources

One of the most awaited decisions from the Commission in this Carbon Plan order is whether or not it will include new natural gas plants in the near term.

“The assumptions related to natural gas and the role of natural gas-fired generating resources reflect one of the most significant resource planning decisions in this proceeding.” ~North Carolina Utilities Commission in its Carbon Plan Order December 30, 2022.

The order seems to give significant preference to Duke’s testimony around natural gas, particularly its prevalence in all of Duke’s proposed portfolios and its role in allowing Duke to reliably retire its coal plants according to its proposed schedule. Notably absent from consideration by the Commission in this proceeding is the National Renewable Energy Laboratory (NREL) and Duke Energy joint study that shows integration of carbon-free resources without the need for new gas power plants. That study was released shortly after the deadline for consideration in the 2022 Carbon Plan.

Therefore, based on Duke’s testimony, the Commission deems it “reasonable” for Duke to plan for approximately 800 MW of CT power plants and up to 1,200 MW of CC power plants at this time. These are the capacity amounts Duke proposed be installed by the end of 2029 in its near-term action plan. If/when Duke files a CPCN for new gas plants, the Commission states it will use this Carbon Plan order as “one factor” in determining the need for proposed new gas plants.

So, on the question of new gas, the Commission didn’t give a clear “yes” or “no” answer, but appears to favor the possibility of new gas if Duke takes the next steps to propose it.

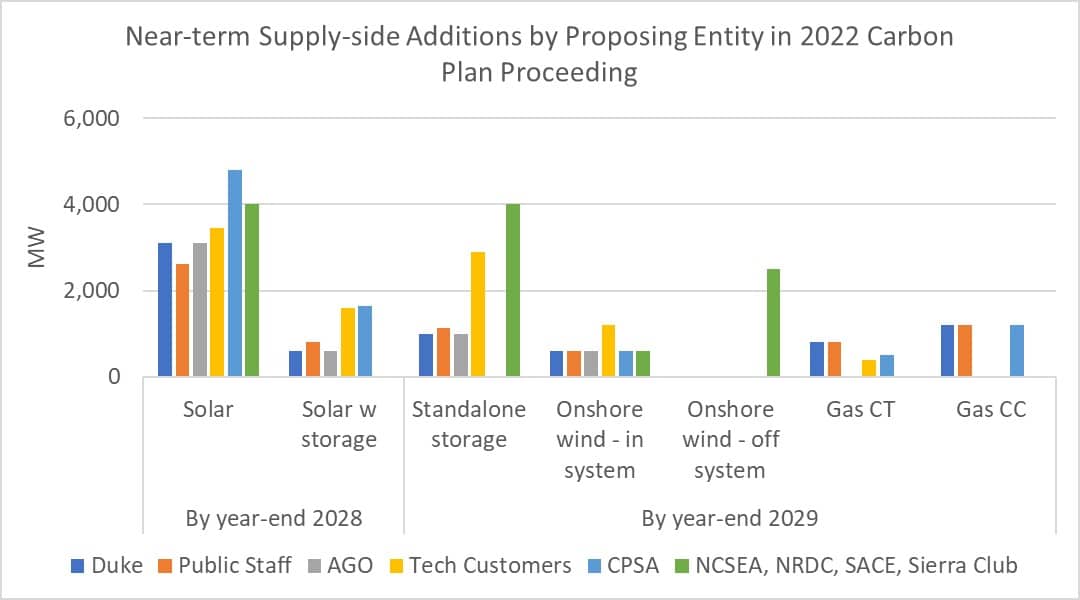

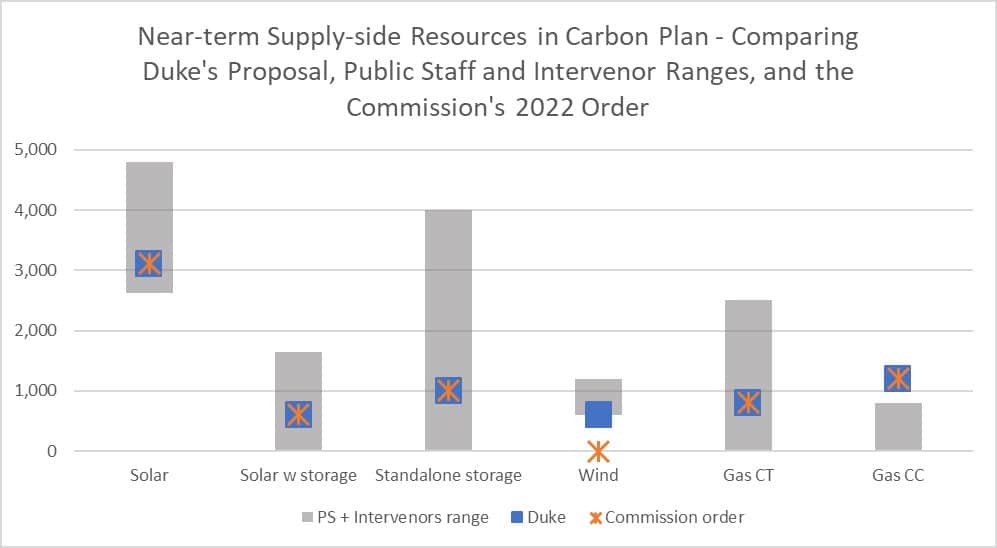

But what about the rest of the potential supply-side resources? First, let’s remember the ranges proposed by Duke, the Public Staff, and various intervenors. All agreed that by the 2028-2029 timeframe, the most MW of additions should come from solar, but the exact amounts targeted varied. Intervenors that proposed portfolios without gas tended to have higher amounts for storage.

