On Thursday, July 21st, the Georgia Public Service Commission concluded the months-long process of deciding on Georgia Power’s 2022 Integrated Resource Plan (IRP) or long-term resource plan. The results of the IRP will lead to progress on energy efficiency, more coal retirements, and more competition on where Georgia Power buys its power, but action on key issues has been deferred.

Bryan Jacob, Forest Bradley-Wright, and Guest Blog | July 21, 2022 | Energy Policy, Georgia, UtilitiesThis blog post was jointly prepared with contributions from Southface (Will Collier and Katie Southworth) and the Southern Alliance for Clean Energy (Bryan Jacob and Forest Bradley-Wright).

The results of Georgia Power’s 2022 Integrated Resource Plan (IRP) process are in. The July 21st final Order by the Georgia Public Service Commission makes incremental progress on clean energy in Georgia: it requires additional investments in solar, energy efficiency, and energy storage alongside market-based reforms to enhance competition. However, the Order also includes the unfortunate approval of risky fossil gas purchases and leaves a number of critical issues to be addressed later in the 2022 rate case and 2025 IRP.

So, what did we get? Here’s the good, the bad, and the unknown coming out of the 2022 IRP.

The Good

Three Wins for Energy Efficiency

A notable win today was the unanimous support of all five Commissioners on three gains for energy efficiency: competitive modeling of least-cost demand-side management (DSM) is now a requirement, annual energy efficiency targets were increased by 15%, and a new manufactured homes energy efficiency program was funded.

1. Energy Efficiency Targets Increased by 15%

Commissioner McDonald’s motion to increase annual energy efficiency goals by 15% was unanimously approved by the Commission. While considerably less than the levels proposed by SACE and Southface, the Commission has continued to show leadership on energy efficiency by increasing Georgia Power’s annual energy efficiency savings targets for the next three years by 15%, which is on top of the 15% increase required in the 2019 IRP. Energy efficiency investments empower customers to have more control over their electric bills. Moreover, the customer savings resulting from this decision are now expected to exceed half a billion dollars.

2. Competitive Modeling of Least-Cost Energy Efficiency is Now a Requirement

We applaud the Commission’s Order requiring Georgia Power to have energy efficiency and other demand-side resources compete head-to-head against supply-side resources in future IRPs. This is a critical step to determining the least-cost, least-risky, and most diverse resource mix, and should ultimately lead to increased investment in low-cost energy efficiency. We look forward to working with the Company and Commission staff to ensure the competitive modeling fully captures the value and benefits that energy efficiency and other demand-side resources can provide to the utility and its customers.

3. Manufactured Homes Energy Efficiency Program Created

The Commission also unanimously approved funding for efficiency programs to serve residents of manufactured homes, which have far higher electricity cost per square foot than other housing types. This reflects the Commission’s endorsement of a program we proposed to Georgia Power, and supported through expert witness testimony.

Coal Retirements

The Commission approved the retirement of several outdated coal power plants:

- Wansley 1 & 2 (August 2022)

- Scherer unit 3 (December 2028)

- Gaston (Alabama) Units 1-4 (December 2028) – 50% owned by Georgia Power.

However, the Commission stopped short of completely eliminating all of Georgia Power’s remaining coal fleet (discussed further below), which the company itself had proposed.

All Source Procurement

The Order requires the Company to use a competitive all-source procurement process in future capacity procurements, which implements a recommendation we proposed in the 2019 Georgia Power IRP.

500 MW Competitive Procurement of Battery Storage

The Commission’s vote for increased energy storage was another bright spot from today’s vote. In addition to the 265 MW McGrau Ford project, the Commission voted 4-1 to require a competitive RFP for an additional 500 MW of energy storage, which will be operated by the Company.

