Each year, SACE highlights solar data and trends throughout the region in our annual "Solar in the Southeast" report.

Bryan Jacob | July 19, 2022 | Energy Policy, Solar, Utilities

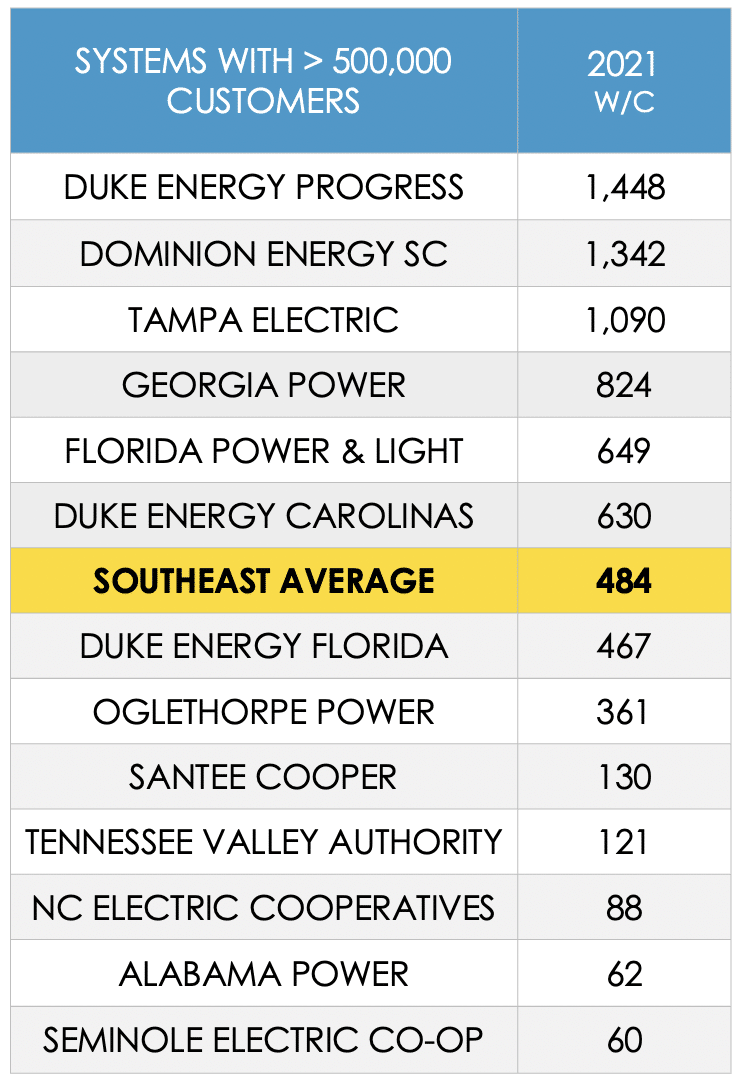

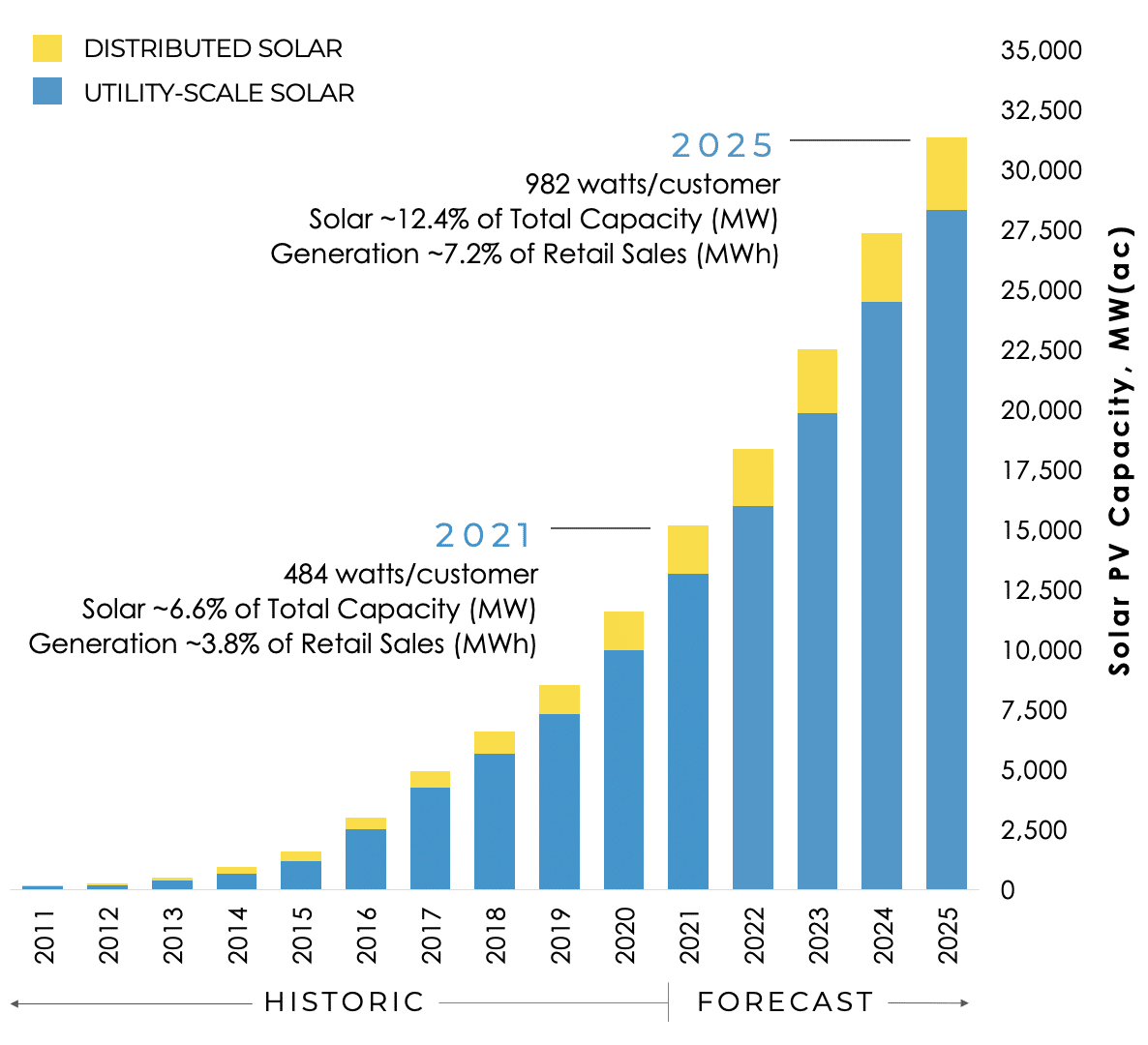

To provide an equitable, unbiased comparison of various-sized utilities throughout the Southeast, SACE has ranked utilities on the basis of watts per customer (W/C) of solar power sourced to customers. We have also calculated and forecasted the total installed capacity of solar power (in megawatts, MW), particularly for state comparisons.

Highlights in this year’s fifth annual “Solar in the Southeast” report include:

- Which utilities joined our SunRisers list and which re-joined the SunBlockers

- States that have surpassed and will surpass North Carolina’s former solar lead

- Policies behind solar progress

- How the pandemic affected solar growth

- Impacts to the forecast from the present supply chain disruption

On Tuesday, July 19, SACE hosted a webinar with Bryan Jacob, report author and SACE Solar Program Director, who was joined by Maggie Shober, SACE Research Director, and Dr. Stephen A. Smith, SACE Executive Director.

Download the Report Read the Blog Series Watch the report webinar

Large Utility Leaderboard

The top four utilities on the large utility leaderboard remained the same from last year: Duke Energy Progress (DEP), Dominion Energy South Carolina (DESC), Tampa Electric (TECO), and Georgia Power. New this year, Florida Power & Light (FPL) joined the top five.