When all of the proposed Carbon Plan near-term supply-side additions are compared to the Commission’s 2022 Carbon Plan order (and its previous order in the 2022 solar procurement docket), it is clear the Commission sided very closely to Duke’s proposal.

The Commission’s order does not specify a target for either onshore or offshore wind. Instead, it directs Duke to “study and consider the acquisition and development of wind lease areas off the coast of North Carolina,” and to “engage with onshore wind stakeholders and economically model utility-owned onshore wind in its next round of modeling.” So beyond wind, the Commission’s order includes near-term supply-side additions that are nearly identical to Duke’s proposal.

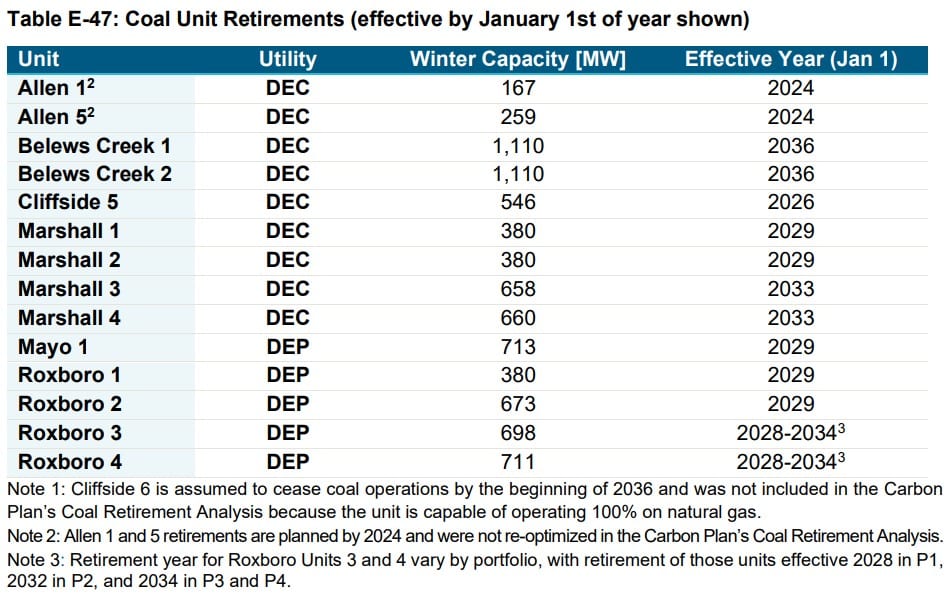

Duke’s coal retirement schedule “reasonable for planning purposes”

The Commission’s order deems Duke’s proposed retirement schedule for coal units “reasonable for planning purposes,” despite testimony from intervenors, including SACE, that earlier retirement had the potential to produce cost savings for ratepayers. The schedule for coal retirements, presented in Table E-47, shows some retirements starting January 1, 2024 (Allen units 1 and 5), and as late as January 1, 2036 (Belews Creek units 1 and 2). Additionally, the Commission requested further analysis of conversion of Belews Creek units 1 and 2 to 100% gas in the next Carbon Plan proceeding.

What isn’t in the Carbon Plan

The Commission concluded that because of the limitations of the legislation setting up the Carbon Plan, which focuses on carbon dioxide, it does not have the authority to consider methane emissions.

The order does not mention the potential for North Carolina to join the Regional Greenhouse Gas Initiative (RGGI) to trade emission credits with states across the East coast in an effort to meet emission reduction goals. Joining RGGI is being considered by North Carolina’s Department of Environmental Quality.

In the context of winter storm Elliot

The order cites the North American Electric Reliability Corporation’s (NERC) 2022-2023 Winter Reliability Assessment, which evaluates the system adequacy and identifies potential reliability issues over the 2022-2023 winter season, as noting that the region that contains North Carolina has a risk of shortfall in extreme cold weather events. The rolling blackouts implemented by Duke on Christmas Eve 2022, according to the Carbon Plan order, provide a “sobering example of the consequences to customers during times of stress on the electric system.”

Duke will brief the NCUC about the late-December outages at its staff conference on January 3. So we will learn more about the causes of Duke’s need to implement rolling blackouts then. But initial reporting from the Charlotte Business Journal is that six power plants may have been partially or completely unavailable, including planned outages at one nuclear plant (Robinson Unit 2) and one gas plant (Lee combined cycle). Other outages or reduced capacity may have impacted gas and coal plants.

What is clear from hourly load forecast and generation data from the EIA grid monitor dashboard is that Duke, and several other Southeast utilities, underestimated the load spike associated with the extremely cold temperatures experienced on December 23-24, 2022. National labs have estimated that there are significant cost-effective energy savings in North Carolina through measures like high-efficiency heat pumps, insulation, and duct sealing. These measures would also reduce the morning and evening winter peaks that both of Duke’s utilities that operate in North and South Carolina experience. Beginning January 2, 2023, the federal tax credits for these types of energy efficiency improvements increase significantly as a result of the IRA. While we can’t know whether higher and prolonged investments in these measures by Duke would have prevented the need for rolling blackouts in late 2022, it is clear that ramping up these measures across Duke’s two utility territories will help with future extreme cold weather and follows the Commission guidance for Duke to pursue every opportunity for federal tax incentives to benefit its customers.

Start again in September 2023

The Commission must update its Carbon Plan every two years, meaning the next is expected by the end of 2024. This Carbon Plan process was compressed to 14 months because of the statutory deadline of December 31, 2022. To have more time for the next Carbon Plan, the Commission asked Duke to file a proposed Carbon Plan and IRP (CPIRP) on September 1, 2023, and every two years thereafter. Intervenors will again be able to file alternative plans and other testimony ahead of a hearing in May 2023 to inform the NCUC’s next Carbon Plan, to be issued by the end of 2024.