This blog was written by Sara Barczak, former Regional Advocacy Director with the Southern Alliance for Clean Energy.

Guest Blog | October 17, 2018 | Energy Policy, NuclearThe infamous, “zombie” Bellefonte reactors near Scottsboro, Alabama were cancelled in 2016 by TVA after being mothballed for many decades (and cannibalized for parts used at other reactors) with billions of dollars spent/wasted. The project remains a very, very bad economic bet despite recent efforts by Franklin L. Haney’s Nuclear Development, LLC to lure Memphis Gas Light & Water (MLGW) into buying power from it.

The Bellefonte site has a fascinatingly long, complicated history that serves as the poster child for all that often goes wrong with nuclear power construction projects, which can be summed up in one word: failure. And failures aren’t worth repeating, especially multi-billion dollar failures with serious outstanding safety concerns that have already cost utility customers too much for literally no electricity ever produced.

Why is MLGW being courted?

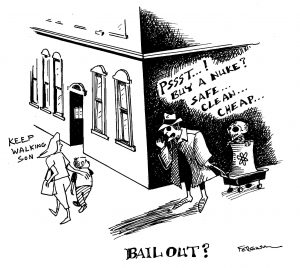

It’s important to remember that Mr. Haney has been trying to revive the Bellefonte project for years (see our analysis on a privatization scheme for the site back in 2013 here) and won the bid to acquire the abandoned plant for pennies on the dollar from TVA in 2016. But now, Nuclear Development, LLC is apparently trying to get over $8 billion in controversial taxpayer-backed federal nuclear loan guarantees for the project. There is a November 2018 deadline by which they need to show the Department of Energy that they may have a customer to one day purchase the electricity (that likely will never be generated).

Enter the Courtship of MLGW. Haney and his friends are promising massive cost savings to MLGW. And get this – Michael Cohen (yeah, that Michael Cohen) reportedly is also part of this bizarre affair: “Franklin Haney, a Chattanooga developer who is a principal with Nuclear Development, has come under scrutiny after allegedly offering President Donald Trump’s former associate, Michael Cohen, $10 million if he could help Haney land the federal loan.”

What should MLGW do?

We’re encouraged that MLGW is reviewing all of its options and agree that it shouldn’t rush that review. However, there are a lot of reasons Bellefonte shouldn’t even be on MLGW’s short list. (We won’t focus now on the serious safety concerns about reviving a cannibalized, abandoned nuclear plant.)

First, MLGW should look to the current fate of JEA, another municipal utility down in Jacksonville, Florida, that wants out of their contractual obligations with the ONLY remaining new nuclear power construction project in the U.S. – Southern Company’s Plant Vogtle in Georgia. Years ago when rosy projections were offered about the costs of new nuclear power, JEA bought in to the Vogtle expansion. JEA offered to buy a significant portion of power from MEAG, one of the Vogtle co-owners. Years later, with the original price tag of $14 billion having doubled and a more than 5 year schedule delay, JEA is using every legal and political maneuver to extricate themselves from the bad deal they agreed to.

Second, MLGW should take a hard look at the supposed savings Nuclear Development, LLC claims they’ll receive if they buy into Bellefonte. Definitely question the cost and the schedule – completion by 2023? In what universe? If something sounds too good to be true, it probably is. (Another phrase also comes to mind, “Run for the hills!”) Thankfully, it does sound like MLGW is voicing skepticism.

Third and most importantly, MLGW should look to actual affordable opportunities that are available today that could save their customers money. In fact, JEA adopted this approach in their dispute with MEAG. In a September 18 letter, they assert that, “Costs for both solar and storage have dropped significantly over recent years and prices are expected to continue to drop, a fact that is in stark contrast to the megawatt price that will result from the [nuclear] Project.”

MLGW, similarly, could access cost-effective solar to meet customer expectations for clean, safe, reliable electricity. Project developers from within the Tennessee Valley can offer solar to MLGW at prices lower than the wholesale price TVA charges. They are doing deals like this in surrounding states like Georgia. This is the kind of contract MLGW should be pursuing rather than a high-risk bet on the cannibalized, “Zombie” Bellefonte reactors.