The report also dives deeper into the circumstances impacting solar development in our region, including the supply chain disruption, policies behind the performance, and utility leaders and laggards across the region:

Supply Chain Disruption

The present supply chain disruption has influenced the SACE near-term forecast. For example, in last year’s report, we had been anticipating 20.6 GW for 2022 and 24.4 GW for 2023. Those forecasts are now reflecting 18.4 GW and 22.5 GW, respectively. The projection for 2024 reunites with the 27 GW forecast in last year’s report.

Federal and State Policy

The bipartisan Infrastructure Investment and Jobs Act (IIJA) includes substantial investment in transmission critical for a nationwide clean energy transition. A federal clean electricity standard (100% by 2035) no longer seems possible, but Congress still has an opportunity to adopt a package of clean energy tax credits.

Even these tax credits have been called into question by recent proclamations from Senator Manchin. Please contact your elected officials, particularly your Senators, and encourage them to support this critical package of clean energy provisions.

Take Action: Urge Your Members of Congress to Take Climate Action

State legislation in North Carolina requires a Carbon Plan by the end of this year – to deliver 70% reduction by 2030. An evolution of net metering policy was approved in South Carolina and is being considered in North Carolina. Florida’s Governor vetoed a bill that would have destroyed the state’s distributed or rooftop solar market.