2.3 GW of renewable resources

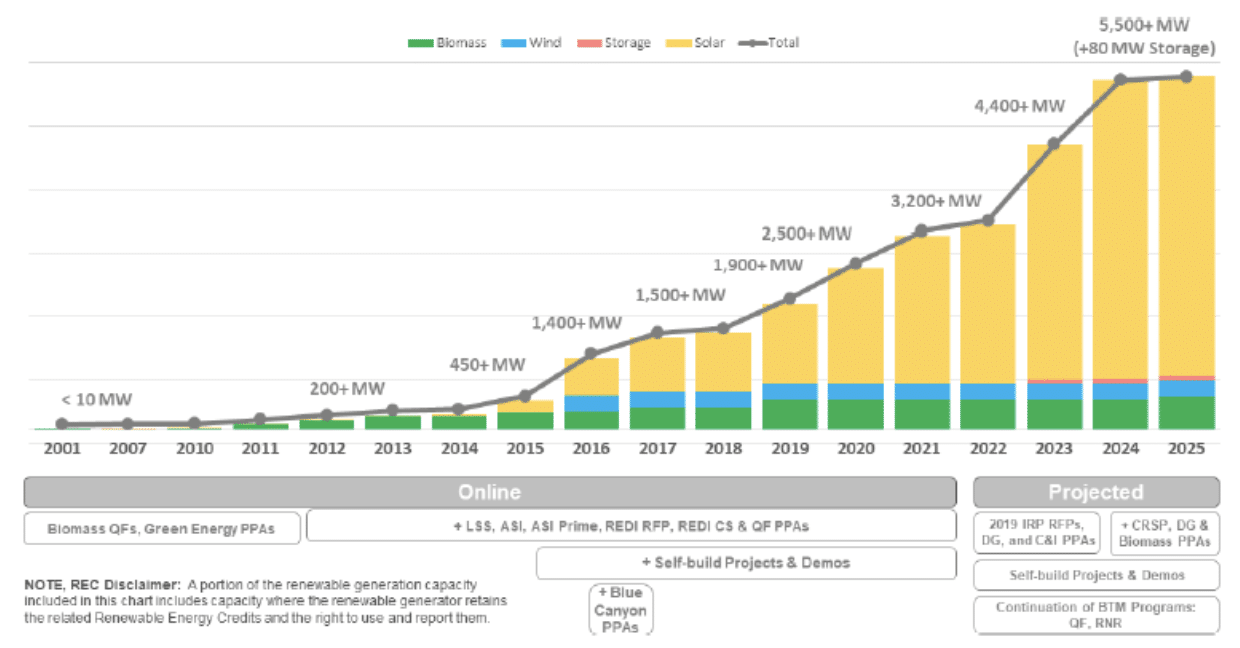

In the last decade, the Georgia Public Service Commission has established a legacy of economic investment in renewable energy, especially utility-scale solar. Commissioners have strategically created a regulatory environment through which Georgia has emerged as a national leader in solar development and generation. The Commission continued its support of solar in the 2022 IRP, approving a total of 2.3 GW of renewable resources to be installed between 2026 and 2029. This is the largest solar capacity addition ever approved in an IRP cycle in Georgia.

Figure 3. Historical and expected cumulative renewable capacity for Georgia Power, 2001-2025

The Bad

Fossil Gas PPAs

Unfortunately, the Commission moved forward with the approval of six fossil gas purchase power agreements (PPAs), despite objections and concerns voiced by intervenors on issues of fossil gas price volatility and carbon risks. Because most of these PPAs are affiliate transactions with Southern Company, the PPAs will still have to be reviewed by the Federal Energy Regulatory Commission (FERC) before the Company can proceed. The additional scrutiny is due to the potential for financial self-dealing by the utility and its parent company. SACE cited concerns related to the procurement process for these agreements which SACE and Southface Witness Ron Binz testified to in the proceeding. SACE/Southface recommended that the decision (below) on retirement of Bowen 1 & 2 coal units should inform whether all of these gas PPAs are actually necessary. So it seems particularly concerning and premature for the Commission to approve the PPAs before deciding the future of Bowen 1 & 2.

The Unknown

The Commission deferred decisions on a number of key issues, which will be addressed in later proceedings.

Bowen Retirement put off until 2025

The Commission deferred a decision on whether to retire uneconomic coal units at Plant Bowen until the 2025 IRP, but the expectation is that the units will be approved for retirement in that proceeding. To Georgia Power’s credit, the Company originally proposed to retire additional coal units in this IRP but was deferential to a decision by the Commission.

Solar Net Metering

Perhaps the biggest disappointment was that a motion to reinstate the “monthly netting” process for customers with self-generation like rooftop solar did not have enough votes to pass (failing 2-3). Despite hours of testimony and cross-examination, the Commission contends they still don’t have enough information to make a decision on this matter. And even a simple amendment to process applications for those already on the waiting list from last year’s pilot was rejected. Instead, this topic was deferred and deliberations will resume in the rate case which is already underway.

Transmission Planning

The motions proposed by the Commissioners in today’s administrative session also added nothing to the dearth of opportunities for relevant stakeholders to participate in transmission planning with Georgia Power – a critical area of concern as the State’s energy transition continues. Georgia Power’s transmission planning can either help or hinder the development of diverse energy resources for Georgia’s residents. So far, the Company is choosing the latter.

Final Thoughts

We would like to commend the Commissioners and Public Interest Advocacy (PIA) Staff for their tireless efforts in this very complex docket, as well as acknowledge Georgia Power for proposing additional coal unit retirements and substantial expansion of renewable resources.

SACE and Southface will remain engaged on the matters deferred from this IRP – particularly the topics of coal unit retirements, solar net metering, and transmission planning. We will continue to advocate for favorable resolution on those issues.