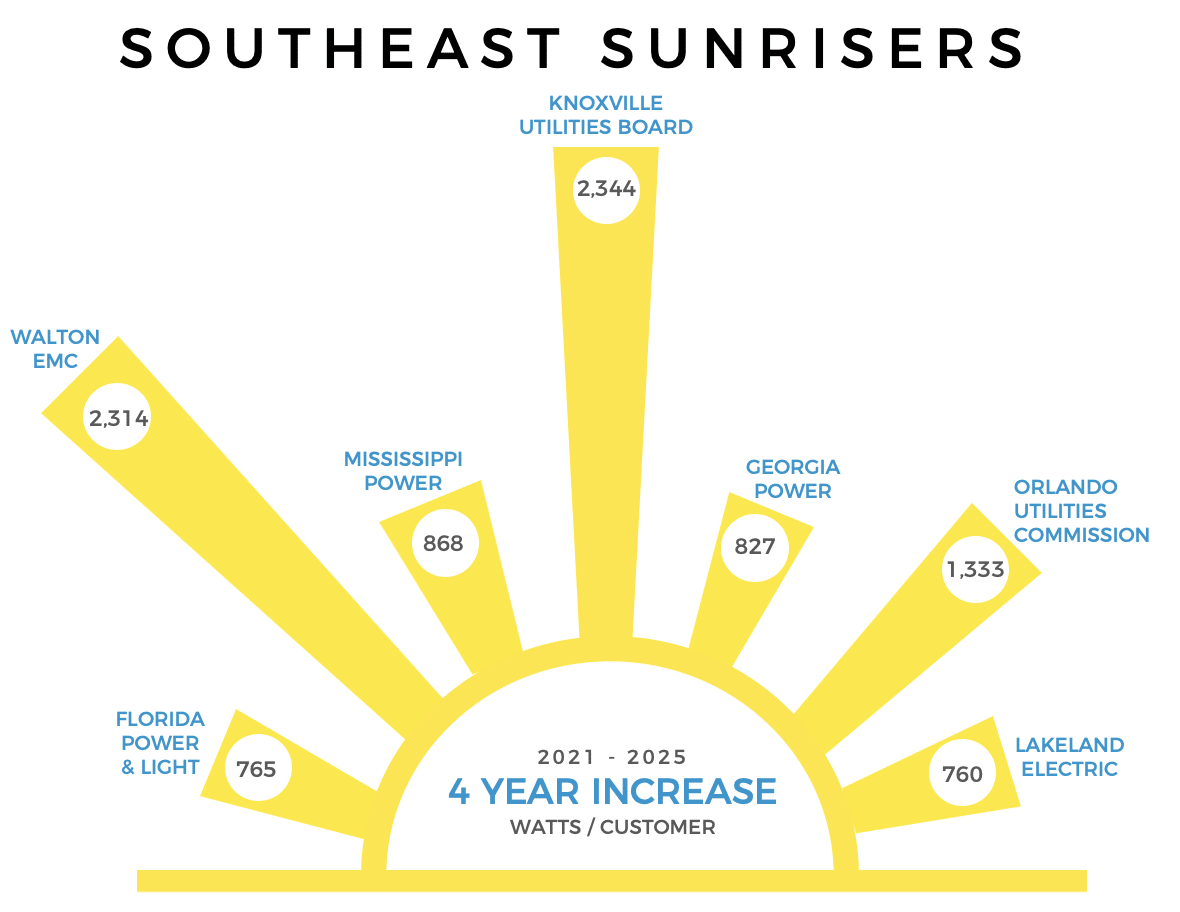

SunRisers

The Knoxville Utilities Board (KUB) earned the top SunRiser slot. Lakeland Electric burst onto the SunRiser list and Florida Power & Light returned to the list for the first time in three years. A familiar name is missing this year. Tampa Electric had been a perpetual SunRiser, the only utility to appear on all four of our prior lists.

SunBlockers

Alabama Power and the North Carolina Electric Cooperatives again appear at the bottom of the forecast for 2025. Tennessee Valley Authority (TVA) and Seminole Electric have rejoined them with the designation as SunBlockers – those utilities whose four-year forecast remains below last year’s region average.

With so much at stake, what is the region to do? Although SACE primarily intervenes in state-level utility regulation and contends that utility resource planning is one of the best opportunities to put decarbonization goals into practice, we can still see that action is not happening fast enough. Engaging on multiple levels, including federally is necessary for concerned citizens. Stay tuned for our upcoming blog series diving deeper into these issues and more.

#SSR2022